CoinLoan’s Third Quarter Results

Hi CoinLoaner,

We have prepared a report detailing our latest improvements and changes. A lot has been happening lately, so grab your seat and see the rocket flying!

CoinLoan has tremendously grown. In 2018, we realized being independent has a great value that keeps our vision for the future of finance intact. In 2021, we continued our efforts to make the platform simple and user-friendly, suitable both for newcomers and crypto veterans.

“CoinLoan aims to become a platform for anyone looking to manage their crypto assets at ease. However, without client satisfaction, we can’t be on top of the game. Every time we plan to release new updates, we gather feedback to learn about the issues requiring immediate attention and fixes. Perhaps, that’s why CoinLoan has its fanbase” — Max Sapelov, CoinLoan's CTO.

We are constantly shaping CoinLoan to the needs of our customers, bringing innovation and deploying new features. This wouldn’t have been possible without your constant feedback. We are sending out a massive thanks to our community for suggestions!

This summer was a breakthrough unlike anything before. We went deep into marketing, increased the number of tech personnel, and tripled the budget on the platform. This was not for nothing — not only have we fully formed teams but attracted enough new users to cross the 100k mark! Would you like to know more? Keep reading to learn the details! Starting from now, we aim to publish such reports every quarter to keep you updated on recent changes and improvements.

Metrics

We have come far. This summer, we observed exponential growth across all the key metrics: customers, profits, and assets.

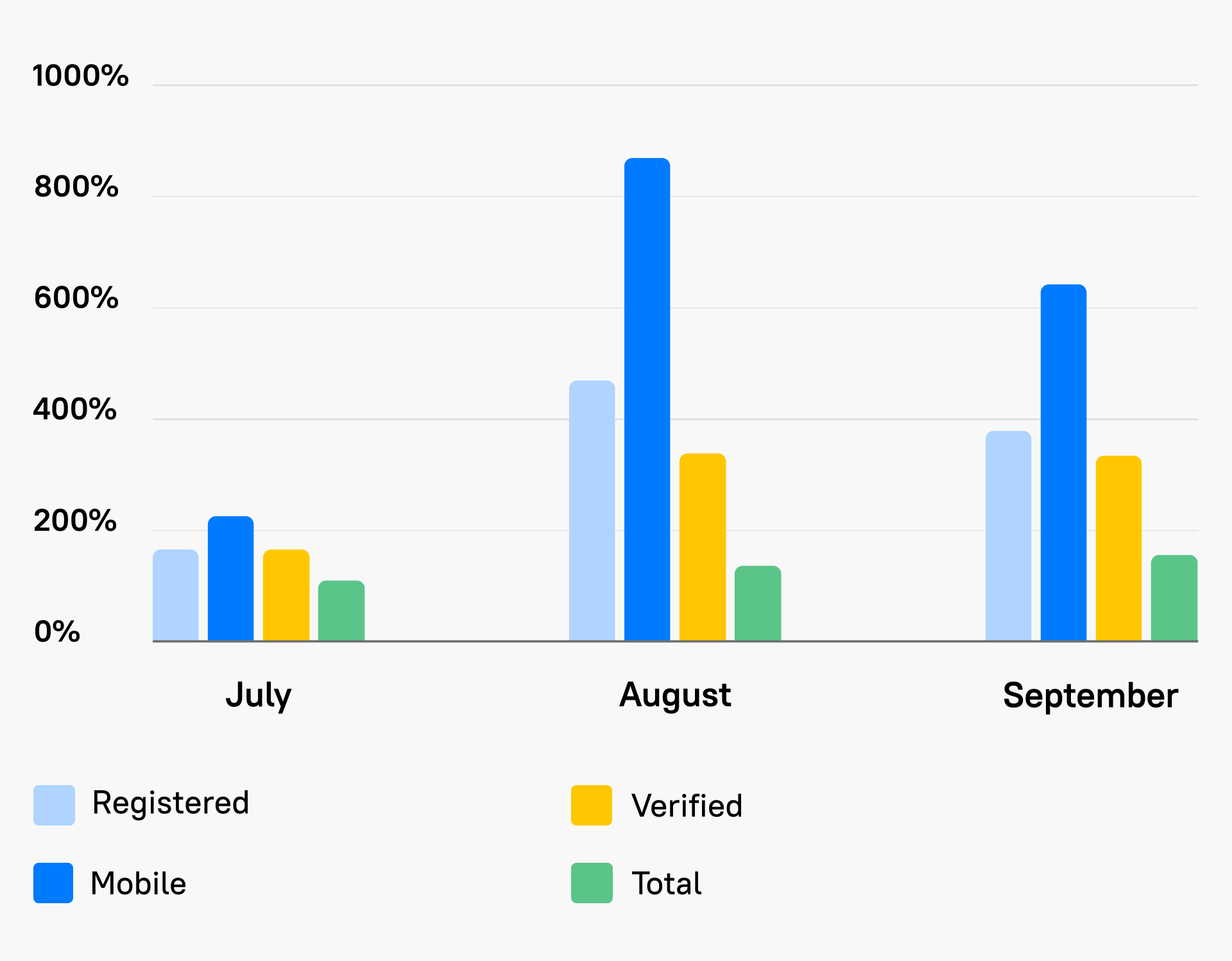

Customer Growth

Newly-launched Marketing activities to attract new users paid off well. Our campaigns targeting existing and potential users gave us a boost we had never seen before. Consequently, we have more than quadrupled the number of registered users, effectively attracting those unaware of our existence.

Key takeaways:

- CoinLoan surpassed 100k verified users (2x100% growth in registrations), and the number keeps on rising.

- The overall mobile user growth surged by 841% in August.

- 330% more users have completed KYC verification compared to the previous quarter.

- 462% more users registered with our platform compared to the last period.

The demand for mobile financial apps is exponentially surging globally. People around the globe are looking for ways to quickly check their accounts, instantly buy and sell cryptocurrency, and apply for a loan on the go. Keeping that in mind, we dived deep into re-designing and updating our mobile app and added new features.

Advertising campaigns for our mobile platform provided us with over 800% total mobile customer growth in August. The result speaks for itself — CoinLoan mobile app has the potential to become the primary source of client growth. In the coming months, we plan to allocate more resources for its future development.

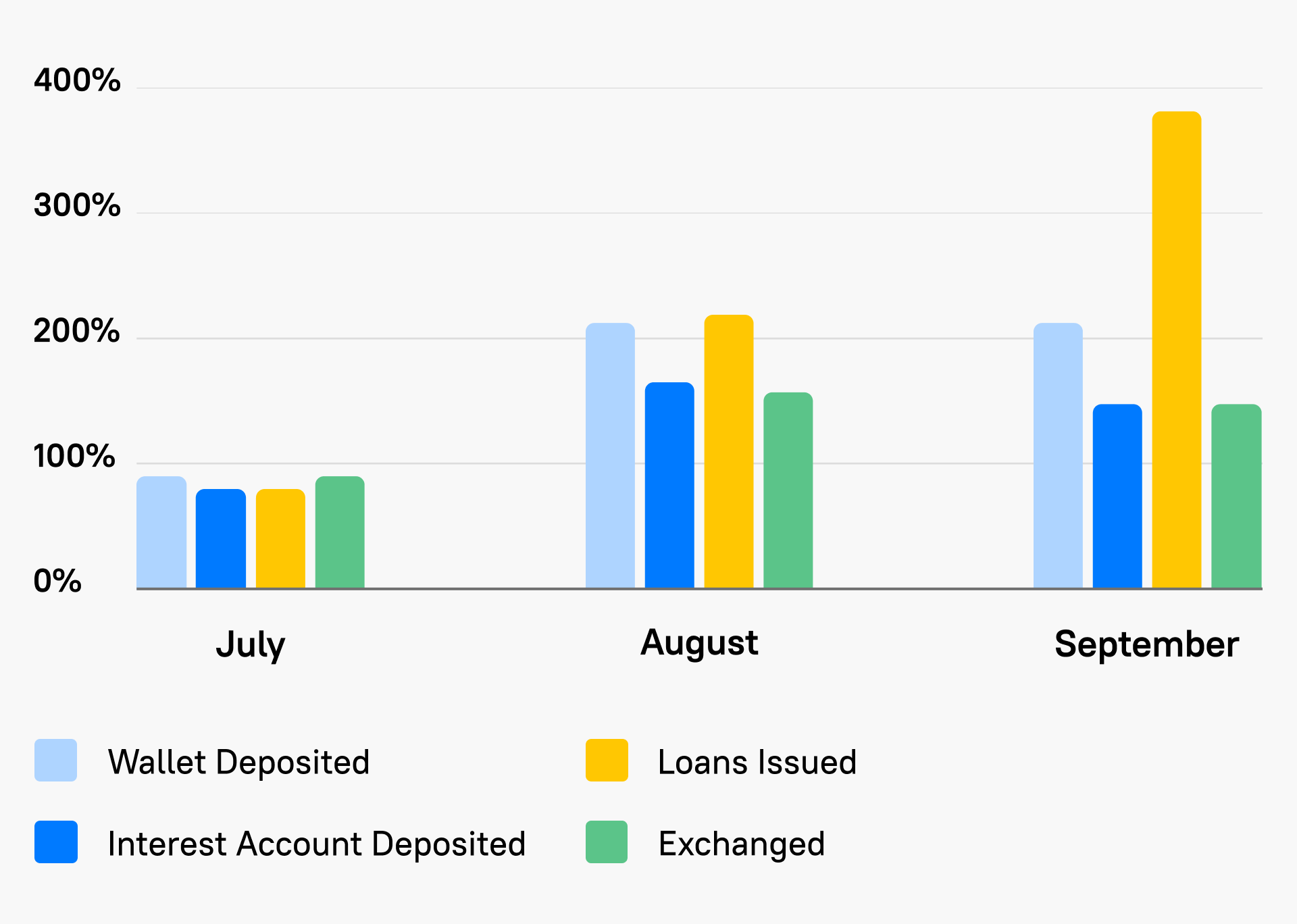

Asset Growth

The growth of assets deposited, exchanged, and loaned has spiked in numbers. The surge happened for two main reasons: customer growth and the introduction of new cryptocurrencies.

Key takeaways:

- The number of deposited assets more than doubled (211% growth).

- Funds deposited in Interest Account surged (161% growth).

- CoinLoan issued 230% more crypto-backed loans compared to the previous quarter.

The broader selection of digital assets attracted new and existing clients holding them in vast quantities. That, in turn, led to a spike in crypto-backed loan applications.

211% growth on wallet deposits was expected — cryptocurrency is becoming a tool for fast and easy transfers. While the transactional value of crypto remains undervalued, we are working on introducing new features to make the CoinLoan wallet answer the needs of modern times.

“We lead the charge in making asset management effortless and secure. We are committed to putting people and families at the heart of what we do, giving them back control of their financial life” — Alex Faliushin, CoinLoan CEO.

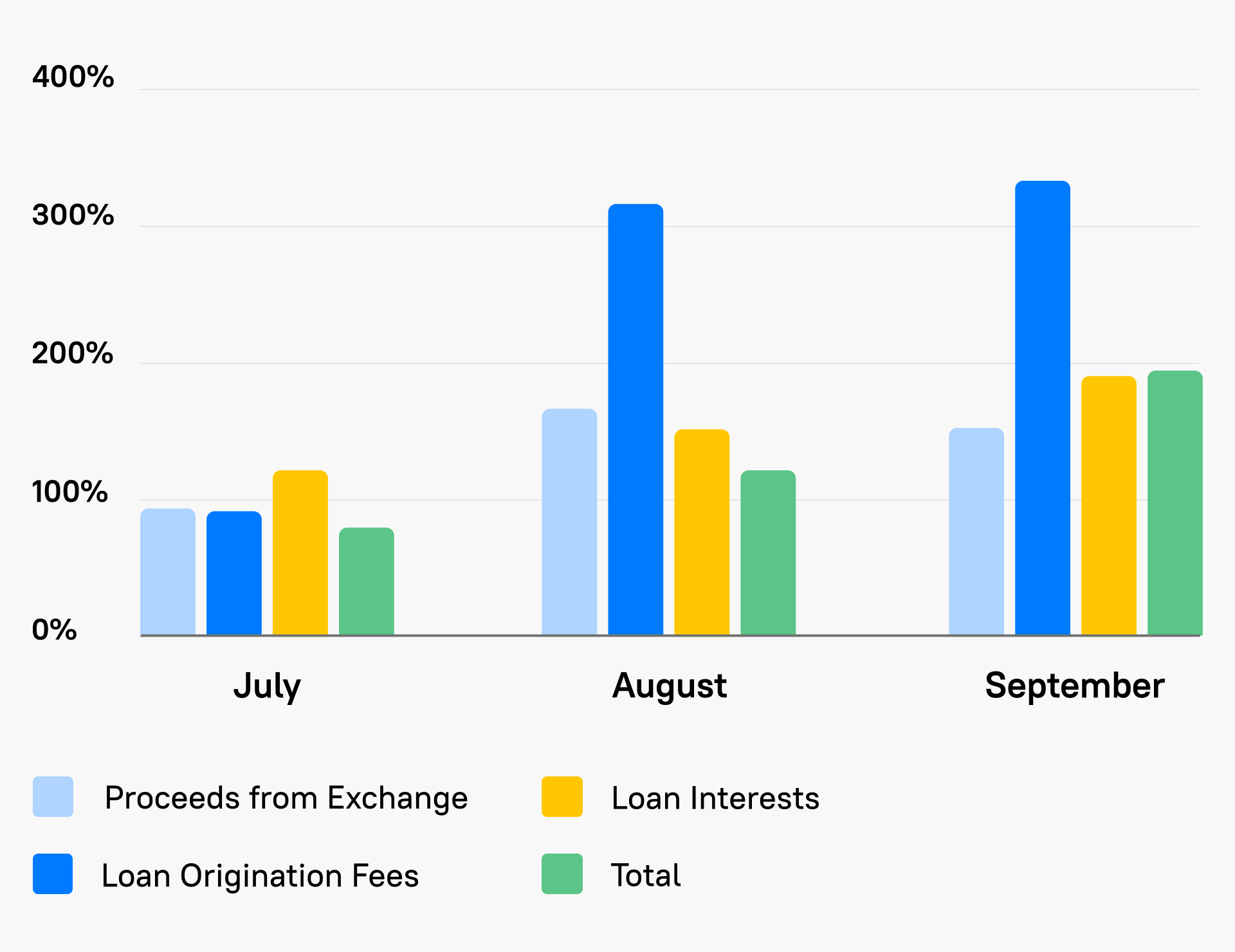

Profit Growth

CoinLoan’s profits originate from the exchange, loan origination, and loan interest fees. From June to August, the key margin sources were on a steady rise, surging by a total of 120%.

Key takeaways:

- +161% profit originating from proceeds from exchange

- +311% in loan origination fee profits

- +146% in loan interest profits

The surge in profits comes against the background of rising customer and asset growths. New marketing activities provided CoinLoan with much more exposure, while new assets attracted users seeking either crypto-backed loans or yield farming. As a result, we felt the changes and are getting ready to move forward. The marketing team has already developed a roadmap for the company for the next few months, while the development team is ready to deploy new assets and features.

Overall ROI for our marketing pre-run activities: 3 months.

Released Features

The CoinLoan team is constantly rolling out new updates and features. We also aim to be the best in the market, thus spending a lot of time re-designing and improving what we currently have. The new features must match three criteria:

- Have understandable and easy-to-learn functionality

- Answer the needs of a current time

- Follow the needs of the clients

With that in mind, we rolled out new solutions and updates that will tremendously improve user experience and offer handy perks our competitors lack.

Reports

Reports is a freshly introduced CoinLoan feature. It allows our clients to obtain all sorts of documentation for tax or accounting purposes. The Crypto industry remains in the grey zone. Yet, the debates on regulation are getting heated, with some lawmakers worldwide already submitting their versions for consideration. The time when taxing digital assets becomes a usual thing is just around the corner. That is why every user should access the tool to ease the data collection. The Reports section is live — you can check the feature in your account.

Types of reports users can generate are the following:

- Wallet Transactions

- Interest Account Transactions

- Total Earned Interest

Clients can request and download statements with the Wallet or Interest Account transactions in CSV or PDF formats.

Web Platform Updates

As some of you may have noticed, the interface also underwent several changes. We added new options our clients can choose for a smoother experience.

Key takeaways:

- In My Wallet, we added a table view for showcasing available assets and an eye icon hiding your wallet balance.

- In Interest Account, clients can now see cash equivalents and total balance.

- In Settings, you can choose the default currency in which you wish to see your balance. The default currency selector is available both on the web and mobile apps.

New Mobile App Features

CoinLoan mobile app is becoming our main focus. During the summer, we introduced several features to make the user experience much better.

Key takeaways:

- Intercom chat is now available on mobile. The number of mobile users has grown, and we aim to provide support in the most efficient manner. Intercom will allow everyone with the CoinLoan app on iOS and Android to receive help much quicker.

- SumSub integration is a freshly introduced KYC verification tool on mobile. New clients can now verify their identities on the go through the mobile app.

- SWIFT payments were already available on the CoinLoan web app, but its mobile version lacked this functionality. Now, clients can deposit EUR and GBP to the CoinLoan Wallet from their smartphones.

- Five languages are now available in our mobile app: English, German, French, Turkish, and Japanese.

Sessions

Security is one of our top priorities. Over the summer, we introduced Sessions. The feature is available on both web and mobile apps. It allows users to see all the devices signed in to their CoinLoan Account. Active sessions can be ended remotely with one click.

Business Operations

Fees and Transfers

Over the summer, we integrated one more custodian, Fireblocks, into the CoinLoan ecosystem to support more assets and blockchains with the bank-grade security. Withdrawals and deposits are free of charge for clients as we cover all the costs.

To avoid rising expenses, we added one more custodian to CoinLoan to widen the list of supported currencies and optimize operation processes. That took some energy and additional investment, but customer satisfaction matters much more to us. We value our clients above anything else and will continue to provide the best crypto management experience possible.

UPD: Since April 2022, we have been taking over withdrawal fees except tokens based on the Ethereum blockchain. Every user is entitled to one free withdrawal of ETH or one type of ERC-20 token, including CLT, per month. Every subsequent withdrawal entails a fee in the withdrawal currency depending on the asset — check our Help Center for details. Other crypto and fiat currencies are not affected — withdrawals are free.

More Support Personnel

As the number of clients doubled, we did the same with our support team. We believe the changes within the platform must not affect the customer. Providing outstanding support is easy when a company is small. Once a startup transforms into something larger, it becomes a challenge — bots replace humans, thus inevitably turning the entity into a cold-hearted corporation. CoinLoan will not go down the same scenario — we aim to remain a fintech company with a human face. Excellent customer support is one of our core features.

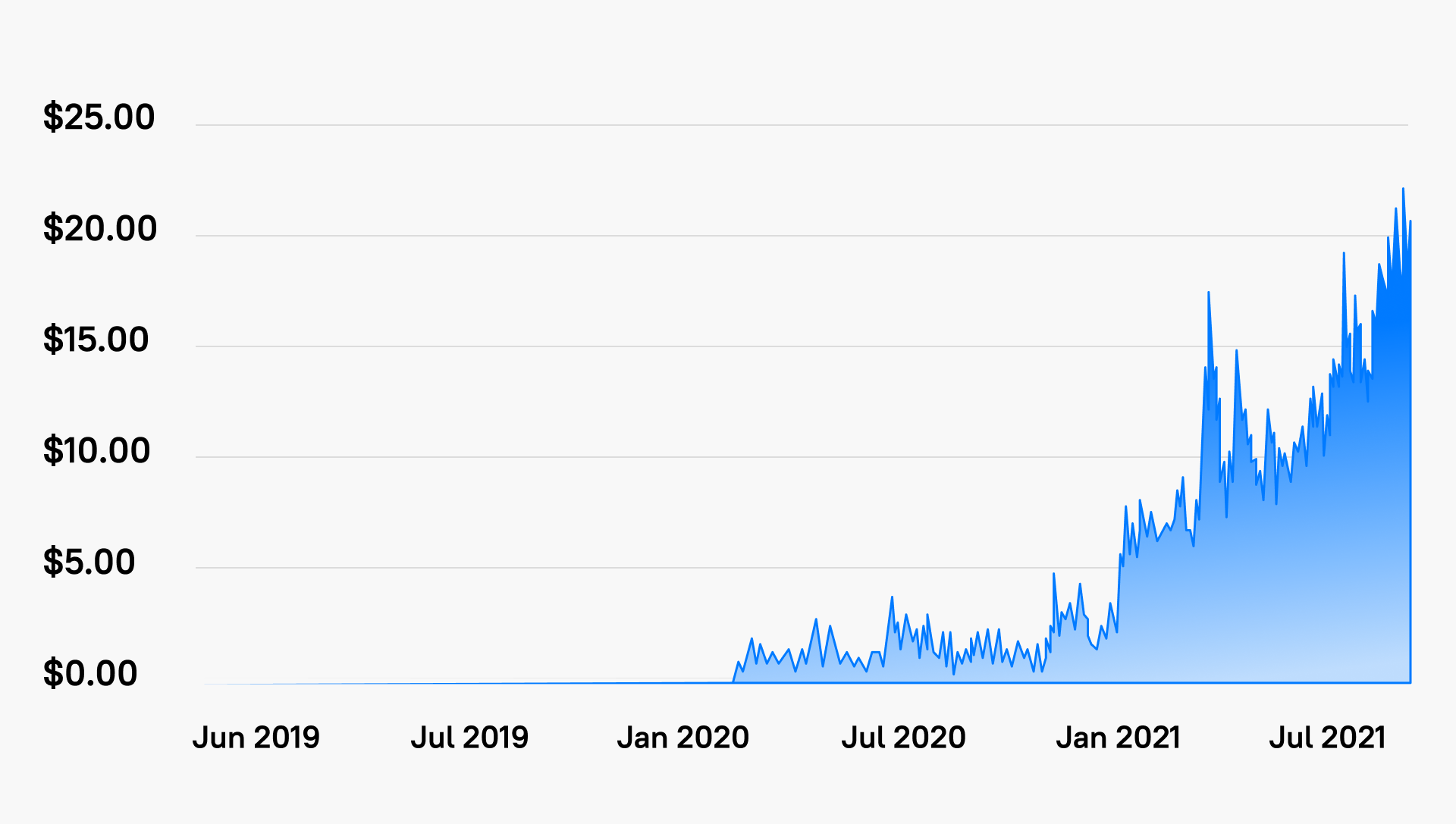

CoinLoan Token (CLT)

Our native token, CLT, grew by almost 10x in 2021, reaching an all-time high of $22.02 on October 29, 2021.

We remain confident of CLT potential in the coming months – we planned a lot for the next three quarters and aim to complete improvements, re-design, dive deep into developing the transactional direction, and introduce new features.

New Assets

Feedback is important to us. Before adding new coins and tokens, we asked the opinions of our users and analyzed suitable candidates. Based on the results, we have added six cryptocurrencies to the list of available digital assets.

Here is a complete list of new additions:

- Polkadot (DOT)

- Uniswap (UNI)

- MakerDAO (MKR)

- Axie Infinity (AXS)

- Compound (COMP)

- SushiSwap (SUSHI)

- Yearn.Finance (YFI)

Challenges

The results for the quarter are promising, yet CoinLoan is facing several challenges along the way. As we use our own resources and avoid outside investment, we are growing steadily. However, the advertising market is changing — anonymity and security became the new motto, which means restrictions and measurement problems for the advertisers. We have learned how to deal with this issue, yet we expect more bumps to rise along the road. Therefore, we need to grow with caution and keep an eye on the market.

Changing compliance requirements also influences our operations. During the year, regulators worldwide finally recognized the potential of cryptocurrency to become an investment vehicle, thus sparking fierce debates on how to legalize industry and tax it. We are ready to enter the new world: CoinLoan renewed its financial license this summer and refreshed its legal department. We will continue to comply with regulators. Nothing changes here.

What’s Next

There are several areas CoinLoan will focus on for the next few months. We aim to continue improving our security to answer the challenges of the current time. Hackers are coming up with new tricks to test the crypto industry constantly. That is why we must offer our clients the highest level of safety and continue redesigning and innovating our system.

Customer support is at our core — as the number of clients surges, the support team rises in numbers. We will keep the response time at a comfortable level and provide the quality our customers deserve.

Investing in our operations is something we must do to grow exponentially. We aim to allocate more resources into marketing activities and product development, build strong partnerships, and take the transactional business route.

Transactional business is a new trend in the crypto industry. Emerging in early 2021, it’s an idea of cryptocurrency becoming a tool for fast and secure transactions. The transactional value of cryptocurrency remains undervalued, but we plan to be ahead of time and introduce new features to make our services answer this call.

Finally, our native token, CLT, needs improvement. We want it to have more liquidity and unleash its growth potential. For these reasons, we will soon offer attractive purchasing packages to our clients. Look out for the updates!

Without prejudice disclaimer. Nothing contained in this Blog (or published by CoinLoan otherwise) shall be interpreted and used against CoinLoan or be detrimental to any of its rights. All information publicly disclosed by CoinLoan herein or elsewhere shall be without prejudice to (i) any CoinLoan's rights or interests whether addressed in this Blog or not, and (ii) any position that CoinLoan may take in legal or administrative proceedings.