CoinLoan Weekly: BTC Hash Rate Recovery, Ripple vs. SEC

Bitcoin Price News

The first cryptocurrency reached one more local high last week: on September 4, its price exceeded $51,000. As of September 6, BTC is trading at $51,770 and soon may reach $52,000.

BTC price fluctuated heavily last week, from $46,780 on September 1 to $51,676 on September 5. The overall price change in BTC for that period was +8.06%.

Waiting for a good time to buy Bitcoin? It's already here! You can do it on a CoinLoan Crypto Exchange with zero fees for deposits and withdrawals.

Ethereum Price

Speaking of new highs, Ethereum had one too: on September 1, ETH exceeded $3,500 level for the first time since May reaching the $4,000 level, trading between $3,848 and $3,971 on the weekend. As of September 6, ETH is trading at $3,953 after correcting itself a bit.

On September 3, Ethereum's max price reached $3,981.

7-days ETH price change stands at 24.17%. Get a loan with ETH and repay whenever you want without freezes, fines, and hidden fees.

XRP Price

Last week for Ripple was great: XRP price steadily rose for seven days. As of September 6, Ripple is trading at $1.38.

XRP max price of the week ($1.32) was reached on September 3, and the min one ($1.10) was observed on August 31.

Deposit XRP on CoinLoan without any fees and make a profit.

Cryptocurrency News

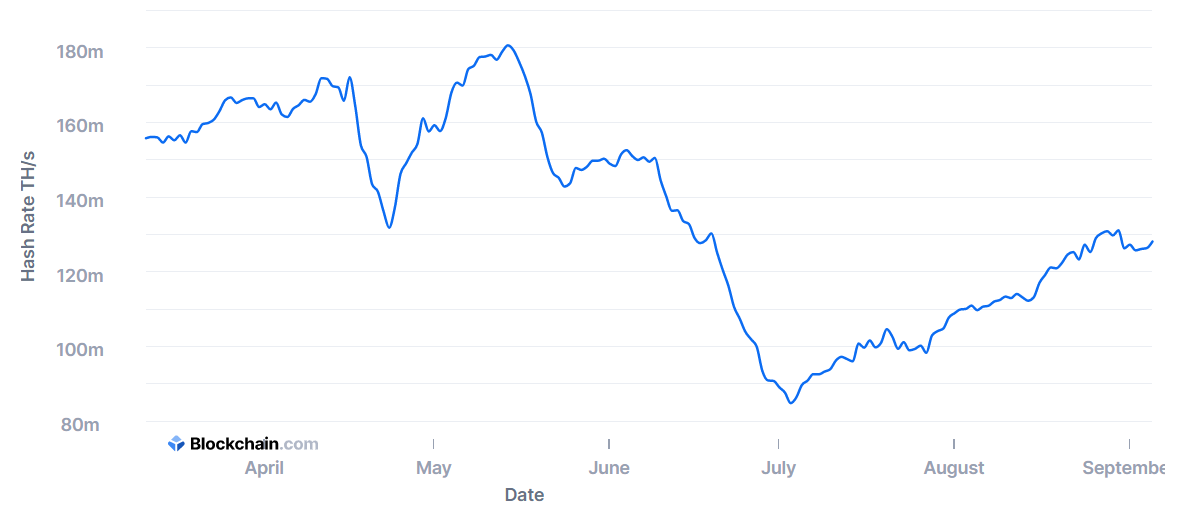

BTC Hash Rate Is Almost at Its April Levels

Three months ago, we saw a mass exodus (more than 65%) of active BTC miners due to the Chinese government's crypto mining ban. Now, the Bitcoin hash rate is finally experiencing a recovery.

It's important to understand the hash rate: it's an indicator of how many miners are actively looking for a hash on the SHA256 BTC network. In July, we saw the hash rate drop below 100 TH/s (84.79, to be exact) for the first time since May 2020.

While Chinese miners were offline looking for a new place to reside, the rest of the miners were still operating, having an opportunity to get bigger profits due to the lower mining difficulty. As of September 2021, the amount of operations resumed with a 30% rise in the hash rate: on September 5, it was 128.09 TH/s.

However, some investors now interpret the hash rate recovery as a bullish signal: in November 2020 the amount of miners was at a similar level, which then led to the spring bull run.

We already covered recent mining difficulty changes in our CoinLoan Weekly posts: more info here and here. Mining difficulty and hash rate are not the same things but they are closely related. What’s the difference? To put it simply, hash rate is the total computational power required to mine a BTC, while mining difficulty is a measure of how much of that power is needed to get a certain amount of income from the mining.

SEC vs. Ripple Update

As we previously mentioned in one of our recent blog posts, XRP is facing legal issues, as the SEC demanded access to the company's internal data.

On August 31, a Connecticut-based defense lawyer James K. Filan announced that "Judge Sarah Netburn is setting this up to Order the SEC to give them to her to review in camera." During the hearing on August 31, the sides discussed the SEC deliberative process privilege.

Judge Netburn will now review the internal documents by herself, without the Ripple legal team.

Stay tuned for the upcoming news, CoinLoaners!