CoinLoan Weekly: BTC Mining Difficulty, BTC and ETH Prices Are Up

Price Change

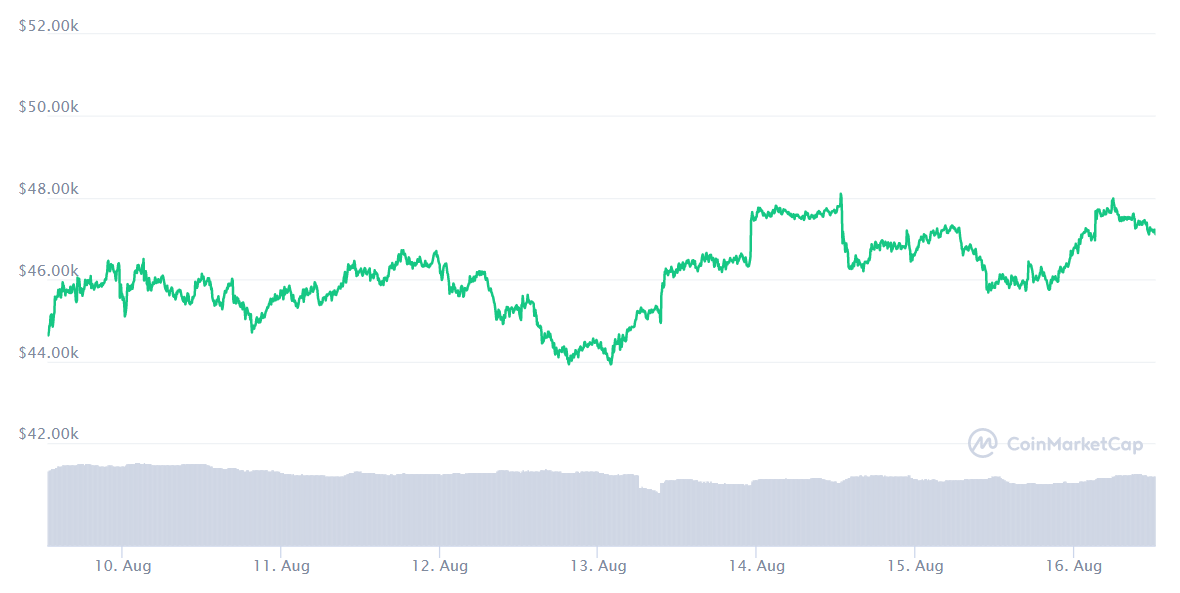

Bitcoin Price

Last week, the price of the leading cryptocurrency price increased by 5.19%, surging 2.50% in the last 24 hours.

Bitcoin reached $48,000 resistance level for the first time since May on August 14. Later the same day, the price fell to $46,257. Volatility remains high: within 24 hours, between August 13 and 14, BTC’s all-week low ($43,924) quickly turned to an all-week high ($48,098).

At the time of writing, BTC is trading at $47,440 level. CoinLoan offers BTC backed loans with the maximum LTV of 70% and interest rates starting from 4.5%.

Ethereum Price

As for the second cryptocurrency, last week was a rollercoaster, showing bullish signals. However, ETH’s 7 days price change is +7.14%, surging 3.73% in the last 24 hours.

The most volatile day of the week was Thursday. That day, ETH reached its all-week low ($2,991). Ethereum max was $3,329, to be exact, the first major leap up since May.

Today, August 16, ETH is trading at $3,289. If you want to buy Ethereum, CoinLoan provides one of the best rates on the market!

XRP Price

The past week was not so bad for XRP either, the coin surged 58.10%.

At the beginning of the week, XRP price was quite stable, trading around $0.850, but on Wednesday, August 11, it started to rise dramatically, reaching $1.05. XRP’s all-week high ($1.349) was reached on August 15, while its all-week low ($0.799) happened on August 10.

At the time of writing, Ripple is trading at $1.28. It's the perfect time to try a CoinLoan Interest Account and deposit XRP assets to see them grow every day.

Cryptocurrency News

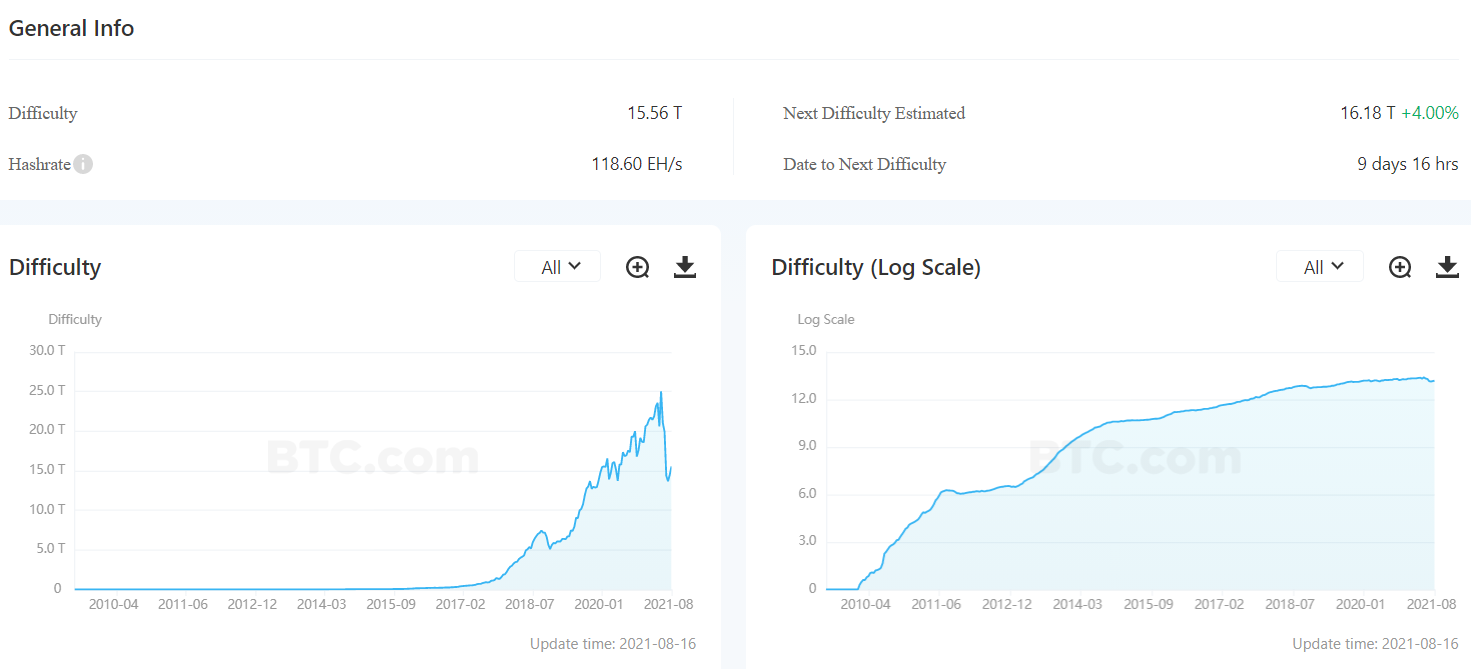

Bitcoin Mining Difficulty Surge

As shown in the recent recalculation, BTC mining difficulty increased by 7.31%, according to BTC.com. Now it’s 15.56T, up since the beginning of August. The next difficulty rate will be 16.18T.

BTC mining difficulty rate is crucial: depending on hardware involved, the transaction speed rises or falls, affecting the price of the leading cryptocurrency.

ETH Chain Capacity to Rise After London Hard Fork

On August 15, Buterin shared his Reddit post with three answers regarding the chain capacity being higher than before an update.

According to Buterin, that effect is split between 3 main causes:

- Pre-London average time of block generation was 3% lower than after update introduction (~13.5s vs ~13.1s). Now, it has returned to its long-run normal level.

- The maximum gas limit before the London fork up was 15M, with 2-3% of unused space (empty blocks). Post-London, if the average gas limit is below 15M, the base fee will decrease until the average is back to 15M.

- For the base fee to remain constant, the average block load has to be slightly above 50%. Average blocks in actual load were 51.5% full, ~3% above the intended fullness.

Ethereum London Hard Fork took place on August 5, effectively introducing 5 EIPs, including the anticipated EIP-1559.

Stay tuned for the upcoming news, CoinLoaners!