CoinLoan Weekly: Ethereum Bug and BTC Mining Difficulty Rise

Bitcoin Price News

Last week for the first cryptocurrency was about a price correction after a local high when BTC reached a $50,000 level on Monday. Bitcoin's max price during the week was $50,430 on August 23. The min price was $46,527 on August 26. BTC's all-week price change is a 4.70% decrease, and 24 hours one is a 1.13% decrease.

At the time of writing, BTC is trading at $47,074.

CoinLoan offers a smart way to manage your digital assets. Try our Instant Loans feature and borrow money, using BTC as collateral.

Ethereum Price

As for ETH, its price pattern during the last week was quite similar. Ethereum max, $3,366, was reached on August 23. However, later Ethereum lost in value, coming close to $3,000 on August 26.

Overall, last week was a rollercoaster for ETH, and now the second cryptocurrency is trading at $3,229, 1.89% price increase in the last 24 hours. 7 days price change for ETH is almost the same as for BTC: -4.05% vs. -4.70%.

Buy Ethereum at competitive rates on CoinLoan Crypto Exchange.

XRP Price

Ripple week was not so much different. On August 23, the coin was trading at $1.28, an all-week high. 3 days later, XRP came close to $1.06.

As of August 31, Ripple is trading at $1.11, a 1.41% decrease in value in the last 24 hours.

Ripple is currently facing legal issues - SEC recognized XRP as security and filed a petition in court demanding access to the company's internal data.

Deposit XRP in a CoinLoan Interest Account without any fees.

Cryptocurrency News

Ethereum Consensus Bug

On August 27, ETH developer, Martin Holst Swende, tweeted about the consensus bug that hit Ethereum mainnet fixed in Geth v1.10.8. Later he added most mining rigs were already updated and encouraged ETH miners to update to v1.10.8.

Swende also said that the accident "concludes our experiment with public announcements for hotfixes." According to him, the public announcement experiment was successful, as most miners had upgraded in time.

Stay safe and upgrade to v1.10.8, as, according to ethernodes.org, 44.5% of Geth clients still use older versions.

BTC Mining Difficulty Surge

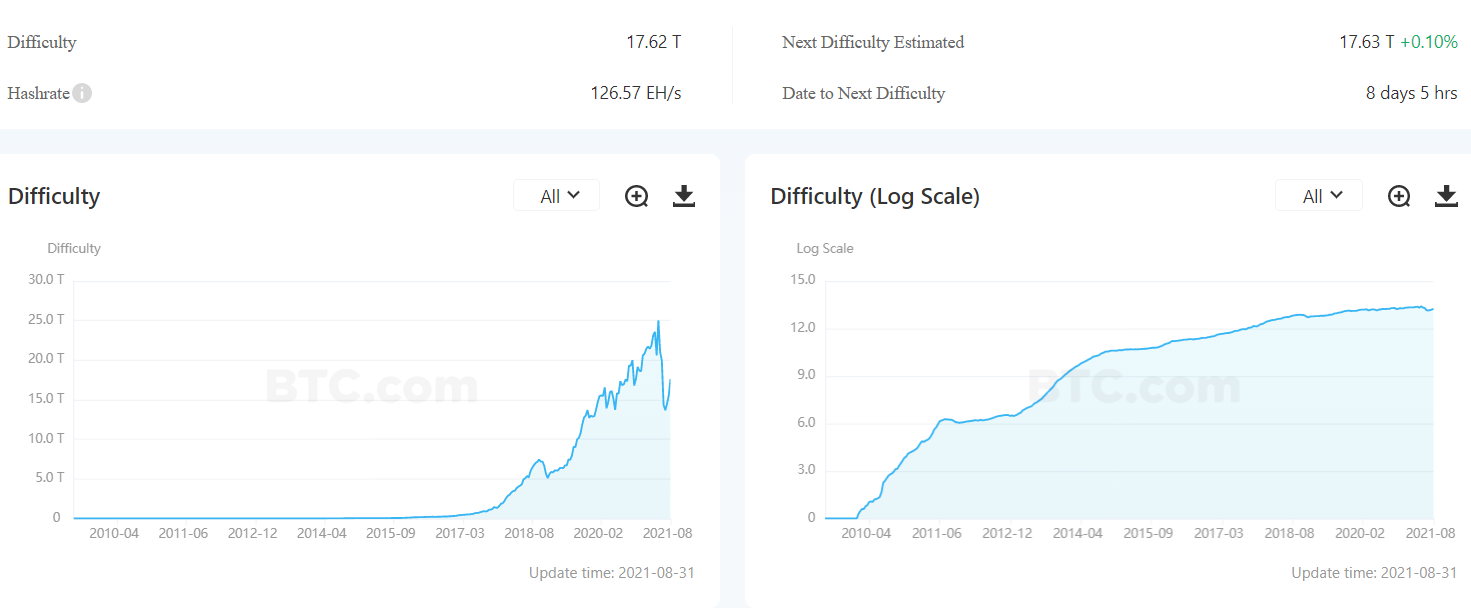

The first cryptocurrency’s mining difficulty (a measure of the amount of computing resources required to mine Bitcoin) has surged for a third time in a row: the first and the second ones we already mentioned in our blog posts.

The BTC mining difficulty rate is crucial for the whole industry - it’s a key indicator of the network health and an important factor in determining miners’ profit.

On Wednesday, August 25, the mining difficulty increased by 13.2% and is now 17.62T with a 126.57 EH/s hashrate.

That latest increase is caused by the operators coming back online after dropping off the network following China’s crackdown.

The next difficulty rate is estimated to reach 17.63T, a 0.10% increase.

MicroStrategy Bought $177M of BTC and Now Holds $2.34B in Crypto

MicroStrategy CEO Michael Saylor announced that the company had purchased additional 3,907 BTC at an average price of $45,294 per BTC. Saylor added that as of August 23, MicroStrategy held almost 109,000 BTC ($2.34B) on its BTC investment.

According to Yahoo Finance, MicroStrategy’s primary objective is to accumulate Bitcoin.The company is also believed to be one of the world’s entities with the most BTC holdings.

Stay tuned, CoinLoaners, so you don’t miss any news or updates!