CoinLoan Weekly: Stablecoin Market Cap Growth & El Salvador’s BTC Vault

Bitcoin Price News

Last week for BTC was a green zone: the asset's seven-day price change is +0.21%, which is a better result in comparison to the previous week.

Bitcoin max price ($48,690) for the week was fixed on September 18, and the min price ($43,974) on September 13.

After its all-week high BTC price corrected and now was trading at $44,703 on Monday, a 6.97% price decrease in the last 24 hours.

A BTC-backed loan is a financial tool that you can make the most of with CoinLoan: our interest rates start at 4.5%, try now.

Ethereum Price

Last week, the second cryptocurrency started with its all-week low ($3,182) and reached an all-week high ($3,652) by Thursday, September 16. From then on, ETH price corrected and fluctuated between $3,326 and $3,586 until the end of the week.

As of September 20, Ethereum is trading at $3,117, an 8.11% price decrease in the last 24 hours and a 3.42% price decrease in 7 days.

If you are looking for a better way to use your ETH coins, try CoinLoan Interest Account. Earn compound interest, credited daily, and take full advantage of the latest crypto management tools.

XRP Price

Ripple started last week at $1.09 on September 13 and continued to grow until reaching $1.12 on September 16 — an all-week high. From then, Ripple price saw some rise and fall through the week, and XRP min price ($1.06) was reached on September 18.

On September 20, Ripple price started to fall quickly, trading at $0.93 at the time of writing, which is a 12.67% price decrease in the last 24 hours and an 11.44% decrease in 7 days.

Buy, sell or swap XRP on our Crypto Exchange, using SEPA or SWIFT — whatever fits you best.

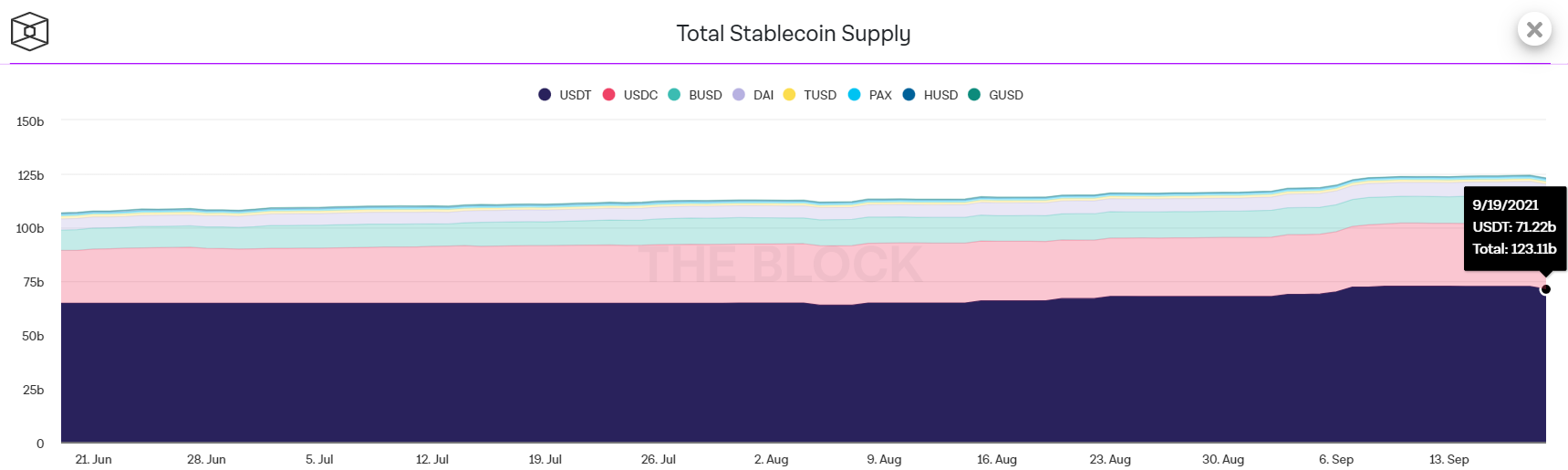

Stablecoins Market Cap Exceeded $120B

According to The Block, the stablecoins market cap is $123.11B, as of September 20, where Tether has a 57.85% share ($71.22B).

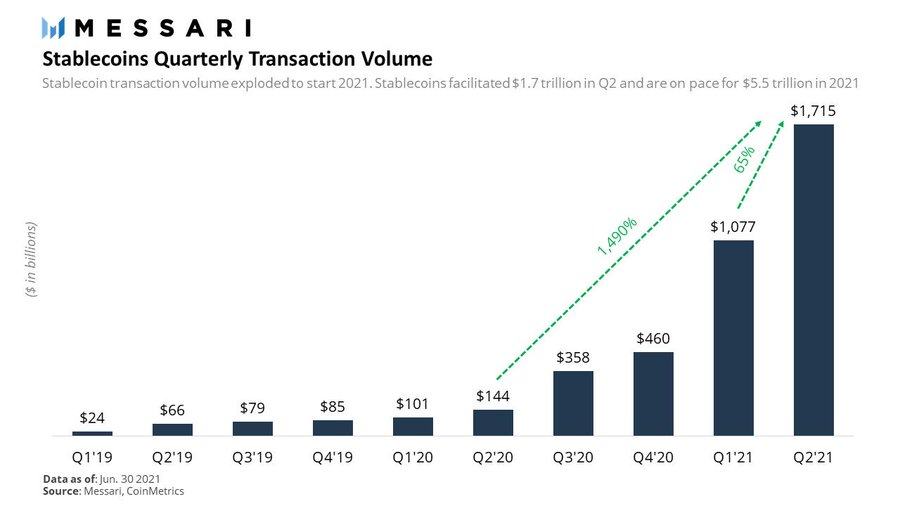

Ryan Watkins from Messari believes that this happened due to the stablecoins becoming a better means of "storing and moving dollars around the world." Watkins also posted Messari data showing that in Q2 '21, people transferred 65% more stablecoins on blockchains than in Q2 '20.

By the way, on CoinLoan, you can use various stablecoins, including the most popular one, a.k.a. Tether (USDT).

El Salvador Bought 150 More BTC

In his Twitter, El Salvador President, Nayib Bukele, announced that El Salvador bought the dip and got 150 new BTC coins by taking advantage of the currency falling below the $45,000 level. Overall, the country now holds 700 BTC. Previously, on September 7, when Bitcoin became legal in El Salvador, the government bought 550 BTC. In comparison to BTC whales the amount is rather modest - an average whale holds 12,164.76 BTC.

Bukele also said that “they can never beat you if you buy the dips” and called it his presidential advice.

Walmart Support for LTC Payments Deemed Fake

On September 13, GlobalNewsWire posted a press release from Walmart where the company announced the apparent support for LTC payments. As a result, the LTC price spiked and saw a surge of 35%. Litecoin foundation also reposted the press release. However, later on Walmart called the news fake and deleted the post on GlobalNewsWire, making LTC price face a harsh downfall. Charlie Lee, the founder of LTC, stated the release was fake but convincing. “We try our best to not tweet fake news and this time we really screwed up,” he added.