CoinLoan 2021 Annual Report

Hi CoinLoaner,

In 2021, we enjoyed success in many ways, and we are excited to share our achievements throughout our 2021 Annual Report.

The Report gives an overview of the company’s progress. We present details of our work and the ongoing effect of our activities, evaluate the statistical data, analyze our business and marketing strategy, and share our thoughts and plans for the future.

Without further ado, let's get down to business.

In a nutshell

At the end of 2021, CoinLoan’s financial position was the strongest in our history. The Company grew and celebrated the milestones of achieving its goals step-by-step. Besides, we observed exponential growth across all the key metrics: users, profits, and assets.

Notwithstanding that we maintained our focus on our strategic priorities, namely, improving the CoinLoan platform and advancing new business activities, other factors also impacted our results for the year.

Increasing the number of tech personnel, growing the budget on the platform, and launching new marketing activities also helped us.

“Our strong culture and values underprint a business built on specialization, team spirit, integrity, and accountability. Our values shape how we conduct our business, provide services to our customers, interact with each other, and support our community. Our clients and employees count on our long-term economic sustainability. They also rely on CoinLoan to deliver on our promises.” — Alex Faliushin, CoinLoan CEO.

The ongoing support of our executives and all of our employees makes what we do possible. We would like to thank them and you, our clients, for your continued support and confidence as we advance our efforts to move the company in a new direction. We look forward to updating you as we progress our initiatives in 2022.

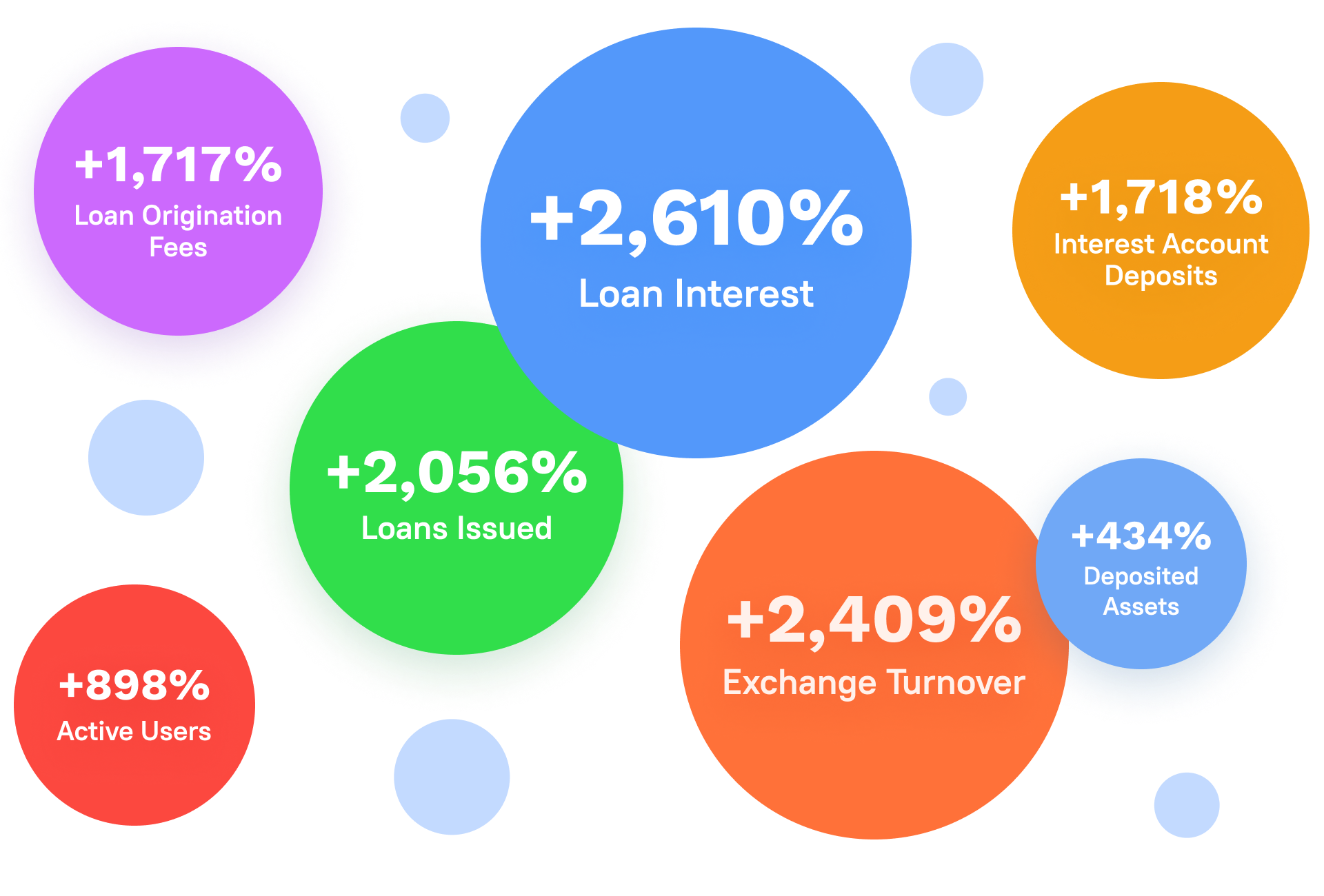

2021 growth highlights

Overall metrics

Our 2021 results were truly extraordinary, continuing our long track record of outstanding performance.

Let’s delve into the details of this past year.

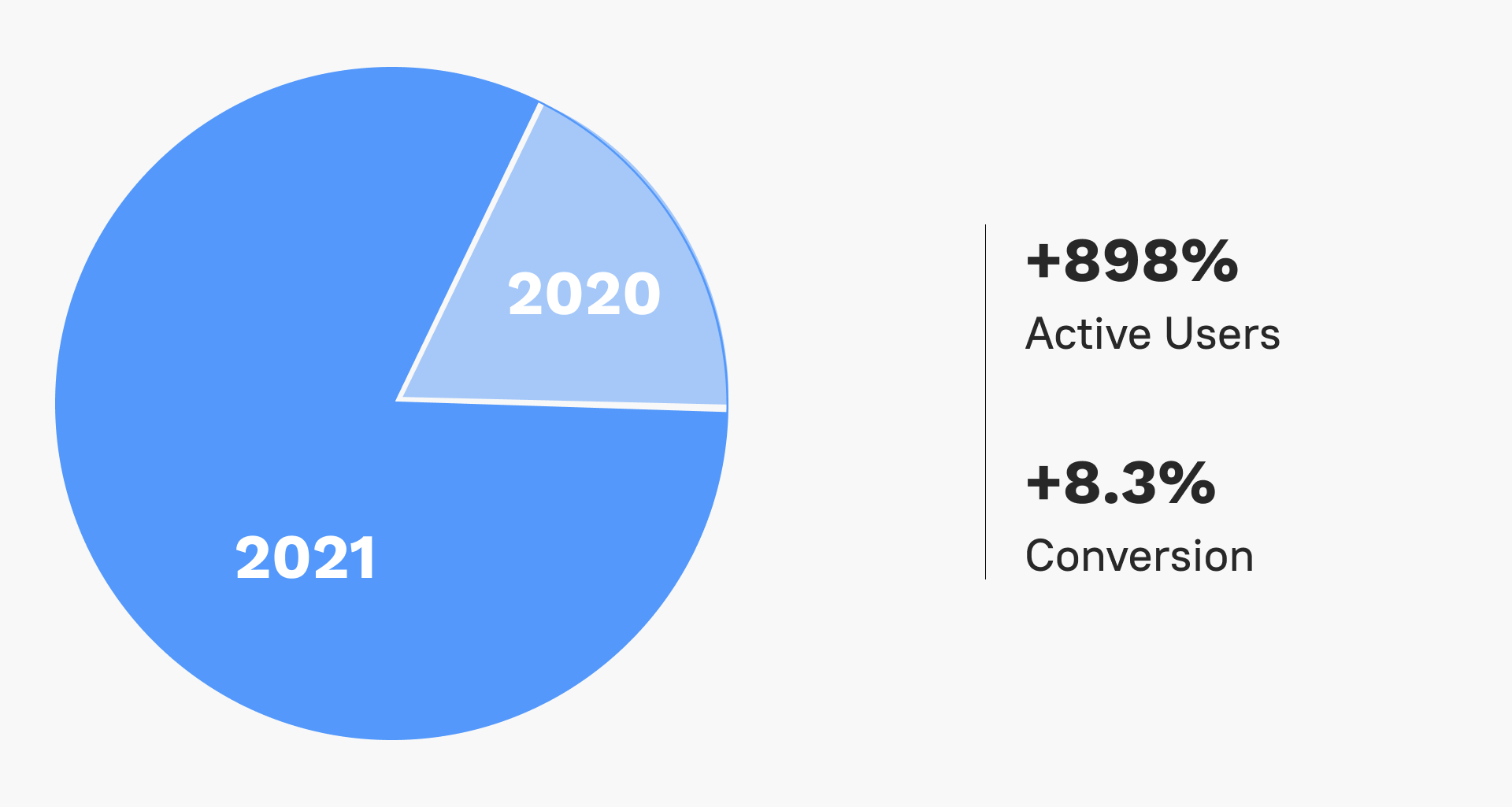

Customer growth

Compared to 2020, last year brought unforgettable results in customer growth. The number of active users increased by several times (+898%). The conversion rate also boosted and amounted to 8.3%.

The users' growth became possible due to the following marketing activities, which are still in progress: content marketing, social media marketing, email marketing, lead generation, advertising, and SEO. Besides, our platform became quite popular, and customers recommend it to their acquaintances.

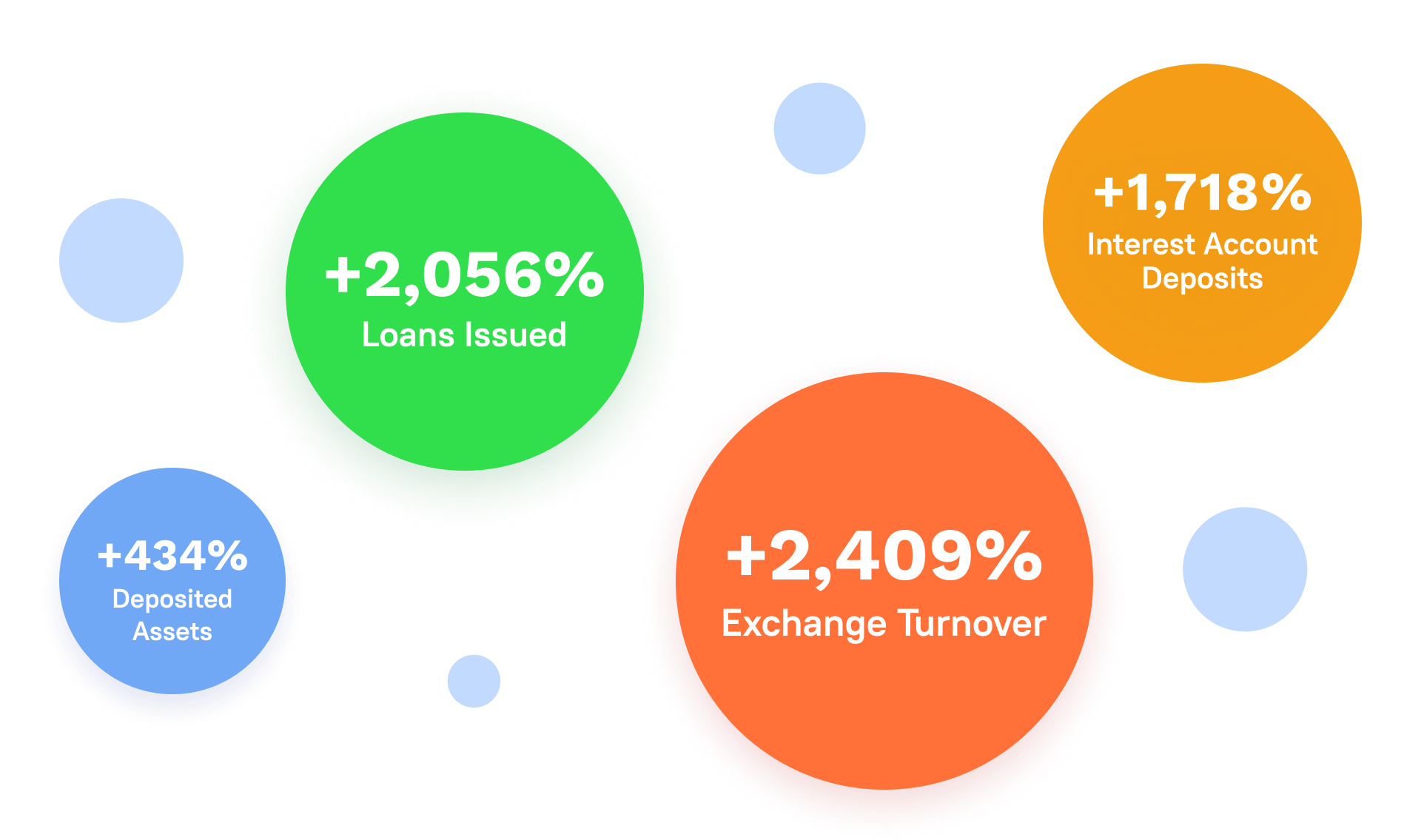

Asset growth

The growth of deposited assets, crypto-backed loans, Interest Account deposits, and asset exchange turnover spiked in numbers compared to the year 2020.

Crucial metrics (compared to 2020):

- Wallet deposits grew by +434%.

- Exchange turnover rose by +2,409%.

- Crypto-backed loans surged by +2,056%.

- Interest Account deposits spiked by +1,718%.

The spike happened for several reasons:

- Customer growth due to marketing activities;

- Implementing new features and adding new cryptocurrencies to the platform;

- Re-designing, localizing, and updating our mobile application;

- Customer Support team growth and constant improvement of our customer service.

“Cryptocurrency is becoming a tool for fast and easy transfers. While the transactional value of crypto remains undervalued, we are working on introducing new features to make the CoinLoan wallet answer the needs of modern times.” — Max Sapelov, CoinLoan's CTO.

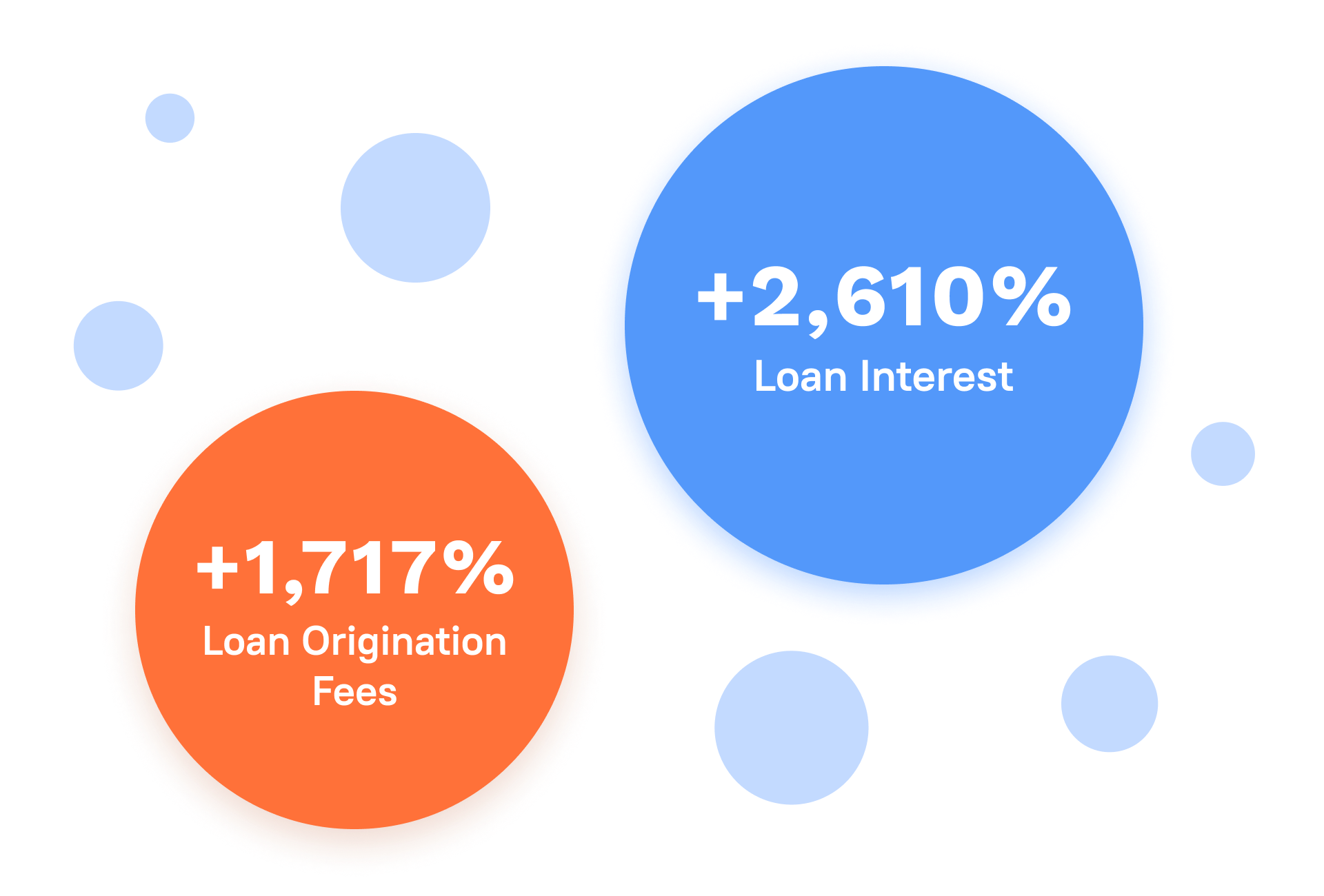

Profit growth

The primary CoinLoan profit channels are loan origination fee and loan interest.

Crucial metrics (compared to 2020):

- Loan origination fee profits surged by +1,717%.

- Loan interest profits grew by +2,610%.

In 2021, profits grew at a record level due to rising customer and asset growths, as well as loan activity.

Released features

Looking back to 2021, we are proud to confess that one of the main reasons for our outbursting success was releasing new features and updating the older ones:

- We evaluated and offered new coins and tokens on CoinLoan to enrich the variety of assets available.

- We added more languages to both web and mobile platforms to strengthen our global presence.

- We delivered new features like financial reports, deep linking support, and many others to answer the clients’ demands.

- We had integrations with crucial services to boost the overall performance of our platform and improve user experience.

We provide our services to our customers from an infrastructure designed and operated by us but secured within a third-party data center facility. Our technology and product efforts are focused on improving and enhancing the features, performance, availability, and security of our existing platform and developing new functionality and services.

Let’s look into released features in more detail.

Both web and mobile platforms updates

- Default currency selector: We implemented the option to choose the default currency of the Wallet in Settings. The available default currencies are US Dollar, Euro, Pound Sterling, Bitcoin, and Ethereum.

- Financial reports: CoinLoaners can generate financial reports for all their transactions on the CoinLoan platform. We now offer the following report types: Wallet Transactions, Interest Account Transactions, and Total Earned Interest.

- My Wallet update: If users deposit or withdraw ETH or its tokens, they see a warning notification about using an address only on the Ethereum blockchain to avoid permanent loss of their funds.

- BTC and LTC addresses update: The BTC and LTC addresses migrated to Bech32, a modern format with lower fees and higher processing speed. We added an option to select between Bech32 and Legacy (former SegWit tab) formats. We advise our clients to use Bech32 and turn to SegWit (Legacy) only if their third-party wallet has no support for addresses running on the new format.

Mobile platform updates

- Refer a Friend: We added the Refer a Friend option to our mobile app. The option is available in Settings. Our clients can invite their friends to CoinLoan by generating a referral link right in their application. When invited friends use our services, the clients get the following referral rewards: +0.2% of every exchange amount, +0.2% of every loan amount, and +0.1% of Interest Account holdings (annual rate, rewarded monthly).

- Localization: In addition to the English and Russian languages, our mobile app now supports German, French, Turkish, Japanese, and Spanish. To switch the language, users should go to the Settings module, tap on the dropdown menu, and select the desired language.

- SWIFT payments: SWIFT payments were already available on the CoinLoan web app, but its mobile version lacked this functionality. Now, clients can deposit EUR and GBP to the CoinLoan Wallet from their smartphones.

- SumSub integration: SumSub integration is a freshly introduced KYC verification tool on mobile. New clients can now verify their identities on the go through the mobile app.

- Intercom chat: We integrated Intercom chat into our mobile application. The number of mobile users has grown, and we aim to provide the support most efficiently manner. Intercom allows everyone with the CoinLoan app on iOS and Android to receive help much quicker.

- Sessions: We developed the Sessions option to keep accounts safe and prevent external intrusion. With this feature, CoinLoners can control all devices with access to the account by going to Settings > Sessions.

- Deep linking support: One of the most prideful features we implemented last year is the deep linking functionality. Now CoinLoaners can use smart links to easily sign up, log in, or go to their Wallet, Crypto Exchange, 2FA screen, and more just by clicking the link.

- Wallet updates: We added the ability to watch the transfers and transactions history and see asset details in USD equivalent. Besides, if you want to deposit USD, the application will lead you to the web.

Web platform updates

- Partial Loan Repayment: We implemented the Partial Repayment feature, with the help of which our clients can cover a specific part of their loan early in the loan currency. It may contain an interest for the current period plus a loan principal. The amount is flexible. Currently, the option is available on the web platform only. It will arrive in the mobile app with subsequent updates.

- Redesigned Wallet: We added a table view for showcasing available assets and the eye icon for showing and hiding balances to facilitate access to information and improve user experience.

Added assets

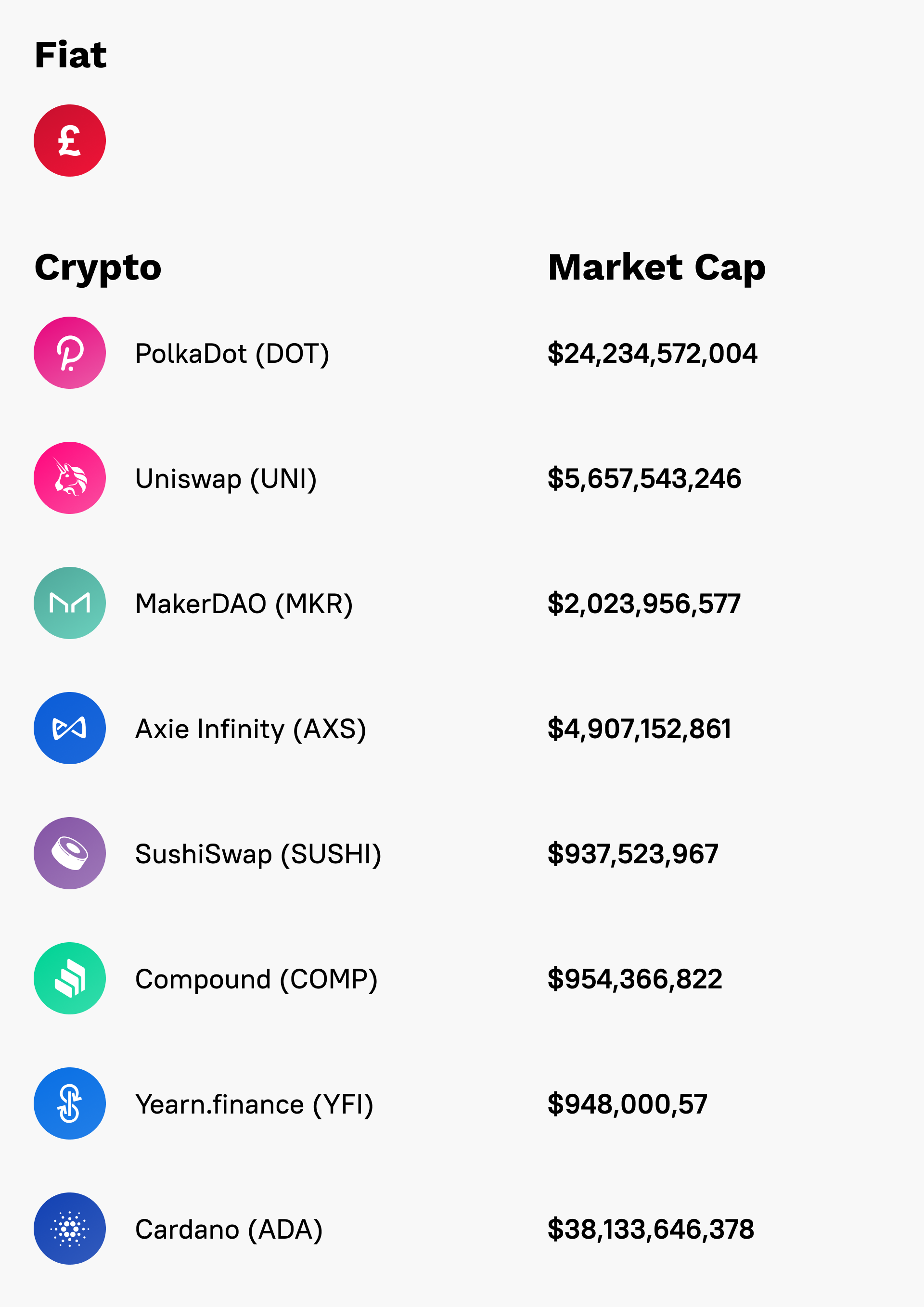

As CoinLoan strives to be a reliable and efficient platform providing access across a healthy variety of digital assets, we have added eight new cryptocurrencies for selling, earning interest, and using as collateral for crypto-backed loans.

Here is the list of newly-added supported digital assets:

* The key metric numbers are taken from CoinGeko.com and calculated as of February 07, 2022.

Marketing activities

Investing in our operations is what we must do to grow exponentially. We allocated more resources into marketing activities and developing the product, built strong partnerships, and took the transactional business route.

The users' growth became possible due to the following marketing activities, which are still in progress:

- Content marketing: We create and share relevant written, downloadable, and visual media so our clients can learn about our company and product.

- Social media marketing: We successfully expand our reach through social media, boosting brand awareness and promoting our product and services.

- Email marketing: Emails remain one of the most important and influential ways for our company to connect with clients and build lasting relationships with them.

- Lead generation: With lead generation, we attract and convert anyone interested in our brand, product, and services.

- Advertising: Thanks to advertising, we attract customers, improve brand awareness, and generate revenue.

- Search engine optimization: We increase our website's visibility and rankings by incorporating SEO strategies in our marketing efforts.

Business operations

CoinLoan has an entrepreneurial spirit at its core. Experienced professionals work in our company, and our product equips individuals to manage their finance and help them live their lives to the fullest.

Customer service and support

We offer professional services to help clients achieve their results with CoinLoan.

As the number of clients grew, we enlarged our customer support team. The team works directly with the clients, consulting them and processing various requests. Our global customer support group responds to all inquiries about using our products via online chat, email, social networks, and other channels.

To be customer-centric is extremely important to us. That’s why we treat everyone with respect and do our best to help. Each support team member demonstrates a commitment to public service, satisfies customers, and holds self-accountable to quality outcomes.

Communication channels

In addition to increasing our customer support staff, we expanded the number of communication channels, including Telegram, Reddit, and others.

We also added live chat to our mobile application to provide faster assistance to our clients.

Transfers

We integrated the Fireblocks digital asset custody into the CoinLoan ecosystem to support more blockchains and assets with bank-grade security.

To avoid rising expenses, we added one more custodian to CoinLoan to widen the list of supported digital assets and optimize operational processes. That took some energy and additional investment, but customer satisfaction matters much more. We value our clients above anything else and will continue to provide the best crypto management experience possible.

CoinLoan token (CLT)

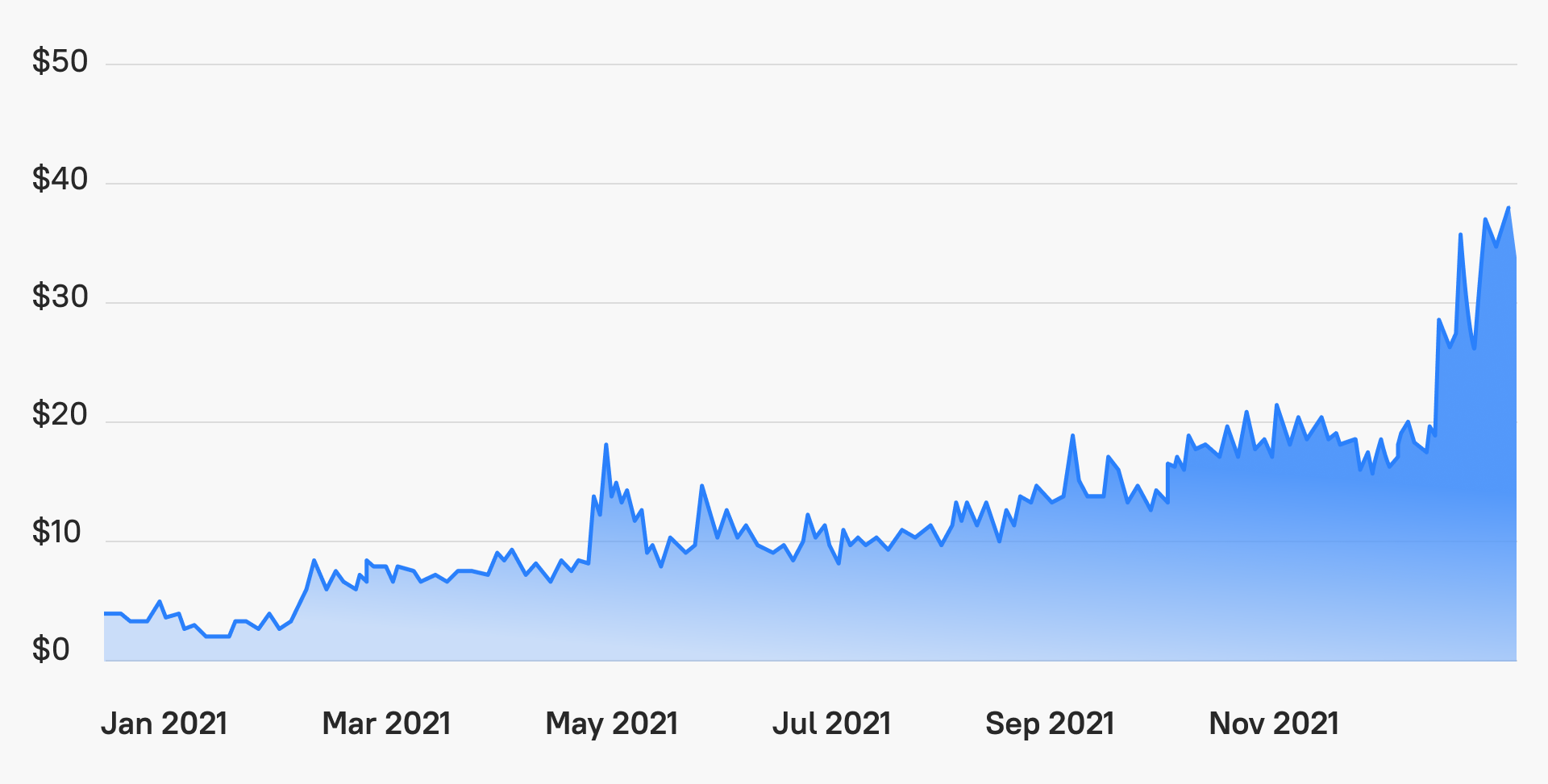

CLT or CoinLoan token is our native Ethereum-based ERC-20 utility asset applied on the CoinLoan platform and used for securing loans and paying fees. Last year, it grew tremendously in value, reaching an all-time high of $38.7.

CLT utilities:

- Our clients can grow annual interest up to 12.3% with staking CLT. The more CoinLoan tokens our customers have, the higher their rates are.

- Our clients get a 50% discount on borrowing fees when paying with CLT. The discount is deducted from the loan currency fees’ amount.

- CoinLoaners have the opportunity to use CLT as loan collateral.

- Our customers can use CLT for exchange conversions against any other asset traded on our Platform.

The CoinLoan Token is available for buying on the Bittrex, Uniswap, Hotbit, and HitBTC exchanges in pair with BTC, ETH, and USDT. On the CoinLoan platform, users can directly buy CLT for fiat, stablecoins, or crypto.

Future plans

Business and growth strategy

We orient our business strategy and invest for future growth by focusing on several key priorities.

Developing robust crypto ecosystem

We know how to run things in the world of digital finance. That’s why we want to create a crypto ecosystem containing several technological products and services. We already buy, sell, swap, open deposits, and provide cryptocurrency-backed loans. We’ve combined cryptocurrency wallets with the best fintech services to create an all-in-one platform focused on convenience and clarity. But we are eager to go further.

International expansion

We continue to increase our global go-to-market resources, operations, and infrastructure investment to deliver the highest quality service to our customers worldwide. Notwithstanding that we are already a financially licensed fintech company that honestly and legally operates worldwide, we plan to obtain more licenses to get more opportunities for our business. Adding new languages support is also a part of our international expansion plan.

Expanding relationships with clients and assets growth

We see significant opportunities to deepen existing customer relationships through communication and support our community. We also want to promote strong customer adoption and reduce customer attrition. We believe that we have the people, processes, and proven innovation to help our customers to get interested.

As a result of customer growth acquisition and adoption, we hope to grow more assets. Wallet deposits, exchange turnover, crypto-backed loans, and Interest Account deposits are our prime sources of income.

Smart customer experience

The blockchain and the cryptoasset market are new and challenging environments for most people. But cryptocurrency is the future. We aim to provide our users with a convenient, flexible, and secure tool to manage their digital assets. We want to show that this is another way to invest. We want to ensure that managing your cryptoassets can be as simple as a traditional banking or investment application — and perhaps even more manageable.

Enhancing crypto lending functionality

CoinLoan is a credible crypto lending platform available on the Web browser, iOS, and Android while working effectively to manage digital assets. But we aim to become the world-largest crypto lending platform. We plan to extend our credit line, especially the institutional one, to achieve this. We have already identified some options we’d like to implement, and we hope we will manage to do it shortly.

Transactional business

Transactional business is a new trend in the crypto industry. Emerging in early 2021, it’s an idea of cryptocurrency becoming a tool for fast and secure transactions. The transactional value of cryptocurrency remains undervalued, but we plan to be ahead of time and introduce new features to make our services answer this call.

Debit crypto card

We are planning to launch our Debit Crypto Card, powered by the Visa network, which will offer suitable financing options to our clients. The card will be linked to the CoinLoan digital wallet and allow storing and spending fiat and cryptoassets worldwide, accessing transaction history, and tracking expenses. The card will have virtual and plastic variations and support Google Pay and Apple Pay.

Security and certification

Safety is our top priority. We operate with ten principles that keep the CoinLoan financial system running smoothly. These principles are rigid and flexible at the same time because the only way to ensure security in the digital era is to be versatile and unshakable. We scan and crash test our system daily to make it stronger, and we partner with white hat hackers to make it ironclad.

We store customers' assets in BitGo, the most trusted custodian. We are security geeks. If you are, too, you can read more about CoinLoan's ten security principles here. We guarantee that our clients will sleep well while their assets are at CoinLoan.

Besides, we are going to complete the Service Organization Control (SOC) 2 Audit, which will affirm that CoinLoan’s information security practices, policies, procedures, and operations meet the SOC 2 standards for security, availability, confidentiality, and privacy. With the addition of SOC 2, we will further strengthen our position by being certified for ISO27001. Certification to the ISO 27001 Standard is recognized worldwide. It will indicate that our information security management system is aligned with information security best practices.

In addition to the above, we are developing a new feature helping to improve the safety of our clients' assets — Address Book. The Address Book functionality will allow users to add and store any number of crypto addresses, making it easier and safer to send crypto to those crypto addresses they know and trust. Stay tuned!

Delivering new features

As part of our growth strategy, we provide innovative solutions and continue delivering new features. We have a lot do:

- Integrate additional blockchains and add new coins and tokens

- Implement charts to visualize financial data on each asset

- Extend market information

- Develop an open API for account management

- Implement more stablecoin transfers

- Add the fixed period option to the Interest Account functionality

- Support YubiKey as 2FA

- Implement margin trading

- Integrate report export for tax management

- Develop customized corporate products

We expect to continue developing our product with more effort.

“Our sole aim is to create a single platform for managing all of our customers’ digital assets. We are planning to launch our debit crypto card, implement margin trading, add new asset classes along with improved exchange functionality, and so much more. We aim to show tremendous growth in the next upcoming years.” — Alex Faliushin, CoinLoan CEO.

Loyalty Program

We are developing a Loyalty Program for CLT holders. In the Program, our clients will have the opportunity to reach four levels: Starter, Value, Advanced, and Performance.

Each level will give advantages in several CoinLoan products and services. The tier the clients are ranked at depends on a share of Staked CLT to their total Interest Account balance. The more their share, the higher their level.

New CLT utilities

In addition to the Loyalty Program, we also plan to launch new CLT utilities to the Instant Loans functionality, such as CLT as loan currency, a discount on loan interest when paying with CLT, and other benefits you may enjoy.

Marketing

Our marketing strategy is to promote our brand and generate demand for our offerings. We use a variety of marketing programs across traditional and social channels to target our prospective and current customers, partners, and developers.

“This year, we are going to focus on further growth. It is essential for us to keep up the top-notch level of user support and get feedback on our new features. We strengthen our marketing with PR, social media, and user acquisition teams. In this way, our community can grow, get more transparency into CoinLoan’s plans and share their feedback.” — Ilia Stadnik, CoinLoan CMO.

We’re ready to launch our brand new partnership program from the business perspective, which will benefit affiliates, media buying teams, webmasters, influencers, and brand ambassadors. We designed it to add custom offers, API integration, and advanced analytics to fit the most needs and mitigate most pains of our partners.

Wrapping up

We’d like to extend our gratitude to our employees, customers, partners, and all of their families. We are continually reminded that we are all connected, and we are grateful for each one of you. At CoinLoan, we look forward to doing business with you all and wish you the best in the new year. Looking to 2022 and years ahead, you should expect us to continue to adhere to the core strategic drivers of our long‑term success: ongoing research and development of our product and delivering a unique value proposition to our customers.

Without prejudice disclaimer. Nothing contained in this Blog (or published by CoinLoan otherwise) shall be interpreted and used against CoinLoan or be detrimental to any of its rights. All information publicly disclosed by CoinLoan herein or elsewhere shall be without prejudice to (i) any CoinLoan's rights or interests whether addressed in this Blog or not, and (ii) any position that CoinLoan may take in legal or administrative proceedings.