No Pain, No Gain? Legal Ways to Pay Less Crypto Taxes

Benjamin Franklin believed that in this world, nothing could be said to be certain, except death and taxes. We cannot but agree with Mr. Franklin; taxes will catch you up sooner or later even if you didn’t know they existed. Have you heard those nightmare stories like one with the student who invested $5k in ETH & now owes $400k in taxes? There are dozens of such stories in Reddit from guys who suddenly discovered that they owe more than they currently have.

To avoid such surprises at the end of tax season, it would be nice to look into that Wild West crypto situation in advance. And to take care of tax optimization, since focusing on saving taxes can do more for your bottom line than another proper investment. Unfortunately, this is usually easier said than done. Because… It doesn’t look like national governments seem to be in any kind of agreement on the crypto question.

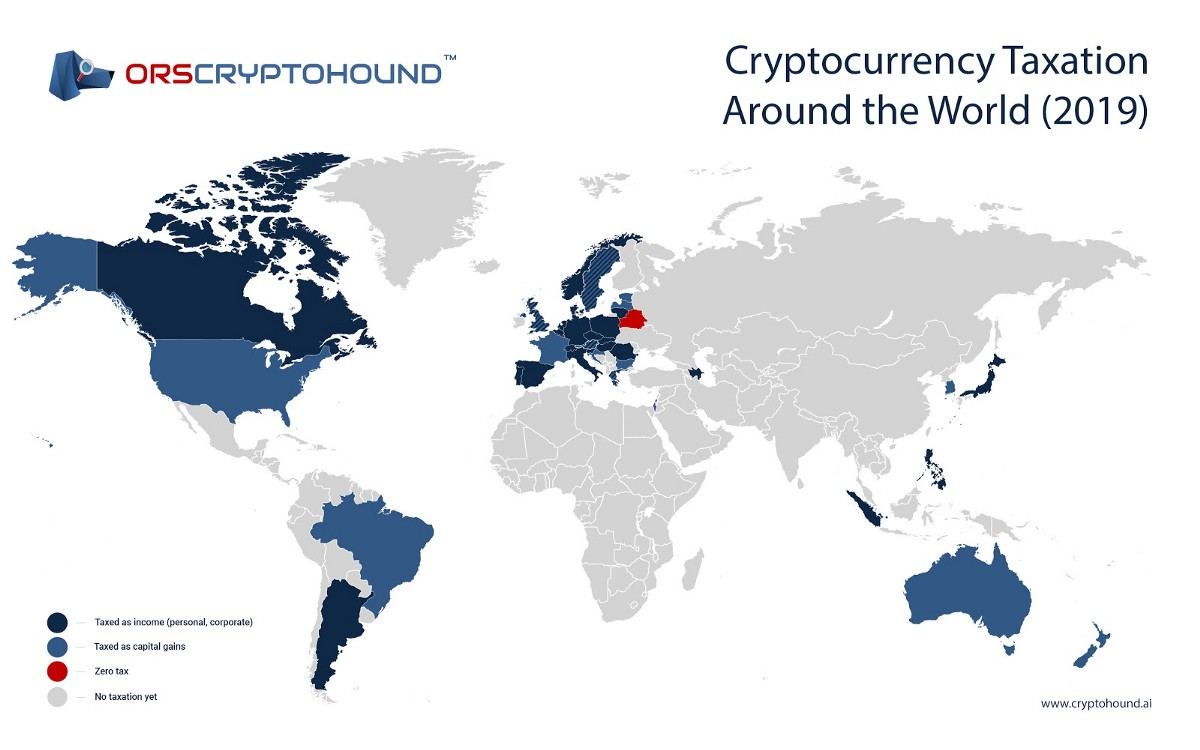

In 2019 cryptocurrencies still have unresolved status on the global stage and approaches to the tax treatment became a challenge for the crypto community. According to ORS CryptoHound, at the beginning of the year 2019 official regulation regarding cryptocurrency taxation exists in about 25% of countries and varies significantly from place to place between 0% and 55% (see the map below).

Countries categorized cryptocurrencies differently for taxation, as illustrated by the following examples:

- Israel → taxed as an asset;

- Bulgaria → taxed as a financial asset;

- Switzerland → taxed as foreign currency;

- Argentina & Spain → subject to income tax;

- Denmark → subject to income tax and losses are deductible;

- United Kingdom → corporations pay corporate tax. Unincorporated businesses pay income tax, individuals pay capital gains tax.

For more info about crypto regulation worldwide, check out the report of The Law Library of Congress on legal landscape of cryptocurrencies around the world that covers 130 countries.

We at CoinLoan have some ideas on how to minimize capital gains and optimize tax strategy. Let’s take the US situation for example.

Internal Revenue Service US states that virtual currencies should be treated as property, not money for tax purposes. Like stocks or bonds, any gain or loss from the sale or exchange of cryptoassets is taxed as a capital gain or loss. So if you are a US taxpayer and sell your crypto to purchase goods or services, it’s a taxable event. If you exchange your Ether for Bitcoin or vice versa, it’s a taxable event. If you liquidate your cryptoassets for USD, it’s a taxable event. But borrowing money against your crypto is NOT a taxable event. You don’t realize gains until you trade, use or sell your crypto.

Unlock Your Crypto’s Value Without Tax Triggering Event

Borrowing on CoinLoan, you can unlock your crypto’s value without having to pay up to 37% of taxes. Since a borrower doesn’t make a profit, a crypto-backed loan doesn’t create a taxable event. Let’s figure out how the gains you make after selling stocks will be impacted by income taxes.

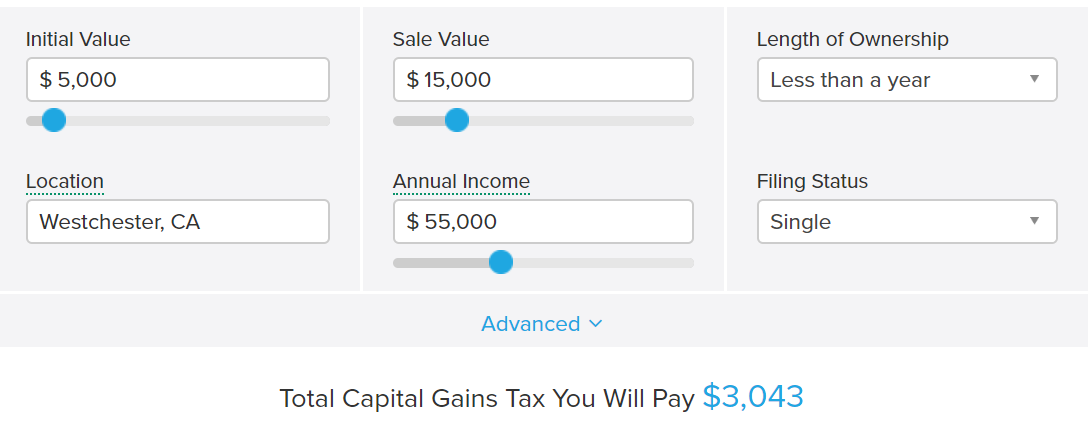

Imagine a guy living in Westchester. About nine months ago he invested $5,000 in BTC and now all his crypto is estimated at $15,000. He’s going to cash it out. Just like any other form of personal property, he incurs a capital gain when selling crypto for more than he acquired it for. In this case, he’s to pay more than $3,000 (see the calculations below).

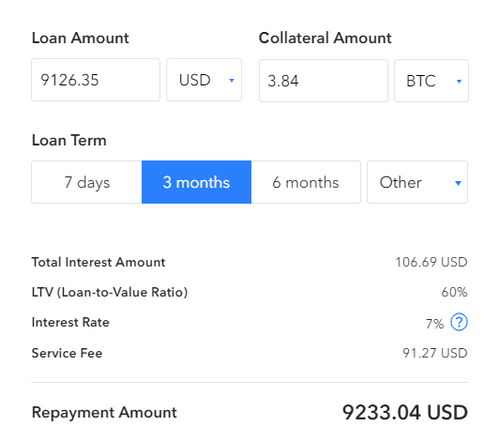

All right, let’s now assume that he borrowed more than $9,000 using his BTC as collateral at the CoinLoan platform. In case if the interest rate is 7%, he’ll pay ~$100 interests and about the same as a platform fee (see the calculations below). Thus, he’ll pay less in interest than the taxes on capital gains — $200 instead of $3,000.

There are aspects to this, you need to consider. Since crypto is treated as property in the US, difficulties are possible if your collateral will be returned with different, newly acquired Bitcoins. Say you borrowed money against your car. If the lender returns a different car, that could be viewed as the sale of the original vehicle, rather than a loan for tax purposes. The same with crypto. Cointelegraph warns that if you end up with a different “car”, the IRS might say that was a sale of an asset, followed by the purchase of another asset.

With CoinLoan, you don’t ever have to worry about that risk. A borrower on the platform receives back the same crypto that was locked as collateral.

Reduce Your Tax by Holding Within a Year

You may not wish to hold your crypto forever. How to exchange or cash it out with a minimal loss?

Crypto taxation may be progressive in some countries. It means that governments estimate capital gains differently depending on how long you held the investment. Trades, sales, and purchases using crypto can be subject to short or long-term capital gains/losses tax treatment. In the US, you’ll pay up to 37% if your assets were held for a year or less before being sold and up to 20% only in the long run. In Germany, you’ll pay 25–28% for short-term gains, but if your assets were held for more than a year, they become tax exempt.

In our example with a Westchester resident, he’ll save $700 (23%) just by waiting for two months until his short-term gain becomes long-term (see the calculations below).

It makes sense to hold cryptocurrencies for more than a year. And it’s just fine if there’s no emergency to free up your assets now. But assuming you need fiat money for everyday expenses, to buy more crypto and so on, here’s a sustainable solution. Would it surprise you to hear about crypto-backed lending again? 😏 It seems like a smart idea. You just borrow some cash against your crypto to wait for the year to pass. On the CoinLoan platform, you can choose any suitable term between 7 days and 3 years. During this period you’re free to use the value of your crypto without triggering a capital gains tax event.

Rethink Your HODLing Strategy

We know this is awful to say, but… HODLing is not always the best choice. Paragraphs above are focused on crypto gains. However, in 2018 more people experienced losses on crypto as soon as Bitcoin and other cryptocurrencies fell by as much as 80–90%. NewsBTC claims that only 34% of losses American cryptocurrency investors saw in 2018 have been realized, suggesting that most Americans don’t understand confusing crypto-related tax laws, and don’t realize they can claim the losses on their taxes.

Let’s say our Westchester guy invested his $5,000 and remained with $1,000 eventually. Liquidating his crypto to lock in realized losses at the end of tax period can be a wise thing to do. In the US, you can use up to $3,000 of capital losses each year as a write-off against income other than capital gains. If your losses are greater than your gains by more than $3,000, the extra losses above the $3,000 can be carried forward to future tax years. It means that you can use your current losses to compensate capital gains if the market eventually turns around and a new bull run begins next year.

Thanks for reading!

Traditional disclaimer: it’s not legal advice, it’s provided for informational purposes only. This piece is less about loopholes, more about knowledge that means power. Okay, what did you mean by that? A person doesn’t know how much he has to be thankful for until he has to pay taxes on it. A better understanding of crypto taxation in your jurisdiction can do more for your profits than a good investment.

Subscribe and keep in touch if you’re interested in crypto-backed lending!

Platform | Website | Telegram | Email | Facebook | Twitter | Reddit