New Fees Structure at CoinLoan Explained

CoinLoan changes static fees structure to the dynamic one to enhance our users’ experience and to meet market demands. CLT holders can take advantage of this update and enjoy preferential fees cut by 50%.

Before We Start

In today’s update, we’re speaking about fees in CoinLoan tokens (CLT). That doesn’t deal with investing fees since they still pay no fees according to Zero Fees Offer promotion. The promo ends in mid-summer after that fees structure update will enter into force for lenders also.

How Did Fees Use to Work?

Basically, you have two options, either to pay platform fees in the currency of your loan or CLT. Fiat fees have always been dynamic. It’s convenient and easy to understand — you pay in a range from 1% to 3% of the overall loan principal amount, depending on the loan term. Borrowing up to 360 days, you’re to pay to the platform only 1%. Well, it looks like CoinLoan has the lowest commission on the market. 🤔

But for CLT those calculations looked in an entirely different way. Fees were defined by the formula no one knew how to use.

So What’s Changed About Borrowing-Fees-Paid-in-CLT?

From now on, the commission paid in tokens is based on the loan amount and on the tokens’ current market value. It’s fully transparent and can be calculated easily. No formulas. But of course, the best thing about it is a fixed discount of 50% for those who pay in CoinLoan tokens.

How Is the Discount Calculated?

- Borrowing fees estimates in the currency of your loan (1–3% of the overall loan principal amount, depending on the loan term).

- This amount is reduced by half.

- The resulting amount is converted into CLT (according to its current market value).

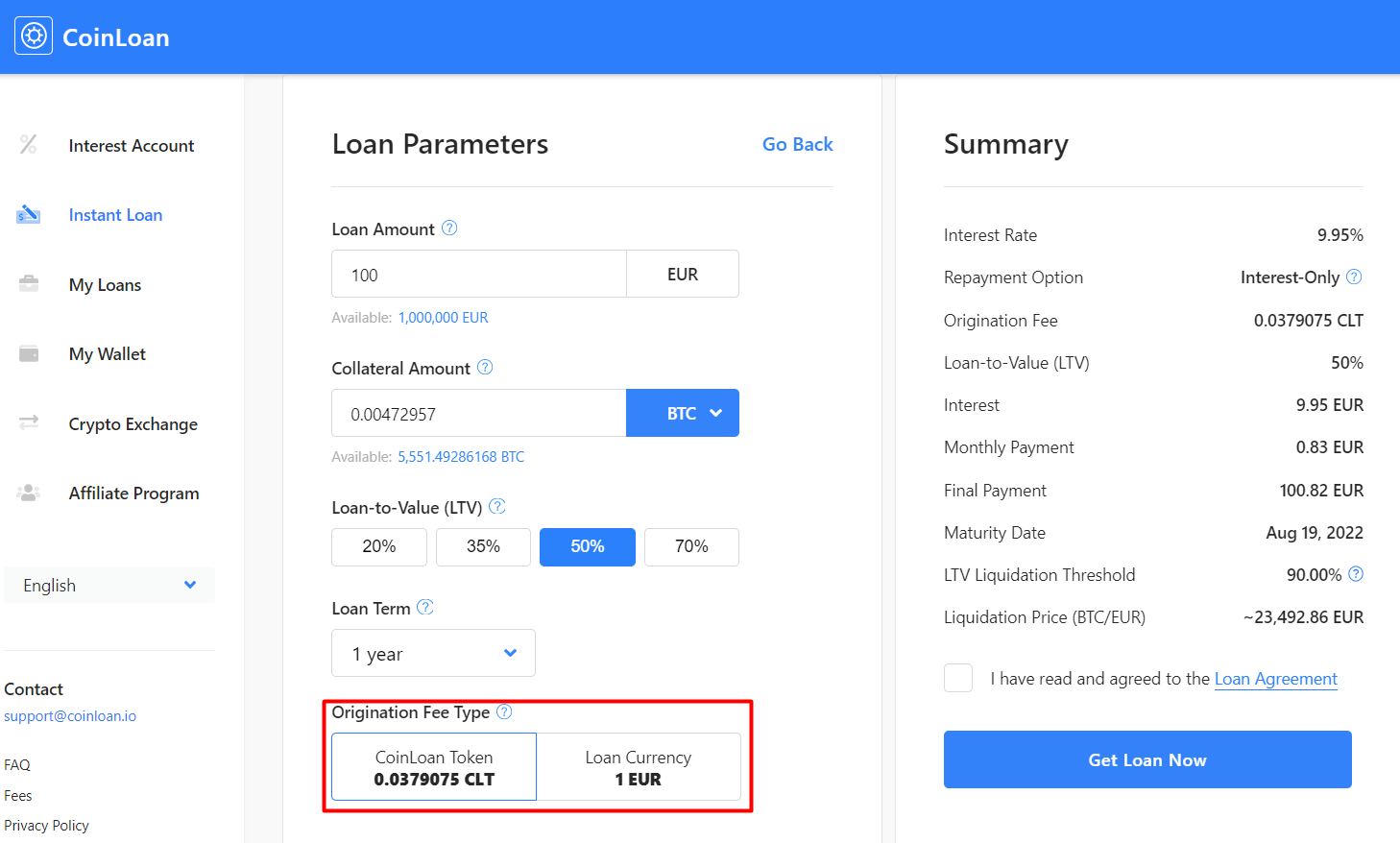

You can consider how the updated fees work on the CoinLoan Platform while getting an Instant Loan.

Here’s Why That’s a Big Thing

Due to a halved price, paying in tokens became a win-win for users, investors and the platform itself. Those who want to borrow two times cheaper, are very motivated now to buy CLTs for saving on platform fees. We expect an increased demand for tokens and boost of their liquidity. Such progress will make it possible, for instance, to raise the LTV limit for using CLT as collateral.

Thanks for reading! Have a suggestion for further updates? Let us know ⤵️

P.S. How do you like our new banner style? 😏

Platform | Website | Telegram | Email | Facebook | Twitter | Reddit