Interest Rates Are Cut More Than Half for Instant Loans

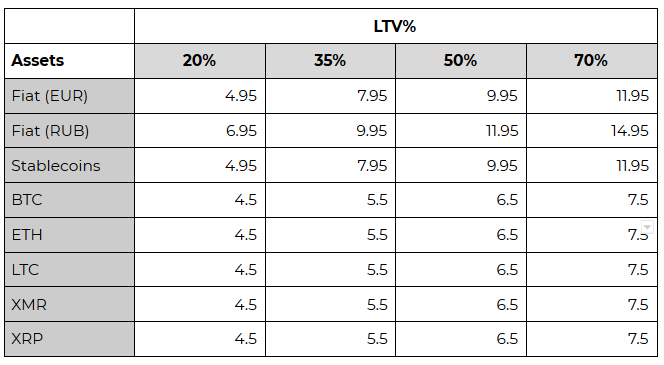

We have changed the way we calculate interest rates. There’s no fixed 10% rate anymore. Instead, rates now depend on the loan-to-value ratio. The lower is the LTV you choose, the better is the interest rate. The cheapest rate for cryptocurrencies is 4.5%; for fiat and stablecoins it accounts for 4.95%.

Looks like CoinLoan now has the most advantageous interest rates, while keeping one of the highest LTV available in today's crypto-lending market.

Get a LoanWhy We Choose to Make Flexible Rates

For borrowers, the best protective measure in an uncertain time is to set a lower loan-to-value ratio. The lower the ratio, the more significant market fluctuations the loan can safely absorb.

Though we’re not supposed to restrict the upper bond of LTV, we want to encourage our users to choose a more robust ratio.

How Does It Work Now

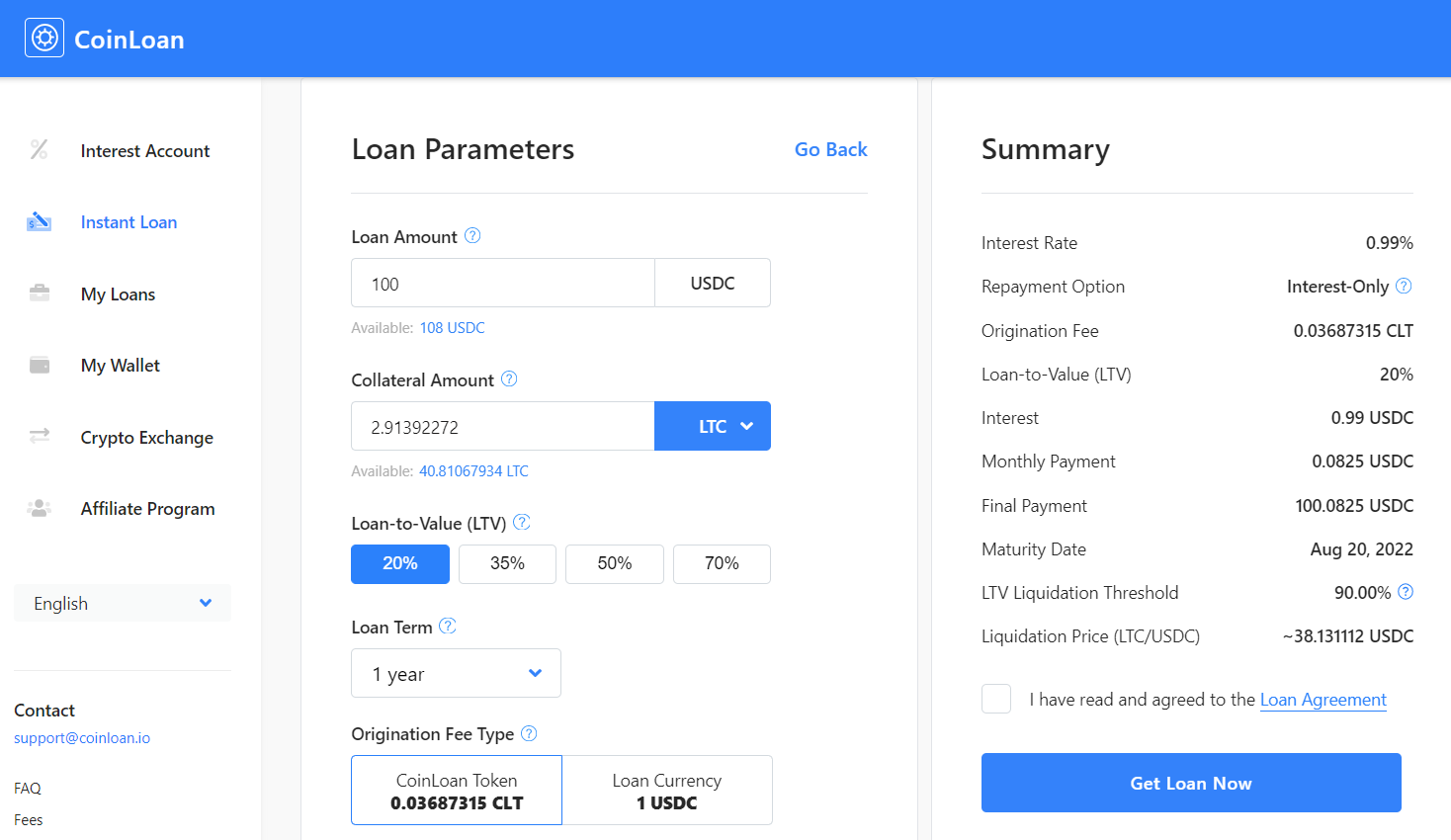

You can notice some changes in the Instant Loans tab. Filling out the application form, you’ll need to click one of the four boxes, choosing between 20%, 35%, 50%, and 70% LTV.

Thus, you’ll determine the amount you’re going to borrow against your collateral and the interest rate you’re going to pay. Switching between the boxes, you can instantly see in a loan summary on the right how LTV influences other parameters of your loan.

How We Determine the Interest Rate

In the figure below, you can see how we set interest rates for different types of assets depending on the LTV. It’s up to you whether you choose a cheaper loan (with low LTV) or a bigger loan amount (thanks to higher LTV).