Instant Loans Shake Up Borrowing: Meet the New Product of CoinLoan

Today we have a gift to put under the Christmas tree of CoinLoaners. We launch a new Instant Loans service for borrowers seeking to get fast and easy loans against their crypto. The vast behind-the-scenes workings of the development team resulted in a more convenient borrowing service; we hope you’d like it.

The working principle is pretty simple. A borrower applies for a loan, and we use deposits we got from users of the Interest Account to comply with the borrower’s request. Every credit, as always, is secured by cryptoasset.

Why Use Instant Loans?

- You can guess the #1 advantage from the title. New loans are brilliant because they are instant. It takes a minute to apply for a loan.

- No need to wait or look for counteroffers on the Lending Market. Approval is automatic.

- We don’t ask your credit history and require no paperwork. Crypto as collateral is the only essential.

- No deposit and prepayment fees for crypto and fiat.

- You’re wondering why do you even need instant loans against your crypto? We address this question in our previous blog post.

How Does It Work?

- Deposit your crypto assets to the platform.

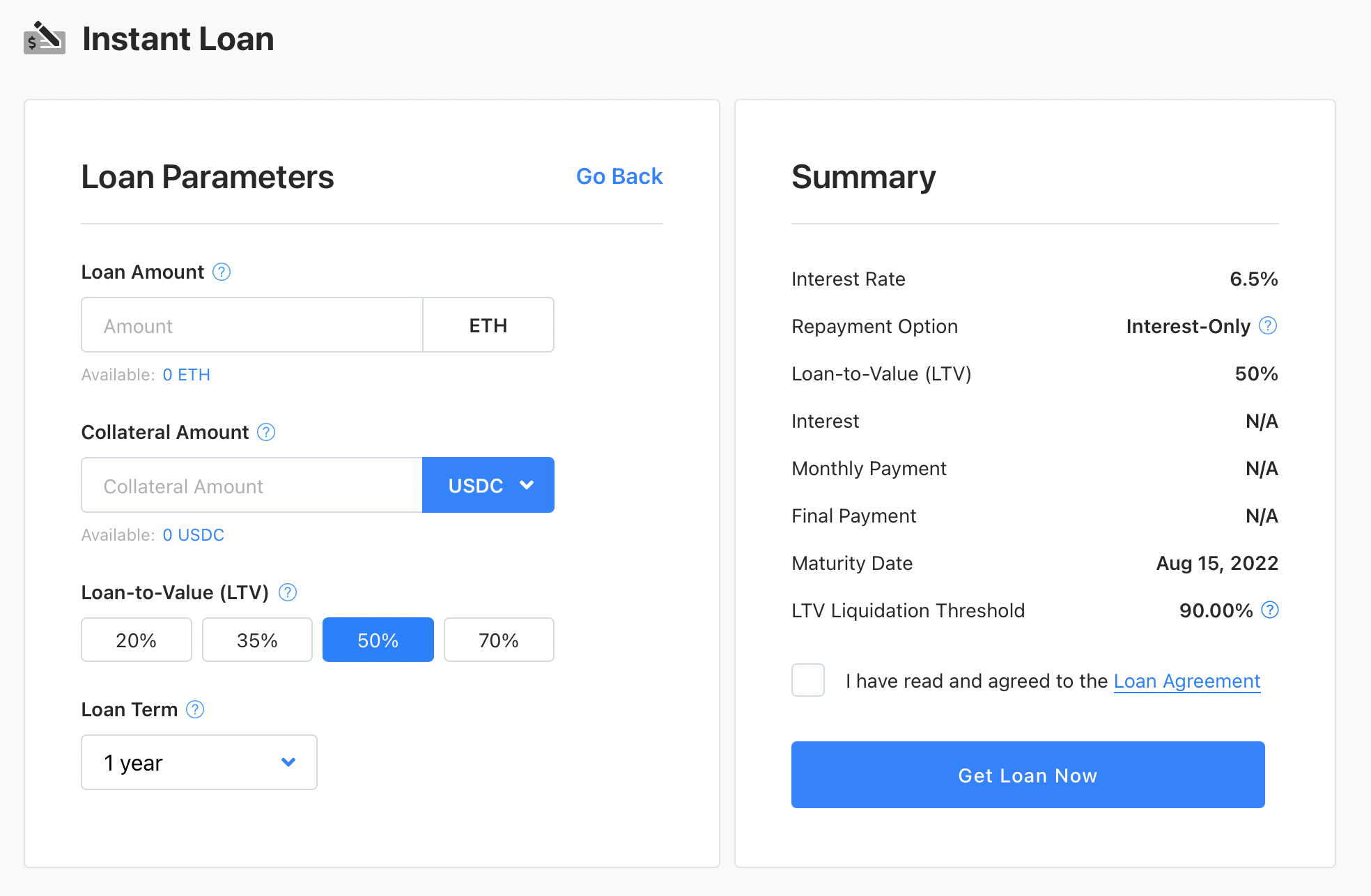

- Go to Instant Loans. Choose a loan term, the amount you want to borrow, or the amount of crypto collateral you have. Click on Get Loan Now.

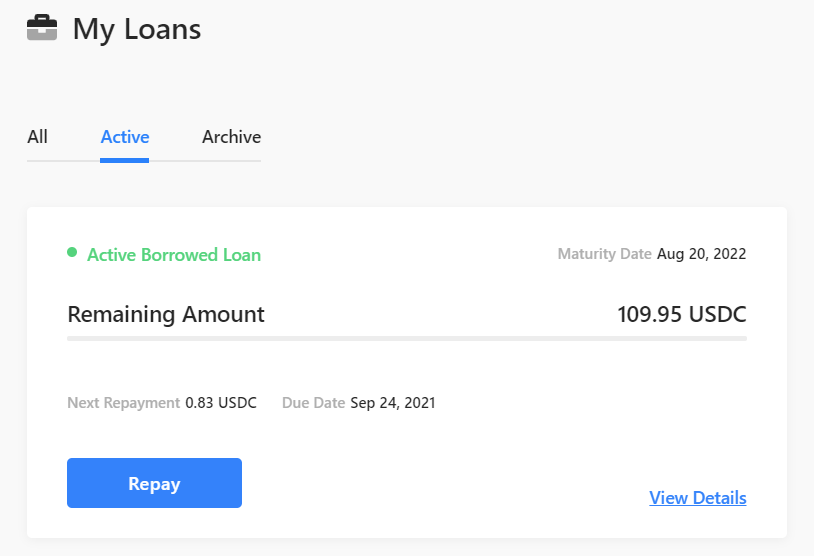

3. And voila, now you can find your loan in the My Loans tab.

4. The change in the status from pending to active means that now you can withdraw lent money from My Wallet.

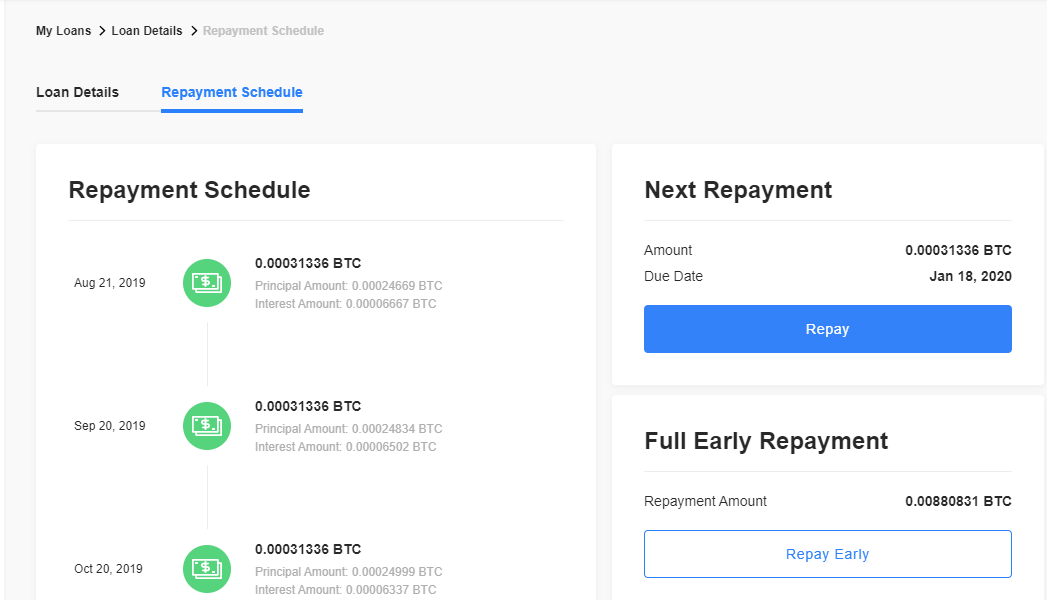

5. Repay your loan according to the repayment schedule or ahead of it if you want. We charge no penalties for early repayment.

6. Once the loan is fully repaid, your collateral funds become available for withdrawal in My Wallet.

Our Rates

The interest is fixed within Instant Loan and varies for different assets. Here’s the list of available loan currencies and their interest rates:

- TUSD — 10%

- USDC — 10%

- PAX — 10%

- USDT — 10%

- EURS — 10%

- EUR — 10%

- RUB — 15%

Remember, you can always opt for a custom interest rate on the Lending Market if you need more flexibility.