How to get more with Ethereum

The world’s second-largest cryptocurrency is approaching a watershed moment. Some industry experts say Ethereum’s long-awaited update could spur the price of its native coin. Here are the key things to know about Ether (ETH) and the most popular blockchain for decentralized apps.

What is Ethereum?

Unlike Bitcoin, which is primarily an alternative form of money, ETH has multiple applications. First, it is the native cryptocurrency of the Ethereum blockchain, which has been dubbed a decentralized world computer. Since 2015, Ethereum has attracted hundreds of thousands of developers from around the world.

As an open-source blockchain platform, Ethereum supports alternative forms of utility — smart contracts, DeFi protocols, fungible crypto, and non-fungible tokens (NFTs). It is used in a wide range of industries beyond finance: gaming, advertising, supply chain management, and more. ETH crypto is so much more than money — it is the lifeblood of the blockchain:

- Digital currency. Ether is used in financial transactions.

- Store of value. Users can buy and hold ETH.

- Earning interest. Holders can deposit ETH in an interest account or liquidity pool.

- Fuel for the network. Every action in this ecosystem costs a specific amount of ETH — a gas fee.

- Highway for decentralized finance. Developers pay ETH to create smart contracts, tokens, NFTs, or decentralized apps on the network.

What is ETH 2.0

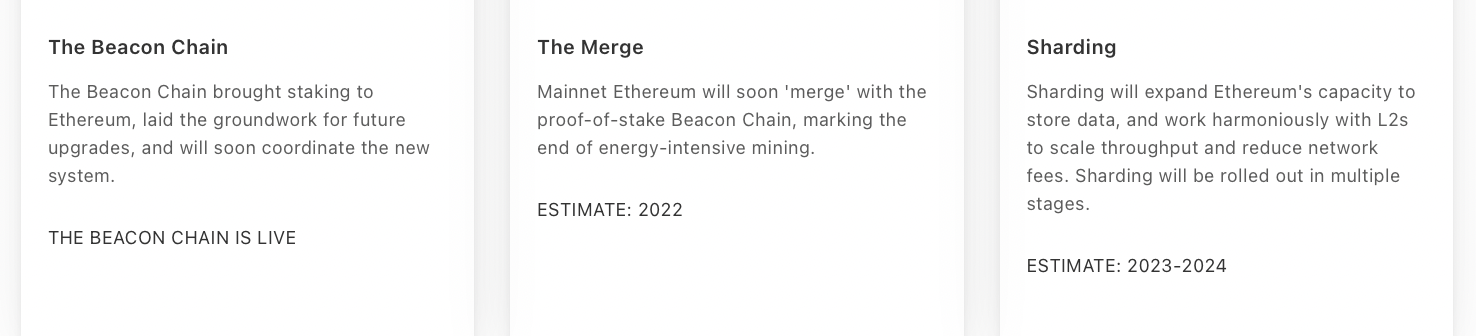

Despite its popularity, Ethereum suffers from inferior speed and scalability — large numbers of transactions slow it down and ramp up the costs. To address the susceptibility to congestion, Ethereum developers are working on Ethereum 2.0, a more efficient, flexible, and sustainable version of the network.

Here is how they explain it: “The community has built a new engine and a hardened hull. After significant testing, it’s almost time to hot-swap the new engine for the old mid-flight. This will merge the new, more efficient engine into the existing ship.”

Significance of the Merge

The Merge upgrade, now slated for mid-September, will replace the Proof-of-Work consensus algorithm with Proof-of-Stake. Transactions will no longer be validated by miners, who need significant computing power. Their responsibilities — storing data, processing transactions, and adding new blocks — will be transferred to validators that stake ETH crypto in a node.

At the moment, Ethereum faces tough competition from other blockchains, particularly as the gas fees shoot up at peak times. To help the network grow and maintain superiority, the Merge will reduce:

- confirmation times

- gas fees

- energy use

According to Citigroup’s estimates, the Merge could speed Ethereum up by 10% owing to reduced block times. The projected 99% decrease in energy consumption would make ETH more appealing to ESG-conscious investors (those concerned about environmental, social, and governance factors).

The Merge is the second of three planned upgrades, a halfway marker. Its deployment will mark 55% completion of the protocol, according to its creator Vitalik Buterin. Nevertheless, Ethereum’s switch to PoS is portrayed as a defining moment for the crypto space as a whole.

Beyond the Merge

Eventually, Ethereum may accelerate from the current 12-15 TPS (transactions per second) to a whopping 100,000 TPS (up 769,000%). This boost would eclipse Solana’s 65,000 TPS and Visa’s 24,000 TPS. Buterin predicts that gas fees could “go down to US$0.05 or even be as low as 0.2 cents.”

Following the Merge, Ethereum will implement sharding to store and access data more scalably. This will split the data-handling burden over the network, reducing congestion and increasing speed. The ultimate acceleration is expected to accompany the Surge, the second planned upgrade.

Amount of Ethereum crypto in circulation

Initially, miners got transaction fees without deductions. Along with the London upgrade in August 2021, the blockchain embedded an Ethereum Improvement Protocol called EIP-1559. This proposal introduced burning — Ethereum halving — to reduce the rate of minting new ETH.

From then on, Ethereum has burned the base fee of every transaction to alleviate its gas fee issue. Its automated bidding system lowers the costs across the board. Meanwhile, users can still accelerate processing by tipping miners.

Ethereum 2.0 will implement triple halving, slashing supply by 80-90% (comparable to three Bitcoin halvings). This should trigger the deflation stage for ETH. PoS will also support coin scarcity, as a large amount of Ethereum crypto will be staked.

ETH price

ETH was first traded on August 7, 2015, for $2.77. It then rose to the low hundreds and rocketed above $1K in January 2021. Four months later, it soared to the all-time high of $4,878.26. This explosive growth was primarily driven by the rise of decentralized finance and NFTs.

This year, cryptocurrencies have been disproportionately driven by the factors swaying other risk assets — namely, the Russia-Ukraine conflict, inflation, and Fed’s monetary tightening. As of this writing, the coin is changing hands at around $1,700 in the aftermath of the crash. July 2022 brought a 70% gain, the best monthly result since 2021.

This recovery has revived discussions of flippening — the likelihood of ETH surpassing BTC in value. While this is not a short-term prospect — Bitcoin’s market cap is still twice as big as Ether’s — the community optimism is growing. What’s more, the upcoming Merge may not have been fully priced in, according to Vitalik Buterin. The co-founder believes that “once the merge happens, morale is going to go way up.”

As we have mentioned, PoS is likely to have a deflationary effect due to reduced issuance. The new model could even prove superior to Bitcoin’s gradual inflation reduction, eventually leading to ultrasound money. Combined with higher demand, the Merge is expected to drive the ETH price up, albeit not immediately — according to Bloomberg, some experts project the rise in the second half of 2023.

Ethereum on CoinLoan

As of this writing, Ether predictions are bullish owing to the build-up to the Merge. You can get the second-biggest cryptocurrency on the CoinLoan platform — buy ETH through our trusted exchange and deposit tokens to Interest Account to earn up to 7.2% APY. You can also borrow against ETH.

If you feel that ETH is a smart buy, CoinLoan has all the necessary tools for digital asset management. Create an account and make the most of ETH’s dynamics in one or more ways:

Use ETH as collateral for crypto loans

Borrow against your crypto — CoinLoan offers instant loans without credit checks! Turn your ETH into collateral to get a loan in any available cryptocurrency. We offer flexible conditions with adjustable loan periods and LTV rates.

Use ETH to receive interest

Earn compound interest on your ETH with our Interest Account. We offer:

- 5.2% APY on ETH

- Up to 7.2% APY with CLT staking

Buy or swap ETH on CoinLoan Exchange

Buy and sell ETH in a few taps or clicks using our trusted Crypto Exchange. We offer dozens of exchange pairs, including ETH/BNB, ETH/SOL, and ETH/XRP.

Final word

No cryptocurrency is guaranteed to rise, and the ETH coin is no exception. Long-term investors take momentary ups and downs with a grain of salt, particularly as the market is still highly volatile. Do not invest more than you can afford to lose. According to Ben McMillan, CIO at IDX Digital Assets, “while we’re seeing crypto prices at relatively attractive prices on a longer-term outlook, there could still be a considerable downside in the near-term.”