Guide to central bank digital currency (CBDC)

Like cryptocurrencies, central bank digital currencies (CBDCs) are digital assets, but these classes have drastic differences. Many countries are exploring ways in which CBDCs can benefit their economies and financial networks. Here is the lowdown on central bank money, its purpose, and use cases.

What is central bank digital currency?

A CBDC is a centralized digital representation of a country’s fiat currency. These pegged tokens may only be issued by central banks, as their purpose is to facilitate the implementation of monetary and fiscal policies. The concept of CBDCs implies full faith and support of the issuing government.

Essentially, this digital money is a form of fiat money, which is also government-issued. It is not backed by physical commodities like gold. A CBDC can also be recognized as legal tender — Jamaica became the first country to do so in June 2022. Jam-Dex can be used to pay for goods and services.

So, why do governments need CBDCs?

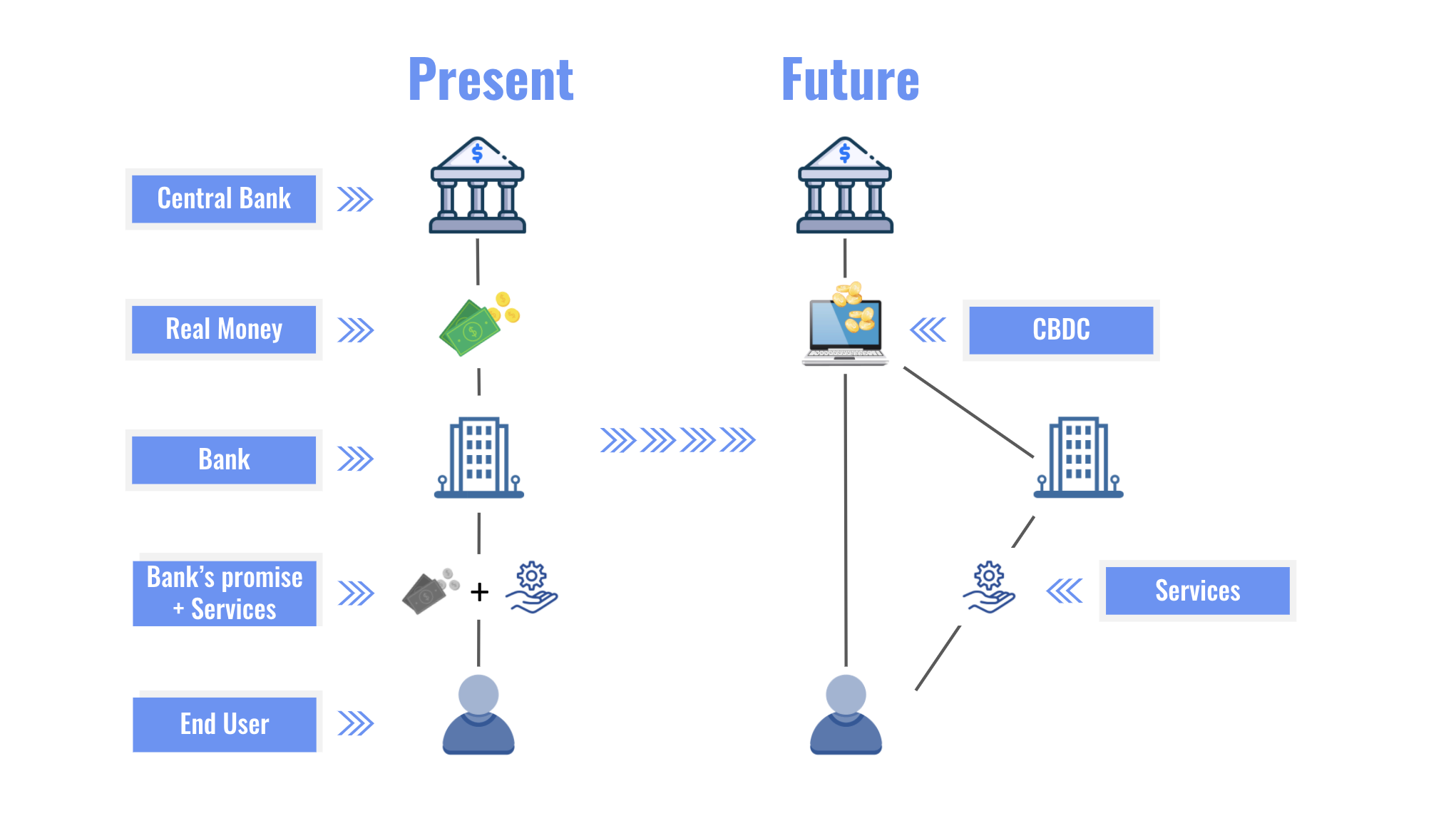

Conventional fiat money is physical — it comes in the form of banknotes and coins. The development of technology has enabled state authorities to create a digital supplement — a credit-based model with digitally recorded transactions and balances.

As a result, some countries saw a decrease in the use of cash (physical currency), even though it is still widely accepted. This tendency became increasingly pronounced during the coronavirus pandemic. Meanwhile, the rapid development and spread of crypto and blockchain technology stoked interest in cashless transactions and digital assets.

This prompted state financial institutions to consider issuing government-backed digital currencies. Today, most International Monetary Fund members are researching CBDCs.

Goals of Central Bank Digital Currencies

You may be surprised to know that around 5% of adults in the United States do not have a bank account. 13% have accounts but turn to payday loans, money orders, check-cashing, and other alternative and costly services. However, CBDCs are more than a low-cost option, as the goals include:

- Providing an accessible, convenient, and transferable means of payment to consumers and businesses.

- Boosting privacy and financial security.

- Reducing the maintenance needs of the financial system.

- Decreasing the cost of cross-border transactions.

- Providing a means of monetary policy implementation to help central banks support stability, manage growth, and control inflation.

- Reducing the risks stemming from crypto volatility.

As crypto is increasingly popular, governments are interested in safeguarding households’ finances. Constantly fluctuating prices may cause severe stress and undermine the stability of entire economies. A CBDC issued by a country’s central bank gives consumers and businesses a stable means of exchanging digital assets.

Distributed ledger technology

In developing CBDCs, the most common frameworks for decentralized consensus are Corda, Hyperledger Fabric, JP Morgan’s Quorum, and private configurations of Ethereum. Typically, central banks build permissioned networks, where access is granted to specific parties. Public participation is not allowed, in contrast to permissionless blockchains like Bitcoin.

CBDC tokens issued on a distributed ledger are redeemable for central bank reserves in the national currency, which they represent. These funds are held in a dedicated account with the central bank. The ledger validates and settles interbank transfers between the system agents, as described in the white paper Central Banks and Distributed Ledger Technology.

Main differences between CBDCs and Cryptocurrencies

Despite a number of similarities, CBDCs cannot be equated to cryptocurrencies. The biggest difference is that reliance on blockchain and consensus mechanisms is optional. These technologies merely inspired the creation of CBDCs, which followed a different path. Here are four aspects setting them apart.

Centralization

A CBDC is issued and overseen by central banks. Cryptocurrencies are largely unregulated — as of this writing, Bitcoin is legal in 110+ states, but only two countries have made it legal tender.

Decentralization, not letting any single entity control digital assets, is part and parcel of the crypto philosophy. Cryptocurrencies offer transacting beyond the terms dictated by cumbersome regulations.

Stability

Cryptocurrencies are highly volatile. Their prices are affected by supply and demand, investor sentiment, and usage. In stark contrast, any state financial system pursues stability, so CBDCs are tied to fiat currencies and mirror their dynamics.

No anonymity

Cryptocurrencies are based on pseudo-anonymity — a person can hold any number of wallet addresses without revealing anything about their identity. At the same time, all transactions are stored in the blockchain and can be traced. Thus, if you happen to post your wallet address publicly, anyone will be able to see your transactions and balance.

Obviously, the same degree of anonymity cannot be expected from a government-issued digital currency. The Federal Reserve’s Money and Payments: The U.S. Dollar in the Age of Digital Transformation research paper calls for “an appropriate balance”, between “safeguarding the privacy rights of consumers and affording the transparency necessary to deter criminal activity.”

No utility in decentralized finance (DeFi) or Web 3.0

While CBDCs use distributed ledger and blockchain, they are, in essence, merely a digital form of fiat. Fiat transactions are already digital, so there is hardly any fundamental difference from conventional money. This prompts skeptics to say that any central bank digital currency will only entrench the interests of central banks instead of solving fiat’s inherent problems.

Types of central bank digital currencies in 2022

Depending on the end user, government-backed digital currencies are classified as retail or wholesale. The former work like physical currency for businesses and consumers. The latter are mainly utilized by financial institutions. Different types of CBDC can co-exist within the same economy.

Wholesale CBDC

For institutions, holding a CBDC is like holding reserves in a central bank — they get an account for deposits and interbank transfers. By using monetary policy tools, central banks can change interest rates and manage lending involving wholesale CBDCs. For example, they can do so via reserve requirements and interest on reserve balances.

Retail CBDC

The primary purpose of these CBDCs is to remove the intermediary risk from transactions. Customers need not worry about the issuers of their digital currency going bust or losing their assets. There are two types of retail CBDCs depending on access and use.

- Token-based. Users need private/public keys to access such CBDCs. Transaction execution is therefore anonymous.

- Account-based. Users complete digital identification procedures to access their accounts.

Problems CBDCs solve and create

Here are the main issues addressed by CBDCs and the difficulties of implementing them, according to a report by the Federal Reserve. The benefits include:

- Removing credit and liquidity risk. Third-party failures — commercial bank errors or runs — do not affect CBDC users. The central bank handles all residual system risks.

- Improving cross-border payments. Transaction costs for international settlements can be reduced through simpler distribution systems and stronger intergovernmental jurisdictional cooperation.

- Bolstering the international role of the US dollar. While it is still the most widely used currency, a national CBDC could fortify its dominance.

- Widening access to the general public. CBDCs can be accessible to the unbanked without the need for a costly financial system.

- Financial inclusion. Through CBDCs, consumers and the Federal Reserve system will be connected directly, without expensive infrastructure.

Key challenges in CBDC adoption

For a CBDC to be implemented correctly, countries need to modify their financial structures and monetary policies and ensure the stability of the national systems. Finally, the digital nature dictates advanced cyber security matters, privacy, and protection.

Uncertainty

This is the main concern, as the effects of a changing financial structure on households, banking reserves, the economy, and its stability are unknown. In particular, a CBDC raises the question of central bank liquidity in case a crisis provokes mass withdrawals.

Monetary and fiscal policy

Central banks have power over many aspects of the economy: interest rates, inflation, lending, and the job market. Before introducing a CBDC, a central institution should develop the right set of tools for economic influence.

Cyber defense and supervision

Privacy is a fundamental element of crypto’s appeal. A central bank issuing a CBDC will also need to monitor for financial crimes, including money laundering and the financing of terrorism. This will require a certain amount of state intrusion.

Secondly, as crypto is a popular target for cybercriminals, a CBDC would also attract thieves and hackers. Measures of thwarting system penetration, data theft, and stealing of assets are non-negotiables.

How many CBDCs are there?

Here are the key insights as of August 19, 2022, according to the Atlantic Council tracker.

- 11 countries have launched central bank digital currencies.

- 14 have pilot projects.

- 26 are developing their versions of CBDC.

- Nearly twice as many (47) central banks are exploring CBDCs.

Generally, attitudes to crypto range from an outright ban on transactions (China) to making BTC legal tender (El Salvador). Nevertheless, the trend of crypto regulation is almost universal, and the latest DeFi woes have only kicked it up a few gears.

China became the first major economy to issue a CBDC when it launched its digital renminbi (digital RMB and e-CNY). It has been in testing since 2020. This central bank digital currency is legal tender, with a value equivalent to other forms of yuan.

To sum up: the future of central bank digital currency

While CBDCs and cryptocurrencies are based on similar technologies, the former have no DeFi or Web 3.0 applications. Despite the use of distributed ledger, central bank digital currencies are centralized and stable by design. They are a government tool for financial inclusion and cheaper cross-border payments without the risks coming from commercial banks.

Crypto enthusiasts will hardly swap their privacy for the stability of a pegged state-issued asset. Yet central bank money could definitely attract newcomers to the financial system.