Crypto credit card guide for 2023

As a means of transacting value, crypto rivals fiat and TradFi. However, digital businesses are adopting familiar instruments, including debit and credit cards. Their holders can start investing in crypto quickly, earn rewards, and borrow fiat against digital assets. Discover how crypto credit and debit cards work in our in-depth guide for 2023.

Crypto credit cards at a glance

In a nutshell, crypto cards work like traditional credit cards. A holder gets a line of credit from the issuer (crypto business) and pays the debt back at a predetermined interest rate. Like conventional cards, these instruments often bring rewards and belong to the same payment systems, including Visa and Mastercard.

What sets these credit cards apart is the connection to the holder's crypto wallet instead of a bank account. They also require mandatory collateral. Accessing a direct line of credit requires pledging digital assets, which renders credit scores irrelevant.

Crypto credit cards maximize purchasing power and simplify buying goods and services with crypto. They work at the checkout just like regular Mastercard or Visa cards.

As a result, crypto enthusiasts can instantly make their portfolios more liquid. Furthermore, due to the volatile nature of cryptocurrencies, they may see their collateral appreciate over time.

Crypto credit vs. crypto debit cards

A crypto debit card resembles a traditional debit card linked to fiat in a bank account. Depending on the provider, holders may top up their accounts with BTC, altcoins, or stablecoins. Then, when paying for a product or service, the card converts the crypto into its USD equivalent, selling it instantly.

A crypto credit card works similarly with one key distinction. Aside from using your own money, you can use a credit line to borrow funds. In addition, both types of cards may support instant rewards according to a predetermined rewards rate.

Why do people need crypto rewards cards?

One of the proponents' key arguments is inevitable adoption and familiarity to the majority of the world's population. A crypto Mastercard or Visa card is an intuitively understandable financial tool. Moreover, any retailer allowing card payments likely accepts both types. Mastercard alone had nearly 2.9 billion cards in circulation in the first quarter of 2022.

Like conventional plastic, cards linked to crypto wallets let holders pay for everyday purchases, make transfers and ATM withdrawals, and redeem points. The case for crypto cards is based on two main advantages:

1. Opportunity to earn crypto rewards

Most traditional credit cards provide rewards like travel points and loyalty points for purchases. Cryptocurrency cards deliver perks in crypto instead of fiat, enabling holders to skip the exchange step. They stack cryptocurrencies simply by using their cards.

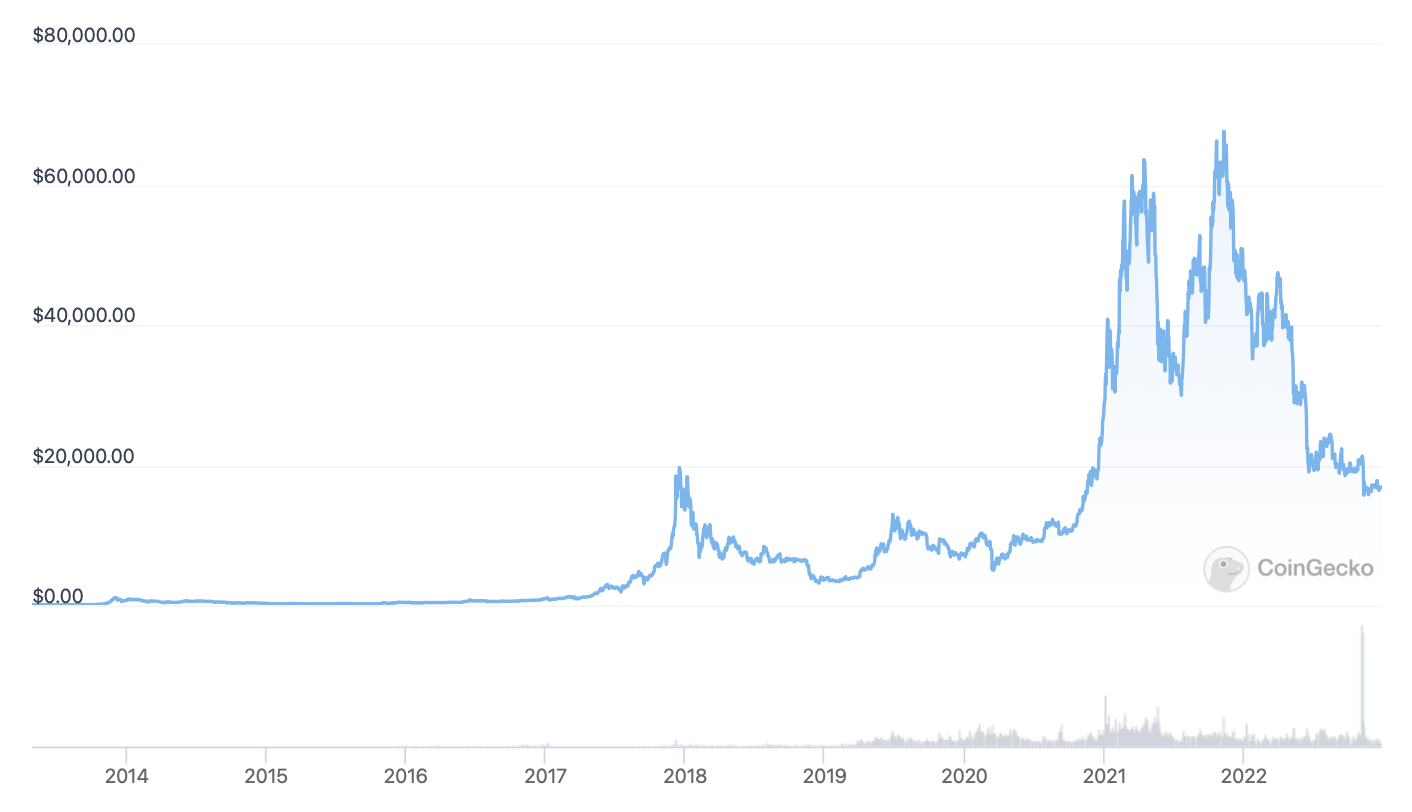

Crypto bulls find the notion of such rewards alluring. The appeal is understandable, given the overall market growth, particularly in 2021, when BTC reached a record high. That said, benefits vary — for example, some providers offer purchase rebates on Expedia and Airbnb bookings, rebates for Spotify and Netflix subscriptions, and regular cash back.

2. Bridging TradFi and DeFi

Over the past few years, crypto adoption has grown as fast as the internet adoption in the 1990s. Still, newbie investors may need help comprehending the inner workings of blockchain. For them, cards are an easier way to get started, similar to the Robinhood app for stocks.

Crypto credit card options

Popular cards let users make fiat purchases without selling their crypto — they turn digital assets into collateral instead. This transformation brings two benefits and popularizes HODLing, which primarily views crypto as a store of value.

First, holders can still profit from their crypto if it appreciates over time. Secondly, collateralization, unlike selling, is a non-taxable event. Neither capital gains tax nor income tax applies. Additionally, crypto card users may get bonuses for every transaction — for example, 1-2%.

Before signing on the dotted line, potential holders should carefully review the terms and conditions. While every issuer wants to offer something unique, there are a few common features:

- Cash-back rewards (for example, 1.5%) in crypto on all eligible purchases.

- Increased cash back in crypto on all eligible purchases over a specific annual spend (for example, $30,000).

- Crypto rewards points convertible into the cryptocurrency of your choice.

Types of crypto rewards credit card

The reward process varies from provider to provider. Sometimes, users must take a few extra steps, while other services are automatic. Compare two existing scenarios:

- The issuer rewards the holder with reward points that are later converted into the crypto of their choice. As a rule, conversion occurs on the date of the monthly statement.

- The issuer credits rewards to the holder's account every time they swipe their card, so they do not have to wait for the monthly statement. In this case, a crypto card works exactly like a conventional card.

Overview of crypto-backed lending

Cards based on crypto collateral resemble collateralized consumer loans but unlock a line of credit. Generally, crypto lending services have three fundamental differences from TradFi banking.

P2P and trustless

Crypto lenders do not conduct credit score checks or background checks on applicants, as the value of their collateral must always exceed the amount owed. With tedious verifications and paperwork removed, approval is usually instant.

Applicants need not worry about their score being low, whether through their own fault or not. Technical inaccuracies in credit reports have given rise to a vast credit repair industry — according to data from the Federal Trade Commission, one in five Americans has errors on one or more reports that affect their score.

For some crypto holders, cards issued by exchanges are more accessible than a credit card from a bank. As long as you have collateral, you can borrow. The LTV (Loan-to-Value) rate ensures overcollateralization: for example, some lenders allow registered users to borrow between 20% and 70% of what their collateral is worth.

Automated smart contracts

Smart contracts are fully automated self-executing agreements. The terms are written directly into code, and each contract is irreversible and traceable. As programming replaces transaction intermediaries, crypto firms can offer lower fees compared to banks.

Potential for appreciation

Clients maintain ownership over their crypto collateral (unless it is liquidated according to the terms). As a result, they maximize their purchasing power without letting go of coins or tokens that may bring a profit in the future. Borrowing against one's portfolio does not require selling any of its contents.

Things to remember before signing up

Although issuers do not perform credit checks, using a crypto credit card influences one's credit history. Typically, unless a minimum amount is paid monthly, missed payments appear on the credit reports, lowering the score. Credit repair is a complex process that takes months or even years.

In addition, crypto rewards are not always available, and different issuers charge different fees. Therefore, applicants should carefully review their credit card options, paying particular attention to the following:

Fees

To avoid paying interest, one has to pay off the balances in full every month. Study the terms and conditions of your agreement carefully, as they may also include the following:

- Late payment fee

- Annual fee (on the card anniversary date)

- Transaction fee

- ATM withdrawal fee

- Foreign transaction fees (for example, outside the EU on cards from an EU-based firm)

Pay attention to the transaction currency as well. Typically, holders pay for goods or services in US dollars. However, some issuers allow direct use of a crypto portfolio — for example, paying with Bitcoin from an associated account. In this case, clients typically have to pay off their debt with the same cryptocurrency.

Flexibility

With thousands of cryptocurrencies in circulation, there are no universal sets of supported tokens and coins for such cards. Investors should make sure their issuer accepts specific assets — rewards are only secondary.

Credit card rewards

Reward rates vary, and some cards come without crypto rewards at all. Thus, look into your potential benefits. For example, travelers prefer cards with travel rewards, and those who want to save money should look at the cash-back rate.

Traditional credit cards with rewards often come with welcome bonuses, sometimes worth hundreds of US dollars. Unfortunately, in the crypto space, such sign-up offers are now scarce.

Interest rate

Many banks lower the APR to 0% for new clients — for example, on balance transfers. Such offers come in handy for debt consolidations and large purchases. Holders can move their debt from one credit card to another, paying no balance transfer fee.

Dedicated cryptocurrency cards do not typically have an introductory period. Thus, their holders pay the same interest rate from day one.

Limitations

Crypto laws around the world vary, and some countries have imposed crypto bans. Make sure that using a crypto card is lawful in your jurisdiction, and examine the terms and conditions. Reading the fine print is crucial, whether for a conventional or a crypto card.

Historical highlights

In 2015, Coinbase presented the first-ever physical card for Bitcoin, which was initially available in 25 US states. This Visa debit card, available to registered users, required an upfront insurance fee. However, holders could pay for goods without additional costs unless they traveled overseas. They could also make ATM withdrawals from their Coinbase Bitcoin balance for an additional fee.

Card developers faced numerous challenges, but as the crypto adoption grew, so did the number of such projects. In 2020, the largest crypto exchange launched the Binance Visa card — a debit card aimed at making crypto more usable in everyday life.

In 2021, CompoSecure Inc., which develops premium metal cards for American Express Co. and JPMorgan Chase & Co., created the Crypto.com Visa card. This prepaid card stores the holders' private keys – they can load their digital assets onto it and convert them to fiat for everyday purchases. Making payments requires entering the PIN into a special app and tapping the card on one's phone.

Cards powered by Mastercard and Visa work wherever these systems are accepted – that is, at millions of merchants worldwide. Both companies started paving the way for crypto credit cards in 2022, despite the prevailing bearish sentiment in the market. By then, their cards for fintech had already formed a niche market.

First crypto credit card

According to Reuters, the first "crypto-backed" credit card was launched in April 2022 by Nexo and Mastercard. European holders could collateralize their digital assets instead of selling them and access a credit line to borrow up to 90% of the fiat value of their holdings.

First crypto rewards card

In 2021, the BlockFi rewards Visa Signature card became available to US citizens. It had no annual fee and provided Bitcoin rewards paid into the holder's BlockFi interest account. However, the card became unavailable following the company's bankruptcy filing in late 2022.

In April 2022, Gemini launched its Gemini credit card issued by WebBank and on the Mastercard network. A few months later, American Express unveiled the first crypto rewards card on its network – a product of collaboration with Abra, a crypto wealth management platform and wallet provider. According to Abra's CEO Bill Barhydt, holders could redeem rewards in multiple cryptos or get entertainment and dining-related Amex benefits.

Fintech credit cards with crypto rewards

Crypto is also becoming part of fiat-focused products. For example, holders of the SoFi credit card can redeem their rewards for crypto (Ether or Bitcoin rewards). Alternatively, they may use them for saving or paying down loans for an eligible SoFi account. Similarly, a Venmo credit card lets users auto-purchase crypto for cash back. The Upgrade card comes with fixed Bitcoin rewards for all purchases the holder pays back.

Barriers to adoption

Crypto credit cards are not everyone's cup of tea owing to the nature of this young market. It goes through bearish and bullish phases, with significant price swings deterring the cautious. At press time, potential users may have two main concerns.

Taxable events

Any purchase made with such cards is a taxable event in some countries. For example, in the US, crypto holders are subject to the capital gains tax per the IRS guidance. This tax applies to situations when crypto gains value before being sold. For an individual whose portfolio doubles in value, the tax bill should be relatively substantial, even for a small purchase.

The same holds for any rewards you may earn in crypto. On the one hand, such benefits may rise in value in the future, while fiat cashback is affected by inflation. On the other hand, conventional rewards are non-taxable, while crypto is (once you sell it). Therefore, those who plan to earn and sell significant amounts of coins or tokens should seek guidance from a tax professional.

Price volatility

Major cryptos had previously soared to record highs in November 2021. Then in 2022, the crypto market experienced record shocks, including the collapse of Terra and FTX. These black swans caused prices to plunge, with BTC over 70% below its all-time high at press time.

Crypto rewards are not immune to fluctuations. For example, any cash back earned may depreciate by the time the holder cashes in. The history of such changes causes risk-averse investors to stay away from crypto, although volatility can work in their favor.

Fewer rewards

Conventional credit cards may offer premium perks, cash back, and statement credit. The latter directly refunds the holder's bank account, lowering their current balance. Meanwhile, cashback may take the form of a direct deposit, a check, a gift card, or statement credit. TradFi clients can also gain interest and cash back with a rewards checking account.

In terms of variety, some crypto cards fall short of expectations. While users may get travel perks and other rewards, these are usually less comprehensive. The opportunity to earn crypto is one of the key selling points — according to CreditCards.com owner Red Ventures, investing cryptocurrency rewards is like "gambling with house money." Furthermore, some issuers pay rewards only in their native utility tokens.

Best crypto credit cards yet to come?

The advent of cards for crypto aficionados is logical in the broader context of the crypto expansion. These financial instruments integrate crypto into everyday transactions and give individuals a simple way to get into the market. As a result, crypto debit cards and credit cards contribute to mainstream adoption.

Yet as a relatively recent phenomenon, they have a long way to go. In the coming years, it is reasonable to expect more additional features, more supported cryptocurrencies, and more available jurisdictions.