CoinLoan Weekly: Uneven momentum, BTC 401(k)s, 1 billion crypto users

Price dynamics

BTC price

From under $21,000, Bitcoin shot up to a 7-day high of $24,160.26 on Wednesday, July 20. It stayed above $22,000 for five consecutive days — until dipping on Monday, July 25. The dynamics showed that bears were still active at higher levels.

On Tuesday, July 19, The Fear & Greed Index finally broke out of the Extreme Fear zone, where it had been trapped for a record 73 days. BTC also started to trade more independently from conventional asset markets: its 30-day correlation with S&P 500 dropped to 0.78.

As of this writing, BTC is changing hands at $22,176.442.3, with a 24-hour drop of -2.3% and a 7-day rise of 6.5%.

Keep your BTC in your Interest Account to earn up to 7.2% APY or get an instant crypto loan without hassle!

ETH price

Stronger momentum helped ETH outperform its biggest rival again. The altcoin jumped from under $1,350 and held above $1,500 save for a dip on Thursday, July 21. The 7-day peak of $1,639.34 came on Friday, July 22.

Like BTC, ETH tumbled on Monday, July 25, erasing hopes of an extended rally. Traders seem to be stuck between macroeconomic pressures and the euphoria around the Merge. Ether has lost almost 70% since the all-time high, but the upcoming transition has helped it gain roughly 45% month-to-date.

As of now, ETH is trading at $1,524.50, with a 24-hour loss of -4.9% and a 7-day gain of 13.4%.

Get up to 7.2% APY on your ETH in Interest Account or use it as collateral for Instant Loans!

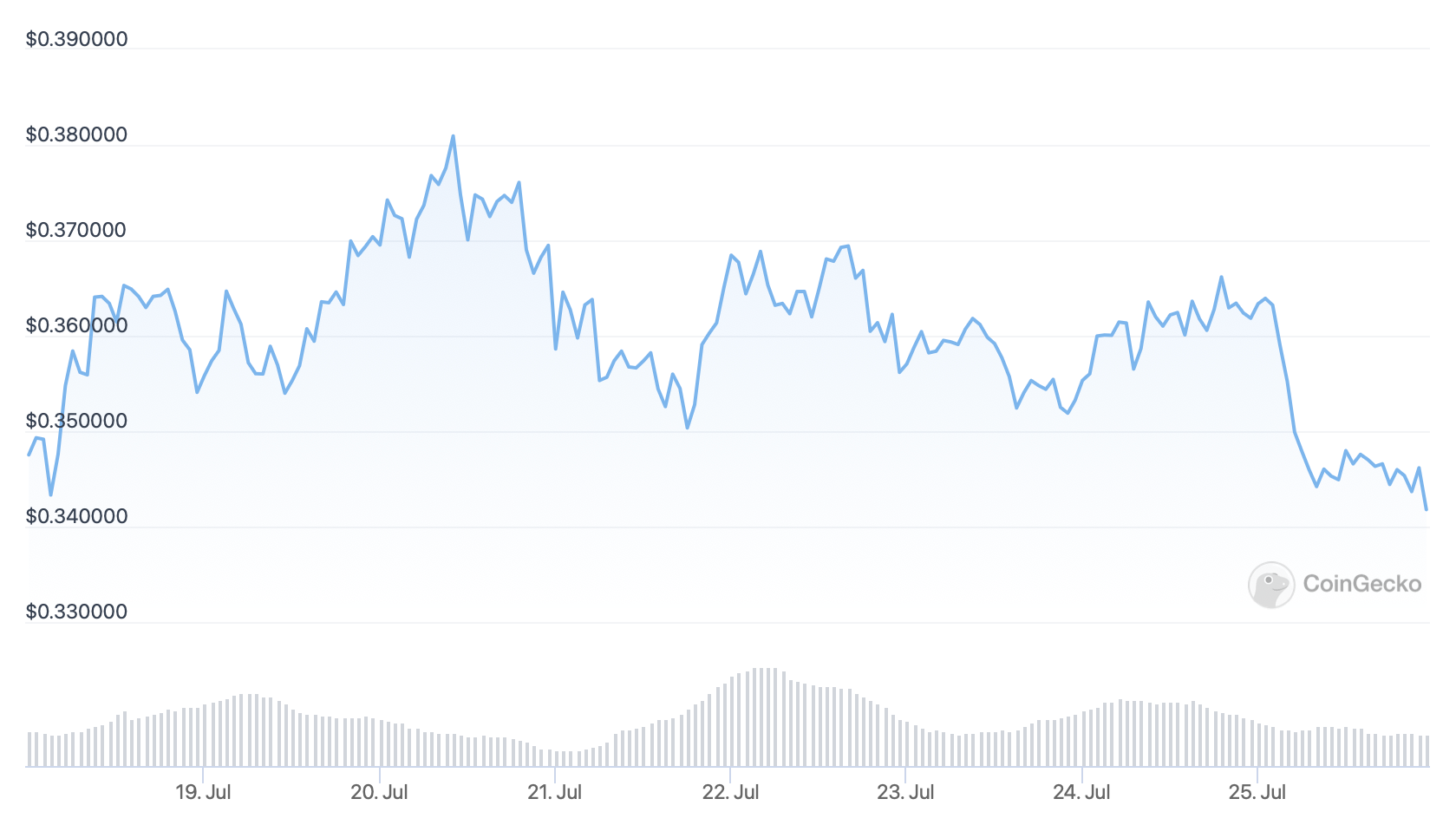

XRP price

Like BTC, XRP failed to rise above its Wednesday’s peak ($0.380931 on July 20). The momentum fizzled out — on Monday, July 25, the token fell below the level seen seven days prior (just over $0.34).

The past few days have shown consolidation between $0.30 and $0.39. If the bears take over, XRP might head toward $0.30. Otherwise, the bulls may push the price higher — all the way to $0.50 — in a new up-move.

As of now, XRP is trading at $0.346720, with a 24-hour loss of -4.1% and a 7-day uptick of +0.8%.

Earn up to 7.2% APY on XRP in your CoinLoan Interest Account or get a crypto loan without credit checks!

Cryptocurrency news

Fintechs unveil Bitcoin 401(k)s

In April 2022, Fidelity Investments announced a never-before-seen option — investing up to 20% of 401(k)s in BTC. It became the first major plan administrator to embrace crypto, and fintech startups are now following in its footsteps.

As of December 31, Fidelity oversaw $2.7 trillion spread over 20.4 million investors. Some of its retirement plans will provide access to crypto via digital assets accounts. For companies, adding BTC will not be quick — the required due diligence and approvals should span a few months, along with 90 days for implementation.

According to Barrons, Fidelity is currently waiting for businesses to sign up. Software provider MicroStrategy, the first company to seize the opportunity, could offer the BTC option this fall.

The investment management firm is also continuing its dialogue with legislators and policymakers as Congress and the Labor Department are skeptical of the novelty. Meanwhile, a number of fintechs focus on individual retirement accounts linked to crypto.

- Users of Bitcoin IRA, a platform launched in 2016, can spread their investment across 65 cryptocurrencies. Currently, it boasts 150,000 users and $2 billion in assets under custody.

- ForUsAll, a 401(k) provider serving small-to-medium-sized businesses, is developing a dedicated platform in collaboration with Coinbase Global, Inc. Alt 401(k) will offer 50+ cryptocurrencies, allowing participants to invest up to 5% of their assets in crypto. With over 150 customers on its waiting list and over $43 million raised, the company is preparing for launch this summer.

- Swan, best known for its app where 65,000 users buy BTC, is gearing up for an IRA launch in the third quarter. Participants will be able to start a new IRA (conventional or Roth) or roll over their existing accounts. So far, the company has found 100 customers and raised $8.5 million in funding. Swan hopes to reach the next target — $30 million — during its Series B round in the fall.

BCG predicts 1 billion crypto users by 2030

The new report by Boston Consulting Group is comforting for crypto investors. The data gathered in cooperation with Bitget and Foresight Ventures proves a nascent adoption stage. Crypto has a long way to go compared to conventional assets: it accounts for a meager 0.3% of individual wealth invested, as opposed to 25% for equities.

The findings contradict the widespread notion that it is too late to get into crypto. Modest investment penetration indicates ample room for growth. Provided the current trends hold, the researchers expect there to be 1 billion crypto users by 2030. To illustrate this, they overlaid the adoption curve for the internet onto the trend lines for crypto holders and ETH addresses with non-zero balances.

A recent report by Verified Market Research offers another lofty prediction — expansion of the NFT industry to $231 billion over the next decade. Three key applications — music, sports, and the movie industry — are expected to drive an annual compound growth rate of 33.7%. Last year, the entire market was worth $11.3 billion, according to VMR’s estimates.

Meanwhile, Metaverse could balloon to $5 trillion in 2030, thanks to e-commerce driving its cash flow. McKinsey & Company settled on the figure after surveying businesses and consumers in different industries around the world. Its report, with an emphasis on consumer behavior patterns, predicts $2.6 trillion revenue by 2030.