CoinLoan Weekly: Sell-off deepens, Binance CEO tops Forbes’ list, sanctions on crypto use in Russia

Price dynamics

BTC price

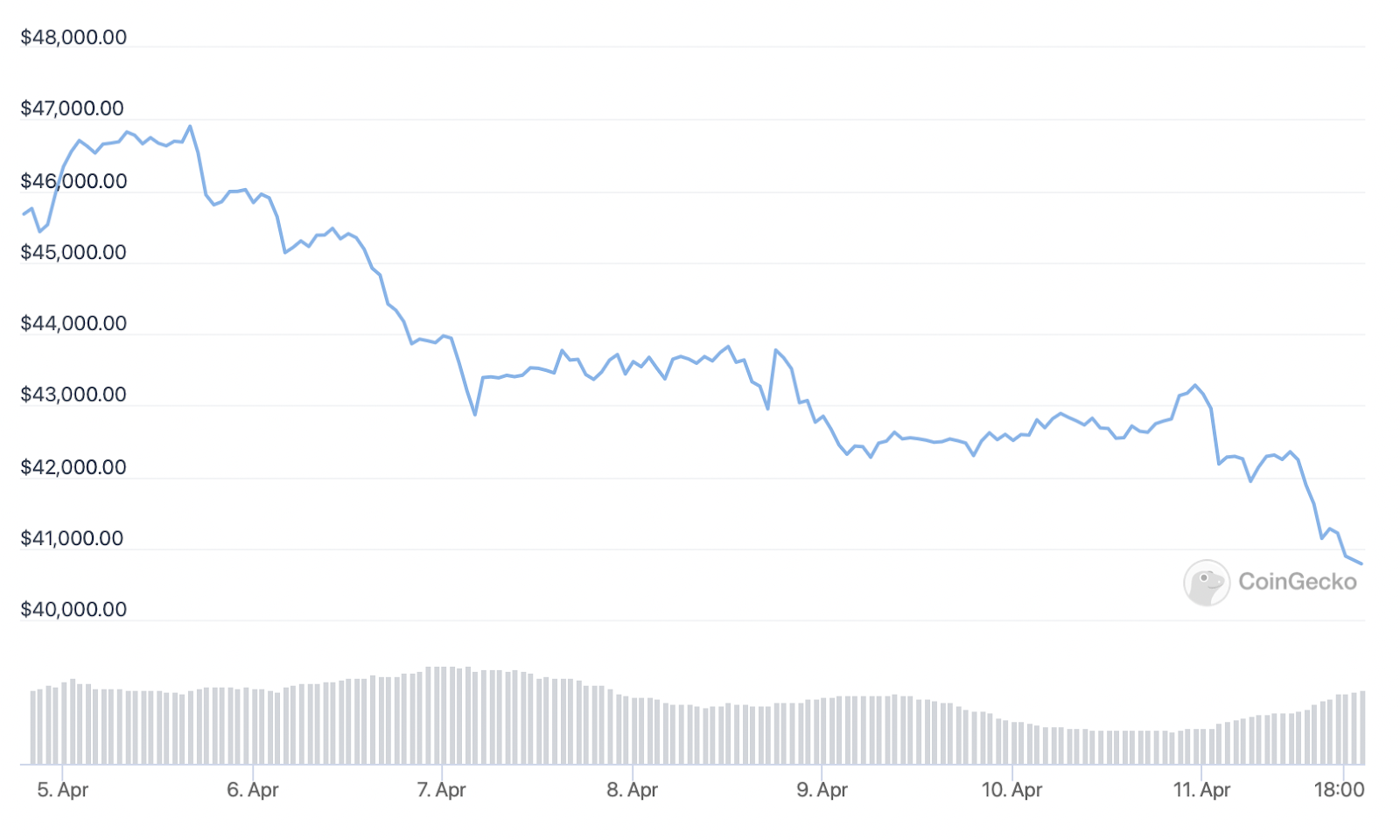

Following a slight jump to $46,901.45 on Tuesday, April 5, BTC collapsed below $43,000 and entered a slim range. It traded under $44,000 until the end of the week, and started falling again on Monday, April 11.

As evidenced by The Fear & Greed index, anxiety swept the market — the indicator left the Neutral zone, falling back to 32. Bitcoin appeared to mirror losses in equity markets due to looming inflation and economic slowdown. It has lost over 40% of value compared to its all-time high on November 10, 2021.

As of now, BTC is trading at $40,742.93, with a 24-hour slip of -4.8% and a 7-day loss of -12.3%.

Get up to 7.2% APY on a Bitcoin Interest Account or use BTC as collateral for Instant Loans on CoinLoan!

ETH price

Throughout the week, Ethereum’s behavior was typical as it followed Bitcoin and stocks. After an uptick to $3,531.11 on Tuesday, April 5, it descended to a tight range. On Monday, April 11, ETH resumed falling despite a historic event — the launch of Ethereum’s first mainnet shadow fork.

In total, ETH lost slightly more than BTC over the week. Currently, it is roughly 38% down from the all-time high.

As of this writing, ETH is trading at $3,019.02, with a 24-hour loss of -7.3% and a 7-day fall of -14.3%.

Use your ETH for quick loans without credit checks or earn up to 7.2% APY with the CoinLoan Interest Account!

XRP price

Ripple closed the week with a loss of nearly 16%. After Tuesday’s peak ($0.829847 on April 5), the coin plunged and reached $0.759071 on Thursday, April 7. Subsequently, it saw a brief uptick and fell further to a range between $0.750 and $0.775.

On Monday, April 11, the decline continued. Despite the jump over the 7-day low ($0.707324), XRP is headed downhill again, and its overall result is the poorest.

As of now, XRP is trading at $0.708254, with a 24-hour change of -6.7% and a 7-day fall of -15.9%.

Make your XRP work on CoinLoan — get a quick loan without additional documents or earn up to 7.2% APY!

Cryptocurrency news

Binance CEO tops Forbes’ 2022 billionaires ranking

Binance CEO tops Forbes’ list of the richest crypto and blockchain billionaires in 2022. Changpeng Zhao, with his $65 billion net worth, is followed by head of FTX Sam Bankman-Fried ($24 billion) and Coinbase CEO Brian Armstrong ($6.6 billion). The rating, which was published on April 5, includes 19 names in total.

Bankman-Fried is last year’s front-runner. In January 2022, his exchange attracted $400 million as part of its Series C fundraise, while its valuation stood at $32 billion.

FTX CTO Gary Wang ($5.9 billion) and Ripple’s co-founder and CEO Chris Larsen ($4.3 billion) landed on the 4th and 5th positions, respectively.

Thanks to the 2021 NFT boom, co-founders of the largest NFT marketplace OpenSea have also made the cut. The joint net worth of Devin Finzer and Alex Atallah amounts to $2.2 billion. Yet, co-founders of Alchemy, an infrastructure Web3 platform, Nikil Viswanathan and Joseph Lau, outranked them with $2.4 billion each.

EU imposes new sanctions on crypto in Russia

On April 8, the European Union imposed its fifth round of sanctions against Russia in light of its military operation in Ukraine. They include new measures in the crypto realm — an extended ban on deposits to crypto wallets and provision of high-value cryptoasset services to Russia.

According to The European Commission, these restrictions are aimed at closing potential loopholes. Other monetary elements of the package include

- a full transaction ban and asset freeze on four banks representing 23% of market share in the national banking sector

- a ban on the sale of banknotes and securities nominated in member states’ currencies to any individual, entity or body in Russia or Belarus

- a ban on providing advice on trusts to wealthy Russians

Aside from these measures, the package contains bans on Russian coal and other solid fossil fuels, access to EU ports, Russian and Belarusian road transport, and specific types of export and import. It also prohibits Russia’s participation in public contracts and European money.

The latest round of sanctions was adopted following the atrocities allegedly committed by the Russian army in Bucha and other places in Ukraine.