CoinLoan Weekly: ETH’s surge, mining hike, Ukraine’s crypto legalization, XRP vs. CBDCs

Price dynamics

BTC price

Bitcoin’s dip to $38,389.03 on Tuesday, March 15, was followed by three days of intense volatility. On Friday, March 18, the price approached $42,000, mirroring the direction of most equities and altcoins. After Sunday’s peak of $42,241.36 (March 20), it headed downward.

The Fear & Greed Index rose to 30 for the first time since March 4. Although investor anxiety has subsided, experts project more volatility in the near term. Friday’s balancing of buy order volume versus sell order volume for futures supports this view. The trading volume across exchanges peaked out on Wednesday, March 16.

Currently, BTC is trading at $40,902.71, with a 24-hour dip of -1.6% and a 7-day rise of +8.1%.

Make your Bitcoin work on CoinLoan — gain up to 7.2% APY or get quick loans without credit checks!

ETH price

ETH also traded higher on Friday, but its growth was steady in comparison. Ultimately, it outpaced BTC and other cryptocurrencies, gaining over 15% in total. From a low of $2,519.99 on Tuesday, March 15, the price shot up to $2,974.15 on Saturday, March 19.

This spectacular result is partly due to the coupling of the Ethereum mainnet with the Beacon Chain. On March 15, the merge was conducted on the Kiln testnet, the final public testnet, before the eventual transition to proof-of-stake.

As of this writing, ETH is trading at $2,901.38, with a 24-hour uptick of +0.9% and a 7-day surge of +15.2%.

Use your ETH for instant loans or earn up to 7.2% APY with a CoinLoan interest account!

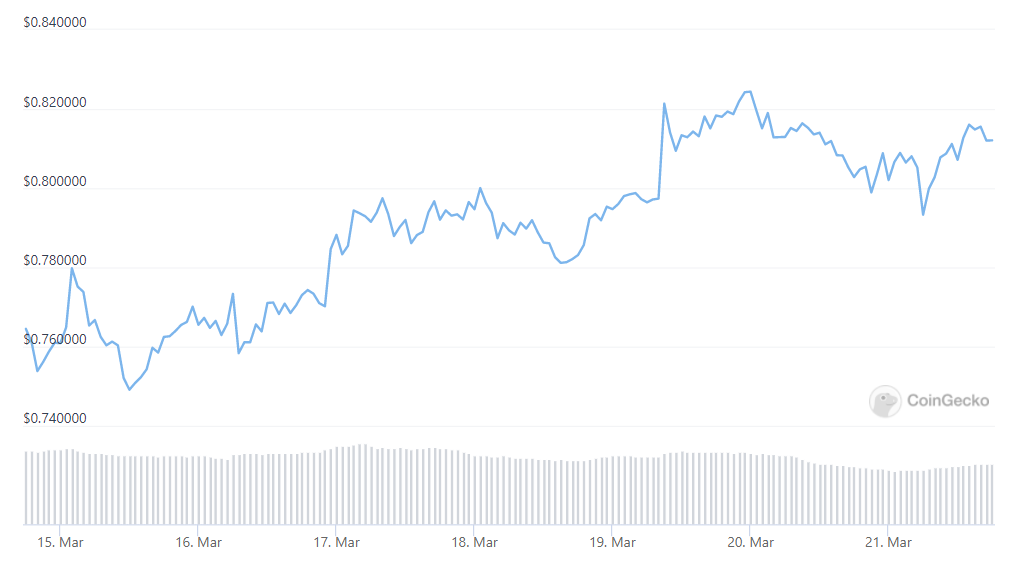

XRP price

Like BTC and ETH, XRP dropped to its week’s low on Tuesday, March 15 ($0.749119). Subsequently, it fluctuated over $0.78 before jumping over the weekend. The price peaked out in the first hour of Sunday, March 20, at $0.824380.

In terms of overall growth, Ripple fell behind Bitcoin and Ether. On the morning of Monday, March 21, it dipped below $0.80 but quickly recovered.

As of now, XRP is trading at $0.812078, with a modest 24-hour gain of +1.1% and 7-day growth of +6.6%.

Use your XRP as collateral for loans — get them instantly without credit checks, fees, or lock-ins!

Cryptocurrency news

Bitcoin mining competition soars

The Bitcoin mining difficulty has set a new all-time high, growing by 13.6% since January 2022. The current rate of 27.53 trillion hashes reflects intense competition. The difficulty is an internal score that grows or contracts exponentially depending on the number of active miners.

Cryptocurrencies use mining difficulty to maintain a specific average time between blocks despite changes in network hash rate (computational power). In the case of Bitcoin, the latter has grown by 4.81% to 217.52 million terahashes per second over the same period.

The influx of miners boosts network security. They are motivated by Bitcoin’s growing sustainability, geopolitical uncertainty, and the perception of crypto as a safe haven. Although the costs have multiplied, some miners are trying to offset energy consumption — for example, by using solar power.

Ukraine legalizes crypto

On March 16, Ukraine legalized cryptocurrencies as president Volodymyr Zelenskyy signed the corresponding bill into law. The domestic market will be regulated by the National Bank of Ukraine and the National Commission on Securities and Stock Market. Service providers, both foreign and local, may operate with legal accounts in the Ukrainian banks.

The law creates a legal framework for the crypto industry in Ukraine and underscores the role of cryptocurrencies in the ongoing conflict with Russia. Since it began, Ukraine has received crypto donations worth over $80 million. The Ministry of Finance is expected to facilitate the launch of the market by amending the country’s Tax and Civil Codes.

Ripple could challenge SWIFT and CBDCs

According to the report by the Arab Regional Fintech Working Group, RippleNet is a possible alternative to CBDCs (central bank digital currencies). The Arab Monetary Fund’s group has underscored multiple risks to local currencies, including loss of basic utility when CBDCs are used outside of their jurisdiction.

RippleNet, a system for gross settlements in real time, is not the only suggested solution. The report also mentions SWIFT (international payments system), Revolut (banking app), and Wise (fintech company). However, Ripple appears as a direct alternative to Swift twice. It is mentioned as an improvement to messaging protocols and a cryptocurrency designed primarily for payments.

In February, Ripple partnered up with the Digital Euro Association to work on CBDCs. On March 15, Ripple’s partner Clearing House joined forces with Wells Fargo to launch an instant payment system that would challenge SWIFT. Yet, the report acknowledges that all of the alternatives have “significant limitations or flaws”, which is why many banks are still focused on CBDCs.