CoinLoan Weekly: Crypto Bull Market?

Bitcoin Price

Last week was a rollercoaster for Bitcoin price. News was reporting fluctuations between $29,498 and $34,736. However, BTC started to rise rapidly on the midnight between Sunday and Monday, reaching the $39,100 level, a 9.40% change in 24 hours. At the time of writing, BTC is $39,627.

BTC is one of the assets that you can use as collateral for a crypto loan.

Ethereum Price

Like Bitcoin, Ethereum is now following the same pattern. During the last week, there was an upward trend. ETH price was swinging between $1,729 and $2,196, making people search for competitive rates on the second leading cryptocurrency. On July 28, Ethereum was $2,278, according to CoinMarketCap. Many traders are now looking to buy Ethereum but the sentiment remains divided. Ethereum max price was reached in May ($4,356.99).

XRP Price

XRP value was bouncing between $0.62 and $0.51. Ripple was in the upward trend for most of the week, starting Monday with a $0.65 price level and +8.25% price change in the last 24 hours. On July 28, Ripple was $0.7, rising by 8.92% from Tuesday's level

Use XRP to earn up to 7.2% APY on CoinLoan.

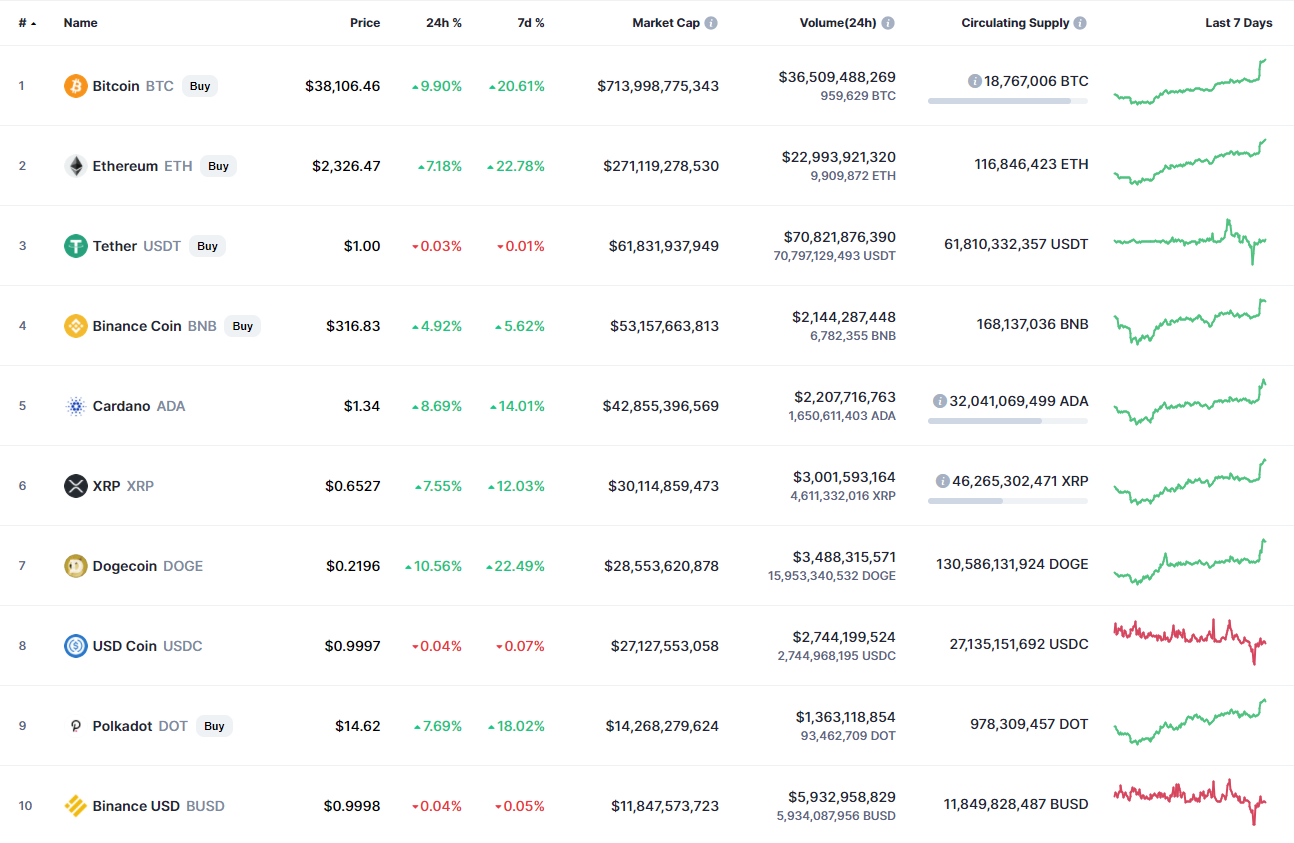

Overall last week was quite positive — almost every cryptocurrency in the top 10 was in the green zone.

CoinMarketCap top 10 currencies performance during the last week

Possible Twitter, Amazon Bitcoin Payment Gateways

According to insider information, Amazon will start accepting Bitcoin as a payment by the end of the year. The rumor also described Amazon's plans to launch its own token by 2022. Jack Dorsey, Twitter’s CEO, also hinted at the BTC adoption stating Bitcoin “is a big part of our future”. The news might have been the catalyst for BTC’s price spike.

Insider added that Amazon plans to establish a gateway for ETH, ADA, and BCH after adding Bitcoin. However, Amazon later decimated rumours stating the company won’t be adding Bitcoin or other cryptocurrencies to its payment system this year.

Vitalik Buterin Spoke of ETH 2.0 Future

In his speech at World Blockchain Conference 2021, Ethereum's co-founder stated that a range of changes would follow after two protocols become one, calling the merger minimalistic. The upcoming adjustments are not known.

According to him, developers will still need sometimes to realize all the anticipated functions. For instance, if you now deposit in the ETH 2.0 network, you can't withdraw funds. And after the merge, there will be no opportunity to do it either. Withdrawals and staking rewards are to be available in the first hard fork after the merge.

Buterin also said that sharding would be the next important step for Ethereum. He emphasized that thanks to blockchain segmentation and Rollups technology, the Ethereum network will process 100,000 transactions in a second in the future.

Crypto and China: Bitcoin and Country’s CBDC Are Not Competitors

In his Bloomberg interview, Ballet Founder and CEO Bobby Lee commented on China's recent crackdown on crypto, stating CBDC and Bitcoin are not competitors. Lee believes China went the heavy regulation route to globalize the digital yuan, China's CBDC. He assumes that the Chinese authorities are concerned about their inability to regulate the asset, not its environmental impact.

Lee thinks that the situation in China won't impact the crypto industry in the long term. Still, the chance of a complete ban of all digital assets remains at 50%, Ballet founder summarized. But BTC price growth to $500,000 level or even $1M would be an essential condition for a complete ban.