CoinLoan Survey Statistics

More than 200 CoinLoaners from around the world participated in our survey and told about their lending preferences and expectations from CoinLoan platform. We are ready to share our insights and say a few words about how are we going to use this info to create game-changing P2P platform.

📝Summary:

- People from 6 continents and 76 countries hold breath waiting for platform launch;

- Looks like the lenders and borrowers are in equilibrium;

- 96.8% respondents are ready to lend in USD and EUR;

- BTC, ETH and CLT are top 3 cryptocurrencies to use as a collateral; - CoinLoaners take an interest in micro, small, medium and large loans as well;

- The optimal loan term for most CoinLoaners is from 7 days to 12 months.

- The majority of respondents indicated that the optimal LTV should not exceed 40%.

Let’s figure out what does that tell us.

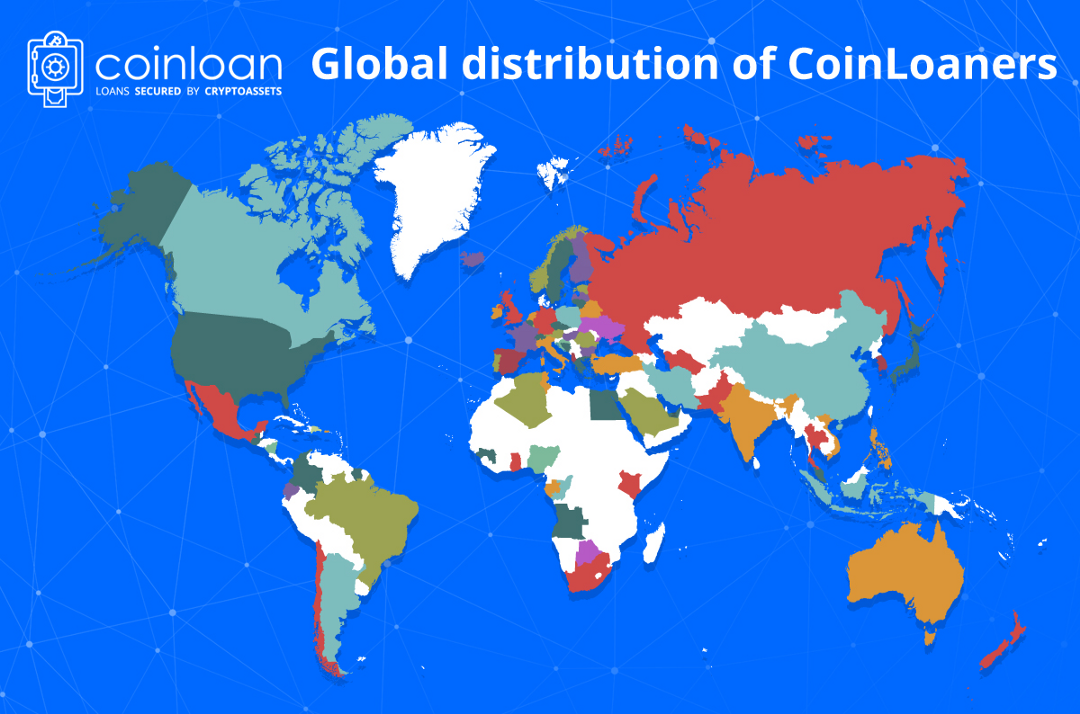

🌍Mapping the Global Distribution of CoinLoaners

Of course, CoinLoan team supposed to know that we are dealing with the global community. Even so, we were blown away by those numbers. The poll found that there are people from 76 countries and all continents expressing interest about the CoinLoan development. We are pretty sure that even this is not the full list. So if your country is not on the map — please let us know and we will put it right here!⤵️😉

We are planning to perform a global market reach. The system will be launched in European and CIS countries and the coverage of the countries will expand along with the development progress.

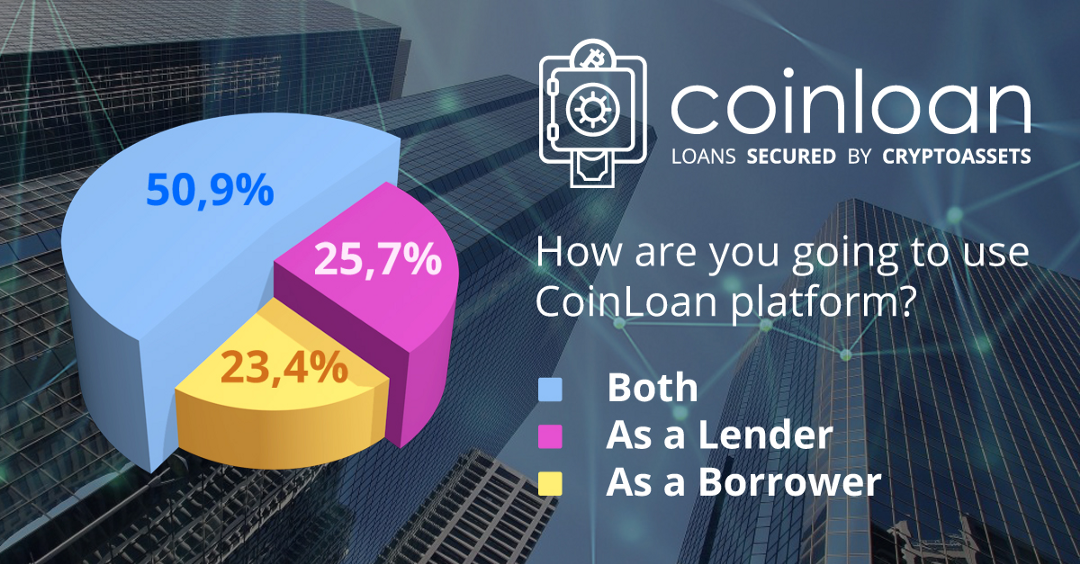

⚖️Balance Between Borrowers and Lenders

The survey has shown, that the correlation of potential lenders and borrowers is almost equal — 23,4% to 25,7%. What is even more important, most of CoinLoaners are interested to act both as lender and borrower.

Excellent news! We want CoinLoan system to have no strict division of users into lenders and borrowers. A borrower can become a lender, and a lender can become a borrower at any time — all depends on your needs and possibilities. This will secure flexibility and loyalty of the system.

This means that the large disproportion in the number of applications is unlikely. And just in case the balance needs support, we are working on partnerships that give us new sources of applications (for example, cooperation with Welltrado).

💸What Fiat Currency Would You Choose to Provide a Loan?

Predictably, preferred fiat currencies for providing a loan are USD and EUR — 96.8% respondents are ready to lend in one of these currencies.

Answering this question, some participants indicated that they would like to lend in cryptocurrency. Please be aware that there are no opportunity to lend crypto. In CoinLoan the borrowers can hold their cryptoassets and get fiat money. The lenders can lend their fiat capital and earn interest with minimal risks.

We will not dwell only on the most popular currencies. A list of fiat currencies in which loans will be issued immediately after the release includes USD, EUR, GBP, CNY, JPY, RUB, CHF, PLN, CZK. This list will expand as the platform develops — we are going to cover all popular fiat money.

💰Which Cryptocurrency Would You Choose to Obtain the Loan?

BTC and ETH are naturally most popular. Significantly, 35.3% of respondents would prefer to use CLT as a collateral.

We will provide loans secured with top 4 cryptocurrencies since the launch — Bitcoin, Ethereum, Litecoin, Ripple. The number of currencies will increase along with the platform development.

💵What Amount of Money Are You Planning to Lend/Borrow?

Respondents have shown the greatest interest in the range of $1000-$10,000. More than half of both lenders and borrowers are up to providing loans and lending in this range. At the same time, respondents have shown visible interest in microloans as well as large ones.

There is a wide range of amounts requested. We are ready to meet these requirements completely due to the flexible approach. CoinLoans’ minimum loan amount is $50 and the maximum is unlimited.

⏳Which Loan Terms Would You Choose?

Thanks to the survey we figured out that both lenders and borrowers prefer loan terms between 7 days and 12 months. 7–30 days and 1–6 months terms share the first place for loaners. For borrowers, 6–12 months is the optimal loan term.

On the CoinLoan platform minimal loan term is 1 day and maximum is 5 years. You are free to choose the favorable terms that are comfortable for you, create an offer and wait for a counter-offer.

💹Which Collateral Ratio (LTV) Is Optimal for You?

Due to the volatility of virtual currencies, the collateral ratio will be set the from 10 to 70%. This means that no more than 70% of the market value of the borrower’s asset can be borrowed.

Unexpectedly, it turned out that not all CoinLoaners tend to borrow 70% of the collateral value. Most of them do not want to risk their crypt and consider that the optimal LTV should not exceed 40%.

We will do our best to keep your assets safe. You’ll be able to assess the possible risks on your own, and set the LTV ratio depending on your asset and loan term. We will send regular updates about loan condition. When the ratio begins to decline to 70%, the system will send a warning to the borrower about the changes in the cryptocurrency rate and the need to replenish the balance or sell part of the assets.

That’s it for today. We hope this information was useful and interesting for you. If you have any questions, feel free to ask them in our Telegram chat and subscribe to Twitter to keep up on the latest news. The platform will be launched officially not later than Q2. It’s right around the corner!