CoinLoan Beats Volatility and Increases LTV Limit to 70%

If anyone asks you about the main bump in the road of crypto-backed lending, which one would you name? The CoinLoan team has a definite answer to this question. The main thing that prevents cryptoassets from being perfect collateral is their crazy volatility.

Just imagine. Today your collateral value is two times higher than your loan and you feel pretty safe. Tomorrow your crypto drops suddenly and overnight is in danger of margin call. The example above might be vastly exaggerated, but nobody can deny that crypto-fluctuations get on borrower’s nerves.

Good news, CoinLoaners. We’ve developed a revolutionary Dynamic Collateral Monitoring System. It allows to overcome the problem of cryptocollateral movements and to raise the maximal LTV limit to 70%.

Off The Record: Here you can read more about what LTV is and how crypto works on CoinLoan as a collateral.

CoinLoan Dynamic Collateral Monitoring System

If your collateral price falls, LTV (loan-to-value ratio) grows. In case of significant decline, you can repay the loan earlier or add extra collateral. We used to sell a part of your cryptocollateral if the LTV ratio of the loan reaches 80% and you do none of the above.

It’s a usual approach for crypto-backed lending platforms, it helps to bring the situation back into balance. But it’s so far from perfect since a borrower loses their savings. Over the past year, we’ve been testing new visions and working on liquidation system improvement. Today we’re excited to present a new solution that allows increasing the liquidation threshold significantly.

How It Works on CoinLoan

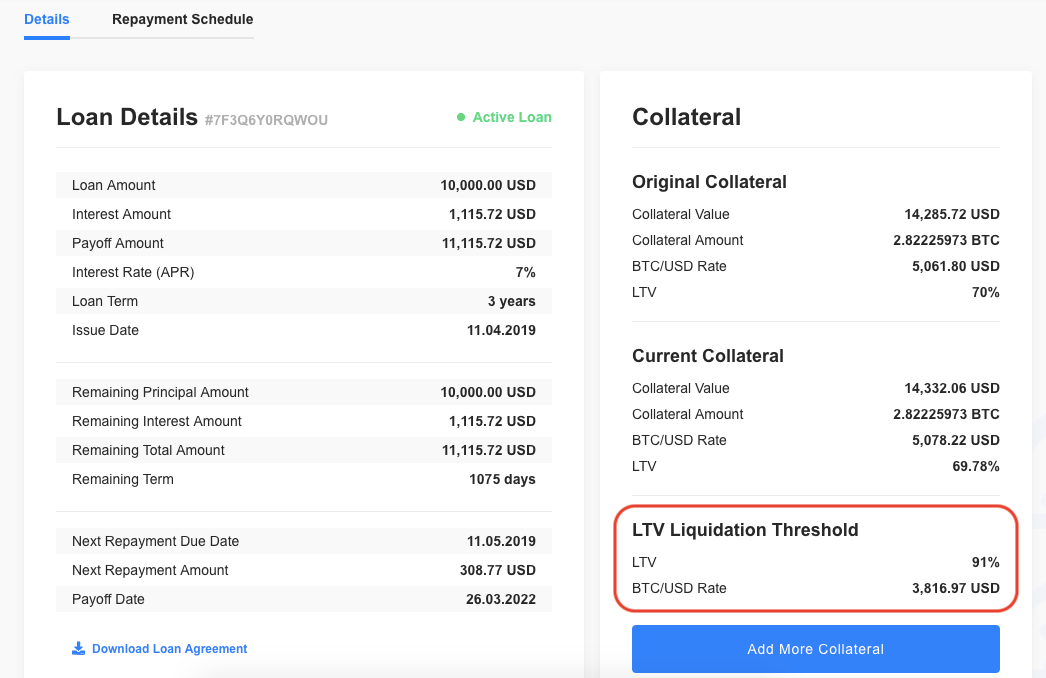

In a nutshell, your cryptocollateral is now far less vulnerable to crypto fluctuations. A margin call may only occur if your LTV ratio crosses the line of 90%. The exact point of liquidation is estimated for each loan individually and depends on the interest rate.

For loans with an annual interest up to 12% liquidation threshold is 92%, for those that expect 13–24% interest rate it would be 91% and so on. You can determine a liquidation point in your particular case in My Loans → Loan Details.

Window of Opportunity

The fact that cryptocollateral can now resist market fluctuations allows us to have one of the highest LTVs on the market and to raise LTV limit from 60% to 70%.

While most competitors still have a 50% LTV limit, we improve the collateral monitoring system so that CoinLoaners can borrow more fiat for the same amount of crypto. Thus, providing crypto worth $1,000 as collateral, now you can borrow up to $700 in fiat currencies.

Thanks for reading! Follow our official channels for more updates and news:

Platform | Website | Telegram | Email | Facebook | Twitter | Reddit