CoinLoan Adds an Interest-Only Repayment Option

Today, we present Interest-Only repayments as an alternative option to the conventional Principal + Interest (Annuity) repayments. From now on, when creating a Loan Offer or Loan Request on the Lending Market, you can choose either an Interest-Only or Principal + Interest repayment option when determining the loan’s terms.

When you lend 1,000 euros for a year at 12% interest, you expect to earn 120 euros. In practice, lending is rarely that simple; often, the interest amount depends on a calculation scheme.

Previously, CoinLoan exclusively worked with an annuity payment scheme, which is widely used by banks and other major financial institutions. An annuity repayment option benefits both lenders and borrowers.

However, our annuity repayment option falls short of expectations in terms of earnings. For example, when you lend 1,000 euros, this repayment option earns less than 120 euros at 12% interest. Thus, CoinLoaners have been asking about our initially confusing interest calculations. From now on, you have two repayment options from which to choose.

More repayment options mean more freedom for borrowers! Next, we will explain our Principal + Interest and Interest-Only repayment options.

Our Principal + Interest Repayment Option (Annuity)

Selecting Principal + Interest means the borrower will pay equal monthly payments that include shares of the principal (the original amount borrowed) and interest (a borrowing fee) during the loan term.

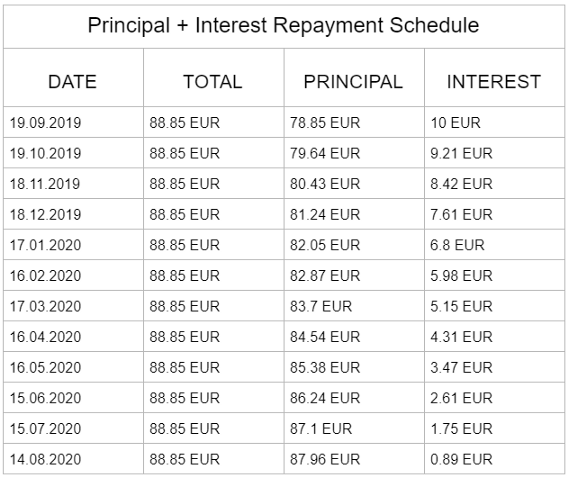

With Principal + Interest, monthly payments remain equal while shares between the interest and principal adjust after each monthly payment. Here, the interest decreases month by month while the share of the loan’s principal increases.

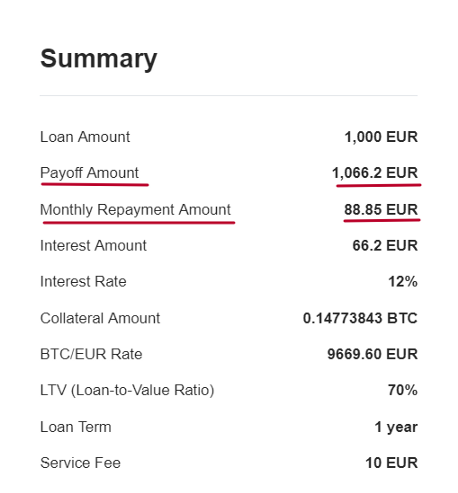

Let’s see how Principal + Interest works in the following use case:

With these terms, the borrower will have a total Payoff Amount of 1,066.20 EUR and make monthly payments of 88.85 EUR over the year. By doing so, both the principal and interest will be fully paid off after the last monthly payment. In this scenario, the interest rate is initially 66.20 EUR.

Benefits of Our Principal + Interest Payment Option:

- For the borrower, an annuity loan carries a small interest rate where the monthly interest decreases over time because it is based on the current outstanding principal.

- For the lender, an annuity payment provides an opportunity to reinvest their funds to earn extra money with other loans.

Our Interest-Only Repayment Option

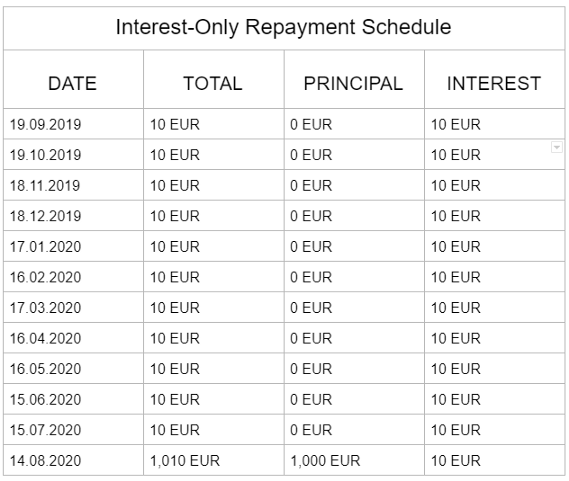

Choosing Interest-Only means that the borrower will only pay off the interest in their monthly payments. Once all of the interest is paid off, the borrower will then pay off the principal amount in full.

Here, payments are low in the beginning so that an Interest-Only loan can reduce monthly payments during the term of the loan. However, the final monthly payment will significantly increase as the borrower is required to pay off the entire principal.

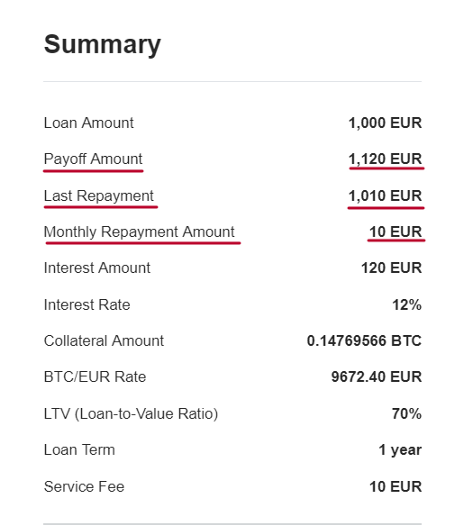

Let’s see how Interest-Only works in the following use case:

With these terms, the borrower would pay off the 120 EUR in interest by paying monthly installments of 10 EUR over a year. Here, the last payment would be for 1,010 EUR to pay off the loan’s principal.

Benefits of Our Interest-Only Repayment Option:

- For the borrower, this option means small monthly payments, because they only have to pay off the loan’s interest throughout the loan term.

- For the lender, it means earning more interest without reinvesting their funds.

How Does the Interest-Only Repayment Option Work on CoinLoan?

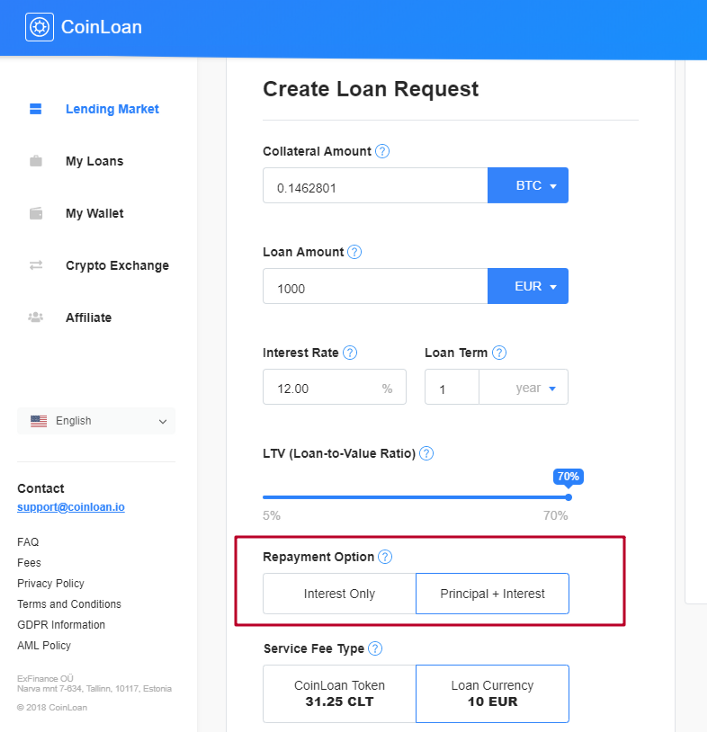

You can already find our Interest-Only option when you create a Loan Offer as a lender or a Loan Request as a borrower. First, go to the Lending Market section located on the left side-bar of your profile.

Then, start creating your Offer or Request. Here, you can select the Repayment Option that is the most convenient for you along with other loan terms.

Click on each option to see how the loan’s details change in the Loan Summary. Click Create a Loan Offer and call it a day!

New milestones are on their way! Follow CoinLoan’s blog to hear about our updates first.

Platform | Website | Telegram | Email | Facebook | Twitter | Reddit