CeFi vs DeFi: How to Choose the Best Crypto Lending Platform?

For many, what Bitcoin promised, DeFi delivers. Decentralized financial platforms are supposed to be an entire alternative financial system for offering and receiving loans, exchange currencies, and making payments — the list goes on. No banks, or brokers, or trusted third parties required. Just secure and transparent software. One day, the promises will probably come closer to reality, but that day is not today. Because what decentralized finance promises, centralized one delivers.

Long story short, "DeFi" makes the better buzzword, and "CeFi" makes the better product. This article aims to help you navigate in the world of crypto-lending protocols and equip you with performance indicators to look for when choosing one.

Who’s Who in Crypto-Lending

Before we start speaking on the pros and cons, let's unpack a bit of terminology and classify crypto-lending protocols.

So far, the best framework for classifying has been offered by Kyle J Kistner in his article ‘How Decentralized is DeFi?’. According to Kistner, we can separate all crypto-lending projects into categories starting with totally centralized (CeFi) to completely decentralized Degree 6 DeFi, that don't exist in nature. All decentralized projects have settled down between Degree 1 and Degree 5 DeFi.

A category in the framework is assigned based on the number of the following components that are decentralized:

- custody

- price feeds

- initiation of margin calls

- provision of margin call liquidity

- interest rate determination

- protocol development.

When we opened the CoinLoan platform in 2018, we were the pure P2P platform with deals made directly between lender and borrower. As long as our P2P platform was operational, interest rates were agreed freely by users. Decentralized interest rate determination made us a Degree 1 DeFi platform.

Since then, we realized that decentralization, even in small doses, means limitations for our users and shifted gradually to a more centralized business model. That shift enabled CoinLoan to develop better crypto-lending tools for our clients. Now, with all those components centralized, CoinLoan is a pure CeFi.

Functionality and Limitations

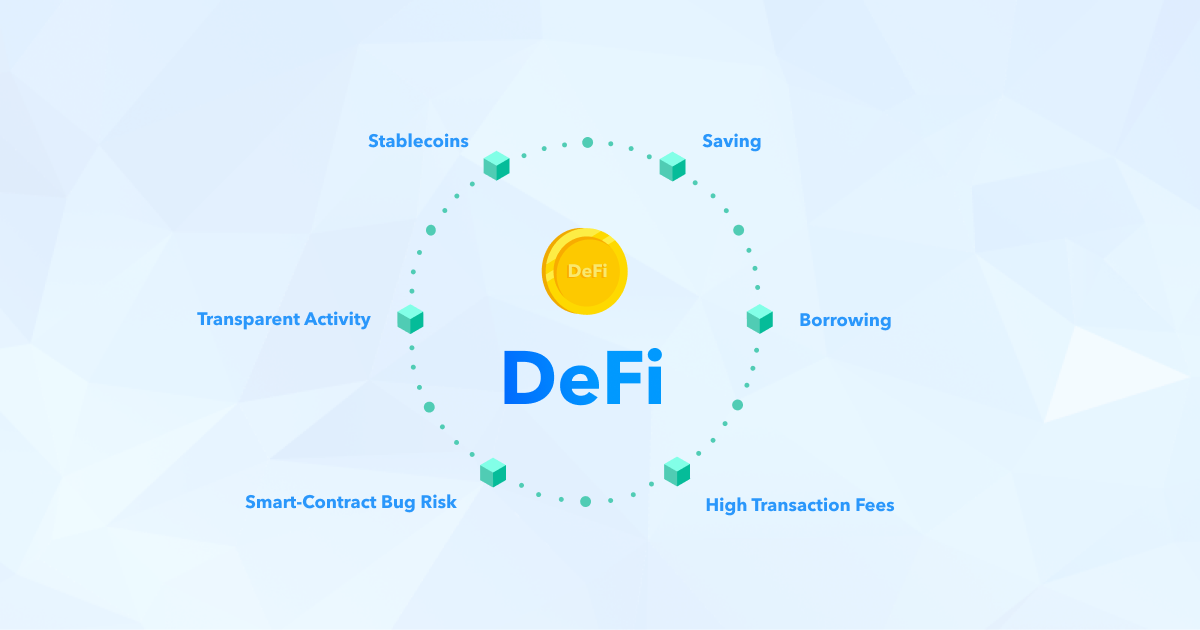

It is surprising how limited are the offerings of DeFi given the ambition to revolutionize banking and create more global, more flexible, and transparent finance. The economics are shaky, the networks are too slow, and nobody's sure how to make the most of it.

Until recently, MakerDao only worked with Ether as collateral, and the transition from a single to a multi-collateral system was celebrated as a big win. But platforms that run on Ethereum blockchain still can’t list any coin except ERC20 tokens, although there are some wrapped workarounds.

Let's not even talk about the technical and legal inability for decentralized platforms to operate fiat assets. With your money in DeFi, there isn't a lot you can do with it. You can't pay bills, can't pay taxes, can't buy most real-world things. It's like being the only person with dollars in a time when all the other people were bartering crafts and furs.

With CeFi, users have flexibility to work with different coins and blockchains. You can get a loan, secured by an anonymous asset, such as Monero.

You can even use fiat assets as collateral to borrow some BTC, or vice versa. A long list of available assets and their combinations is accompanied by a wide choice of fiat transaction methods. You can make deposits and withdrawals using bank cards, international wire payments, payment systems such as Advcash, etc.

User Onboarding Made (Not) Easy

DeFi loves to boast about banking the unbanked and being available to everyone. All true, their applications require no verification or paperwork, but what they do need is an extra effort on the user’s part. High barriers to entry arise from an unexpected direction.

CeFi offers convenient mobile applications with push notifications, two-factor authentication, client support, and other beneficial features. Users don’t need to know what smart contracts are and how self-managed crypto wallets work.

Developing CoinLoan, we witnessed how critical quick and straightforward workflows are for scaling the product to a broader audience. If you make users overthink your product, process, or service, they’ll move on. The faster they can visualize success, the more likely they are to stick with you.

See, not so long ago, we suspended our P2P feature, the one that brought us to the market three years ago. It was running alongside Instant Loans, another our product for immediately fixed earnings for about a year. P2P had been driven out by the competition inside CoinLoan even though it allowed to set more advantageous interest rates. Nobody wanted to bother with settings, guess on appropriate loan conditions, and wait for borrowers to accept loan offers.

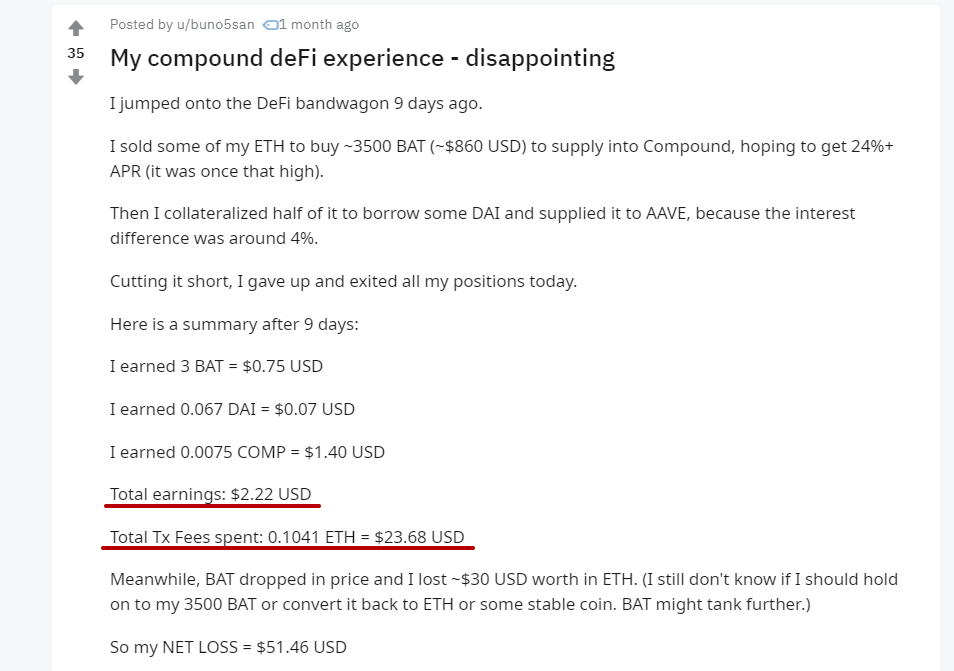

What else can surprise a DeFi newcomer is ETH transaction fees that are simply too high. The wildly fluctuating yield based on supply and demand is not helpful either. On CoinLoan, you pay no unexpected costs. In fact, you pay no fees at all for deposits and withdrawals in coins and fiat.

Not Your Keys — Not Your Coins

One of DeFi's biggest selling points is the idea that platforms are incredibly secure: because they are not centralized and don't need to rely on any singular third-party to operate.

However, the technology you trust was created (surprise!) by people. Due to human errors and smart-contract bugs, your coins may get into someone else's hands, even if you keep keys untouchable.

The visible bounty offers an extremely lucrative perspective for hackers to invest their time and resources to find loopholes in smart contracts. Decentralized platforms have already lost a ton of money due to such loopholes.

Let's just name a few of the biggest stories of the year 2020:

- dForce's lost $25M total locked value in an exploit.

- bZx, the decentralized lending protocol, has been attacked twice in a matter of days, resulting in a loss of around $1M.

- Back on June 29, a hacker drained $500K from the DeFi liquidity provider balancer.

Сentralized platforms vary in their security measures but are mainly based on large financial companies' proven systems. The assets of CoinLoaners, for instance, are held by a qualified custodian BitGo and insured for up to $100 million.

Resilience and Crisis Management

Smart contracts, reliable in a quiet environment, may not always be able to deal with the crypto market chaos. Centralized platforms work faster and make risk management possible. It enables them to take control of the situation and avoid losses in critical moments.

Remember the Black Thursday 2020, crypto’s worst day in 7 years?

A massive amount of panic selling back then has overloaded the Ethereum network to a degree not seen in a year. The average cost of an ETH transaction has risen to USD 0.58, with confirmation taking up to 44 minutes. Many exchanges experienced some form of infrastructure problems during the price crash.

When the market value of collateral plunged, CoinLoan users deposited more crypto to the platform to avoid liquidation. We received dozens of requests in support and did everything in our power to avert liquidations and avoid the platform breakdowns, accelerated and accepted deposits manually before the network confirmed them during the “traffic jam.”

CoinLoan's centralized infrastructure coped with its job. The same cannot be said for a DeFi giant MakerDAO, which faced an emergency shutdown as its under-collateralized debt reached over $4 million.

In conclusion, let's take another look at our comparison diagram. It just seems that the DeFi ecosystem needs time to catch up to its centralized counterparts in terms of security and usability. If you like the idea of being an early adopter standing for something (hopefully) greater, your choice is DeFi. All the rest who are looking for a functional financial tool, pay close attention to CeFi.