5 Common Myths About P2P Investing

Conventional P2P lending is successfully working for more than a decade. Let’s speak about a fundamentally new idea of crypto-to-cash loans, where fully equal parties will be able to provide or receive loans in any fiat currency. What misconceptions an investor can have on a new market?

1. It’s like wild, wild west; assets are unsecured and returns are uncertain.

Level of risk varies. Before using P2P lending platform examine it thoroughly. It’s important to understand the mechanisms of handling risks of lending services for protecting the interests of users. And sort it out, if they are suitable for you.

With CoinLoan system the lender’s funds are secured by a cryptocollateral and protected from the risks of non-return. If the borrower failed to fulfill his/her obligations, the pledged asset will be automatically liquidated as debt repayment. To reduce risks associated with the volatility of virtual currencies, the collateral ratio from 10 to 70% will be set.

2. Investing is for millionaires.

Some investments have very high entry criteria — for example, you need to buy a house or an apartment for investing in real estate, it requires significant savings.

A peer-to-peer lending model is much more accessible. CoinLoan will work with large and small loans, that is attractive not only for legal entities, but also for individuals to the platform. The minimum loan amount will be 50 USD.

The study of the CoinLoan potential user portrait has shown that this is a demanded approach. CoinLoaners take the biggest interest medium loans in the range of $1000-$10,000. At the same time, respondents have shown visible interest to microloans as well as to the large ones.

3. Investing $1,000 is safer than investing $10,000.

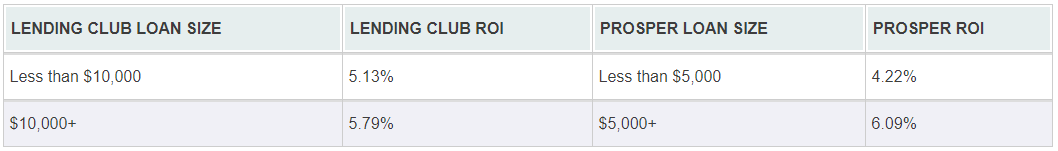

One of the most common misconceptions is that investors choose size-based applications, because small amounts seem more manageable and less risky. Peter Renton from Lend Academy analyzed Lending Club and Prosper P2P platforms data to find out how estimated ROI depends on loan size.

At Lending Club all the loans of $1,000 — $9,999 during the analyzed period returned an estimated ROI of 5.13% and loans of $10,000 and more have an ROI of 5.79%. At Prosper, the medium loan size was around $5,000 but the same trend is seen. Loans below $5,000 generated ROI of 4.22% of $5,000 returned 6.09% — this is already noticeable.

4. It’s illegal or grey market.

Much depends on the region and the country. The license and registration for P2P lending platform can be obtained, for example, at a securities regulatory agency such as the U.S. Securities and Exchange Commission (SEC) in the U.S., the Ontario Securities Commission in Ontario, Canada, the Autorité des marchés financiers in France and Québec, Canada, or the Financial Services Authority in the UK.

The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changeable in many of them. While some countries have explicitly allowed their use and trade, others have banned or restricted it.

Speaking about crypto-to-cash lending, it has to pass rigorous checks for legality, financial stability, and security and obtain the required licenses to operate as a legal payment institution.

5. Lending investment is as clear as mud.

It is generally believed that technologically advanced investment solutions such as P2P are dominated by the “tech savvy generation” and it takes a while to study and understand the investment.

According to the UK Alternative Finance Industry Report published by Nesta, only 18% of investors are under 44 years old and 55% being 55 or older.

It’s quick and easy to invest online, most platforms provide user friendly automated services. In CoinLoan, the lender creates an application for a loan, which indicates:

- Loan amount;

- Currency;

- Interest rate;

- Loan term;

- Additional parameters: possibility of early or partial repayment, the lowest amount for one loan (the loan amount indicated by the lender can be distributed to several borrowers interested in the terms proposed).

The lender will be able to check out the real market offers to define conditions that will allow faster execution of the order. CoinLoan will have sections with statistical data, charts, executed deals and valid offers.

This will create competition within the system, which will allow getting rid of economically unprofitable offers from both sides. The created offer will wait for a counterorder. If the terms of the loan order match with the current market situation, it will be executed instantly.

The CoinLoan team will be glad to answer your questions!